Open Sesame: China Announces Further Opening of the Economy

By Tongyu Zhang

China’s State Council has issued a circular stating the government’s intentions to further open the economy and boost foreign investment. The circular is part of the effort to build China’s so-called “new open economic system”, with measures focusing on streamlining government administration, improving regulations, and reducing institutional transaction costs to create a favorable business environment for foreign investment. The circular is in keeping with the sentiment backed by President Xi Jinping, who has recently released statements defending globalization, and should be seen as a positive signal by the Chinese government to facilitate the opening-up of the economy.

While this infers a more accessible investment environment, complex global economic and political trends, in addition to China’s ongoing economic restructuring, may mean that foreign investors in China will face a challenging year filled with uncertainties. Furthermore, the circular does not set any concrete policies, but rather points to a general direction for the implementation of the measures, which may require some time to be realized.

Further strengthening the opening-up

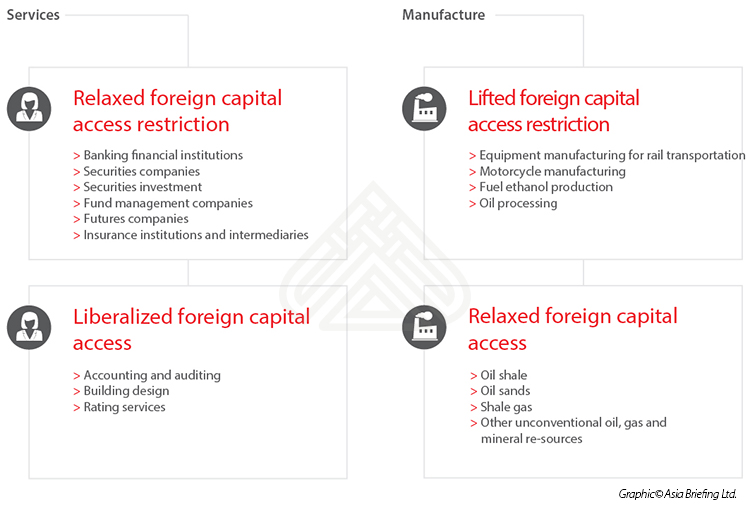

The first part of the opening-up measures put considerable emphasis on relaxing restrictions on foreign investment in service, manufacturing, and mining industries. It also suggests to relax restrictions in telecommunications, internet, culture, education, transportation, and other fields. The following table categorizes the different fields and the extent of their relaxed restrictions.

In addition, for foreign cooperation in oil and natural gas projects, the regulatory system has changed from an examination and approval system to a record filing system.

Note that some of the changes to the restrictions mentioned above, namely those that shall be liberalized and eliminated, can be found in the latest draft of the Catalogue of Industries for Guiding Foreign Investment, which has been published for seeking opinions.

The measures also emphasize foreign-invested entities’ role in innovation and manufacturing industry upgrading in China, by encouraging cooperation between domestic and foreign-invested enterprises (FIEs) on research and development activities and easing the resident and business policies for foreign high-level talents.

Fair competition environment

The circular calls for creating a fair and competitive environment. Business licenses and qualification applications of FIEs will be examined with the same standards and processing timetables as those for domestic-invested enterprises. Domestic and foreign-invested enterprises should also get equal access to participate in China’s standardization reform and government procurement in order to enhance the openness and transparency of the country’s investment environment.

![]() RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

This eye-catching modification is the method of expanding FIEs’ financing channel, which allows FIEs to list on the Chinese stock market, including main-board, SME board, GEM board, and new third board, as well as issuing bonds and other debt financing instruments. However, considering the weak performance of the Chinese stock market last year, the effects of such opening-up measures may not be seen in the short term.

Attracting foreign investment

In order to attract foreign investment, local governments will be allowed to form favorable policies to support foreign-invested projects that can facilitate employment, economic development, and technology innovation, and reduce the costs for the investment and operation of FIEs. Support will be provided to the central, western, and northeast regions for undertaking industrial transformation of foreign investment. For example, FIEs in supported industries in western regions will enjoy preferential tax policies.

Observations

With 20 measures covering various aspects of foreign investment promotion, the document has inevitably been interpreted from several different perspectives. In a statement issued just after the release of the circular, the National Development and Reform Commission (NDRC) highlighted the tendency of foreign-invested manufacturing enterprises to relocate abroad. To answer this, the NDRC emphasizes the measures to boost foreign investment in the manufacturing sector, indicating that the Chinese government has put the restructuring and transition of the manufacturing industry as a main priority. Meanwhile, investors in the market are concerned more about the potential financial sector reform. However, both Bloomberg and Reuters have maintained a cautious attitude when reporting the measures, especially with the country’s recent control of capital outflow, which seems to be at odds with the measures. Thus, it is critical for foreign investors to analyze the policy’s implications based on their own conditions and perform a proper strategy accordingly.

Another noticeable feature of the circular is that the responsibilities of each measure have been divided to related government departments, intending to improve their implementation. Therefore, if an entity is interested in a particular measure, it may be able to find more information by contacting the local corresponding government departments.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

An Introduction to Doing Business in China 2017

Doing Business in China 2017 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates in January 2017, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies who already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Navigating HR Audits in China

Navigating HR Audits in China

Recent changes in China’s labor market have underscored the importance of having both an efficient HR system and a satisfied and reliable workforce, and the HR audit is a useful tool to ensure this. In this issue of China Briefing magazine, we provide a guide for conducting HR audits in China. We analyze why the HR audit is especially important for foreign companies operating in the country, and then detail the different HR audit models and procedures that are available to firms.

- Previous Article The China City & Industry Report 2017 – New Publication from U.S. Commercial Service with Content from Dezan Shira & Associates

- Next Article China Regulatory Brief: Plan for Promoting Employment, and Development Zone Reform and Growth