Exporting Food Products to China: A Step by Step Guide

Navigating China’s intricate F&B regulatory system stands paramount in safeguarding the quality and safety of imported food products. Despite this rigorous framework, a substantial volume of food imports face rejection or destruction annually due to non-compliance or irregularities in quality. This not only incurs losses for both importing and exporting enterprises but can also lead to severe consequences like license revocation and future trade exclusion. With these high-stakes scenarios in mind, companies must remain vigilant, keeping up-to-date with evolving food regulations, and ensuring that their products align with essential import procedures.

China emerged as the second-largest global importer of food and beverage (F&B) products after the US in 2016, with imports surpassing AU$130 billion (US$88.2 billion), as reported by the Australian Trade and Investment Commission (Austrade). By 2022, this figure surged to US$110 billion. Key F&B exporters to China include Brazil, the US, Canada, Australia, and New Zealand. China’s growing and evolving appetite for imported F&B aligns with its transition toward consumption-driven economic growth.

As of 2021, China imported 2,938 types of foods from 184 countries and regions. Yet, despite the lure of its huge market, exporting F&B to China is not easy. China has a multi-layered F&B regulatory system to ensure the quality and safety of imported goods.

The country’s F&B safety is supervised by multiple government agencies and departments, mainly the State Administration for Market Regulation (SAMR), the National Health Commission of China (NHCC), and the General Administration of Customs of China (GACC).

Each year, a large number of foreign F&B firms and exporters fail to access the Chinese market due to insufficient compliance.

Between January and December 2022, a total of 1,134 batches of foreign F&B items were either returned or disposed of due to various reasons, including issues such as non-compliance with food quality standards, inadequate certificates, labeling, and packaging, improper use of food additives, presence of micro-organisms, lack of access for inspection and quarantine, non-compliant ingredients, and other factors.

This causes significant loss to the whole food and beverage supply chain. In worst case scenarios, the import license of the importing trading company is revoked, and their investors barred from carrying on future trade.

Amid this strictly regulated environment, where both consumers and the government swiftly embrace new market players, the stakes are notably high. Achieving conformity to food standards and adhering to import procedures are pivotal for businesses eyeing the Chinese market or contemplating entry.

In this article, Dezan Shira & Associates and the Silk Initiative introduce some of the many certifications, regulations, and procedures required to export food products to China.

Step 1: Complete the importers and exporters registration

Step 1: Complete the importers and exporters registration

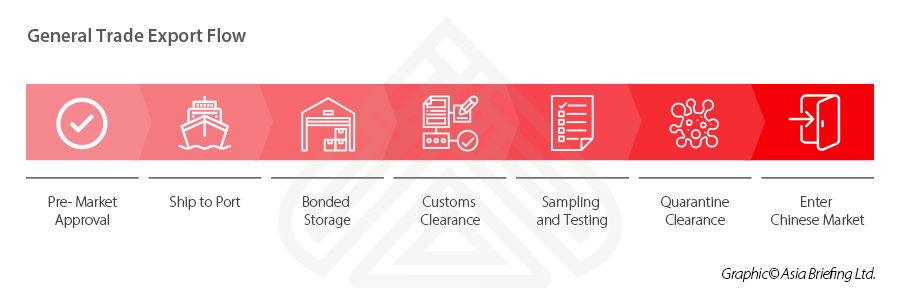

Foreign exporters usually adopt two ways to get goods to China: general trade export or cross-border e-commerce (CBEC).

In either model, all exporters and importers of foreign F&B must be recorded through the “Registration Systems of Imported Food and Cosmetic Importers and Exporters” (http://ire.customs.gov.cn) or the “Internet + customs platform”(http://online.customs.gov.cn/) of the GACC.

If the foreign exporter wants to choose a Chinese importer of record to conduct customs clearance (and quarantine if required), the exporter is advised to use China’s credibility system to gather basic official information about the prospective importer or review the importer’s performance via a public register maintained by the GACC.

In addition, some of the food products that have heightened safety requirements, such as meat and health products, require additional registration. In addition, manufacturers of the following product groups must be recommended by the relevant authority in the country/region they’re established in:

- Casings;

- Aquatic products;

- Dairy products;

- Bird’s nests and bird’s nest products;

- Bee products;

- Eggs and egg products;

- Edible oils and fats;

- Oilseeds;

- Stuffed pastry products;

- Edible grains, milled grain industry products, and malt;

- Fresh and dehydrated vegetables;

- Dried beans;

- Condiments;

- Nuts and seeds;

- Dried fruits;

- Unroasted coffee and cocoa beans; and

- Foods for special dietary purposes and functional foods.

In this case, the foreign manufacturer of the product must register with China’s Certification and Accreditation Administration (CNCA).

If the foreign manufacturer is deemed as meeting Chinese registration requirements, it will be publicly listed on the CNCA website. The registration will be valid for four years and is extendable. In addition, from January 1, 2022, the CNCA registration number must be printed on the Chinese label of the imported food product.

Further, to be noted, as of October 2012, it is mandatory for exporters to register each shipment of food products online with the General Administration of Quality Supervision, Inspection, and Quarantine (AQSIQ) department for tracking purposes.

Step 2: Prepare documentation, pre-import licensing, and trademark registration

Documentation needed to clear customs

China has strict and complex documentation requirements for most food products imported into the country.

Before shipping the products, entities are required to submit properly documented information on quality, quarantine, origin, and import control, along with a detailed packaging list and a description of the packaging material, among other documents.

These documents are reviewed only after the shipment reaches China. Therefore, the entity must ensure that all documents are complete and authentic to avoid any delay and storage costs.

Entities can use the Harmonized System (HS) codes available on the China Customs’ website to check the category of the product, the associated import tax rates, documentation, licenses, and testing requirements (the HS nomenclature is the international system used for categorizing all products traded between countries).

Although the documentation requirements vary between products and product categories, the exporter may prepare the following documents to import food products into China:

- Commercial invoice;

- A detailed packaging list;

- Bill of lading;

- Certificate for export from country of origin;

- Hygiene/Health certificate;

- Certificate of bottling date (for drinks);

- Certificate of free sale;

- Sample of the original label;

- Sample of Chinese label; and

- Inspection certificate issued by AQSIQ.

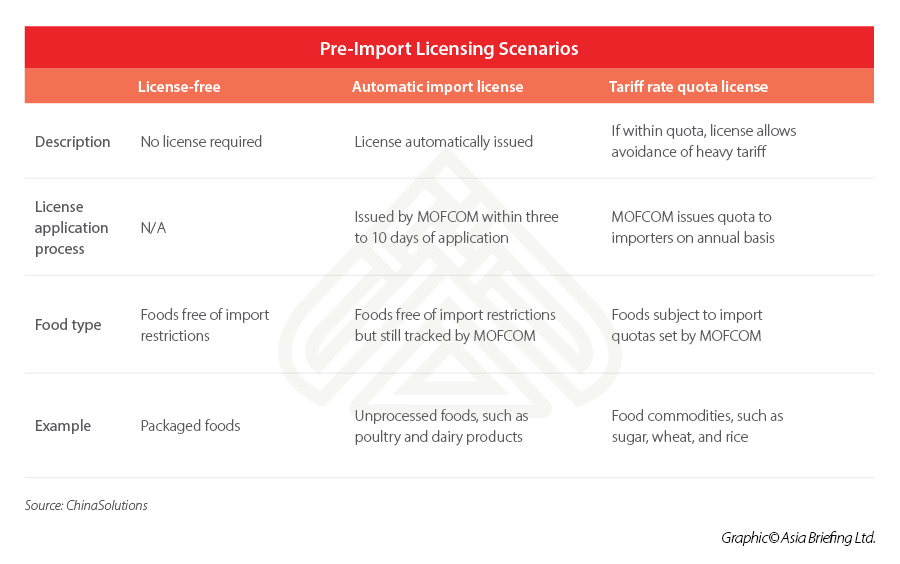

Pre-import licensing

In general, food products entering China do not require pre-import licensing.

But if the product is included in the 2023 Goods Catalogue for Automatic Import License Management, such as poultry or dairy products, importers should apply for an Automatic Import License issued by the Ministry of Commerce (MOFCOM).

In addition, food items subject to import tariff quotas, such as wheat, corn, rice, and sugar, are required to obtain the Agricultural Products Import Tariff Quotas Certificate.

Trademark registration

Since China only acknowledges trademarks registered within its own jurisdiction and follows the first-to-file system, registering the trademark in China is a key step for a foreign entity to protect its brand.

This is necessary if the firm wishes to avoid trademark squatters and disputes with local counterfeiters, which can result in reputational damage, losing customers and revenue as well as time-consuming and costly adjudication.

Foreign companies are recommended to file trademark applications with the Trademark Office of National Intellectual Property Administration (CNIPA) through a registered agent – if they do not have a residency or place of business in China.

Step 3: Labeling

Every food product imported to China must be labeled in simplified Chinese characters to complete the Customs clearance. Several rules specify the labeling requirements on the layout and content of F&B in China. Some of these include:

- Label rules for pre-packaged food (GB7718-2011);

- Label rules for pre-packaged food for special dietary uses (GB 13432-2013);

- Label rules for pre-packaged food’s nutritional labeling (GB28050-2011); and

- Label rules for pre-packaged alcoholic beverages (GB 10344-2005).

*GB refers to “Guo Biao” in Chinese here, meaning national standard.

In general, a label must provide the following:

- The standard name of foodstuff;

- List of ingredients as a percentage;

- Name and address of manufacturers, local agent, or distributor;

- Production date, best before, end date, and guidance for storage;

- Country of origin;

- Quality grade;

- Code of national standard/industry standard for the production; and

- Special contents, if any.

All labels must be approved by the Chinese Inspection and Quarantine (CIQ) under AQSIQ. As label standards in China are subject to change, you are advised to consult experts to ensure compliance with the updated label requirements.

Joel Bacall, Senior Client Manager of food and beverage brand consultancy the Silk Initiative, further remarks that “while you need to ensure your product’s labeling is compliant with Chinese regulations, you also need to consider how your products are packaged from a consumer and market perspective. For example, you will have to consider whether it’s best to cover existing packaging with a new label, as well as how your competitors are re-designing their labeling to gain a competitive edge with the consumers in the market.”

Step 4: CIQ, the food sanitary inspection, and customs clearance

Once the products reach China, the food products are inspected by Customs officials for review of relevant shipping documentation and labeling requirements.

The process is more complex for the first-time exporter. The procedure will be relaxed in the future after the first successful export.

Goods that pass customs clearance and inspection

The imported foods that pass inspection will be issued a China Entry-Exit Inspection and Quarantine Bureau (CIQ) certificate by the GACC and allowed to enter China. This certificate is issued for every shipment of products.

Goods without complete documentation

If the shipment misses any documents and Customs seizes it, the entity may provide the missing documents or a CIQ declaration. To obtain a CIQ declaration, the entity must provide the following documents: a business license, importing license, quota certificate, safety compliance declaration, an introduction to the company, and product information in detail.

Goods that fail customs clearance and inspection

Imported food that fails to be cleared through Customs may undergo technical treatment under GACC supervision and then be re-inspected or be issued a Returns Handling Notice, meaning that the importer must return the product back to the exporter, or the goods have to be destroyed.

Latest regulatory developments

The GACC released the Measures for the Safety Administration of Imported and Exported Food (GAC Decree No.249) and the Administrative Provisions on Registration of Overseas Manufacturers of Imported Food (GAC Decree No.248) on April 12, 2021. Both regulations took effect on January 1, 2022, enacting stricter regulations on food imports. Some notable changes include:

- Expansion of registration scope: Previously, only manufacturers of certain products like meat, aquatic, dairy, birds’ nest, and bee products needed to register. The new rule extends registration requirements to companies involved in processing and storing these items for export to China.

- Registration methods: The old requirement for foreign producers to be registered by their country’s authority has been replaced. Now, the registration method varies based on the product category. Low-risk products can be self-applied or assisted by agencies.

- Streamlined application materials: Some documentation like animal and plant epidemic info, health requirements, and layout details are no longer needed after a food safety evaluation. The audit report and company identification documents remain mandatory.

- Enhanced registration approvals: The GACC can assemble experts or agents to assess applications. Teams of at least two members can use materials, video inspections, on-site visits, or a combination thereof for assessments.

- Clearer registration number rules: Registered companies must now display the registration number on both inner and outer packaging, following Chinese or competent authority-approved registration numbers.

- Dietary supplement labeling: Dietary supplements must feature labels in Chinese on their sales packaging.

- Extended registration validity: Registration validity and renewal are now extended to 5 years, aligning with domestic Chinese food production licenses.

- Renewal requirements: Renewal-related proof materials must be provided for GACC approval. Major changes like production site, legal representative, or foreign registration number necessitate reapplication, invalidating the previous Chinese registration number.

- Validity extension application: Applying for validity extension mandates submission of an application form and statement to the GACC 3-6 months prior to expiration.

- Strengthened responsibilities: The new regulation empowers competent authorities to suspend exports to China and demand immediate corrective actions if any issues are detected, surpassing the previous approach limited to unqualified registered companies.

- Limited competent authorities: While the previous rule included various institutions, the new definition narrows down competent authority to the official department overseeing safety and health of the producer’s country.

Distribution channels

When it comes to exporting goods to China, the process involves a series of intermediaries. This includes import agents and distributors, as well as wholesalers and sub-distributors, who play pivotal roles in facilitating the flow of products.

In comparison to other markets, the distribution setup in China unfolds as a complex journey, shaped by distinct import regulations and product categories. Each product type requires specific import licenses or permits, with wine, dairy, meat, seafood, and fruits mandating specialized licenses.

Traditionally, many food distributors or traders lacked import licenses. Instead, licensed importers took charge of import procedures and clearance on behalf of third-party distributors.

However, times are changing. A shift is occurring with more distributors stepping into the role of import agents or wholesale players, boasting networks of sub-distributors they’ve nurtured. Notable names like Sam’s Club, Metro, and Yonghui, alongside other supermarket giants, are authorized to directly import goods from international suppliers.

In the realm of F&B, distributors, and retailers reign supreme in specific localities and seldom enjoy national coverage. Selecting partners strategically and pinpointing the right location becomes paramount. A multi-faceted approach, blending online and offline strategies, proves effective. Chinese partners often seek exclusive product rights, but granting exclusivity hinges on comprehensive insights into their sector expertise, import capabilities, existing relationships, and distribution networks.

Key takeaways

China presents numerous opportunities for global food exporters aiming to tap into a vast and lucrative market. However, navigating the country’s food and beverage import procedures can prove challenging, especially for first-time exporters, due to its decentralized and localized system.

Given China’s extensive geographical expanse, exporting to various regions within the country demands meticulous attention to detail to prevent administrative setbacks or non-compliance. Adhering to the aforementioned steps can significantly enhance the process’s smoothness and efficiency. Moreover, seeking guidance from proficient consultancies specializing in the food and beverage domain at the local level is pivotal to ensuring a company’s triumphant entry into one of the world’s largest consumer markets.

(This article was originally published on June 13, 2017. It was last updated on August 21, 2023.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

The Silk Initiative is a business strategy and marketing mix innovation consultancy specializing in the food and beverage space. They provide a range of brand strategy, consumer insight, business intelligence and creative execution strategies to clients ranging from global food and beverage giants to SMEs. Need help making sense of the complexities of the China and Asia market? Contact them at info@thesilkinitiative.com or visit www.thesilkinitiative.com.

- Previous Article US Bans New Investments in China’s Sensitive High-Tech Industries

- Next Article China’s Tourism Sector Prospects in 2023-24