Internal Control for Day-to-Day Operations in China

By Dezan Shira & Associates

Editor: Alexander Chipman Koty

The core principles of internal control do not vary significantly between countries. Indeed, China’s legislative framework for internal control largely mirrors the corresponding legislation in the US. In practice, however, the issues that arise in day-to-day business in China present a unique business environment for implementing internal control.

Specific legal features particular to China, such as company chops, require internal control systems that might not be needed in most Western countries. Meanwhile, other issues requiring internal control encountered when doing business in China – including corruption, labor disputes, language barriers, and cultural misunderstandings may be more common than in many foreign investors’ home countries.

As such, foreign investors establishing operations in China should implement internal control systems specific to China’s business environment, rather than simply transplant systems in place from operations in their home countries. In the following sections, we provide some commonly practiced controls in China.

Securing company chops

Company chops, also referred to as seals or stamps, are a unique feature of doing business in China. Chops are engraved with a given company’ details, such as its registered legal name, and are used to legally authorize documents – much like a signature in the West.

However, whereas signatories in the West must be legally authorized representatives of a company, in China, merely having possession of a chop usually grants authority to use it.

The risks are high: It is not uncommon for personnel, sensing that they will be terminated, to seize company chops as a bargaining chip for negotiating severance. Even if the intention is not malicious, it may lead to undesirable losses if the chops are misused.

Thus, all companies in China should develop thorough internal control systems to ensure its employees use chops legitimately. One control is dividing responsibility for chops among key personnel, such as chairman of the board, rather than normal employee involved in day-to-day operations.

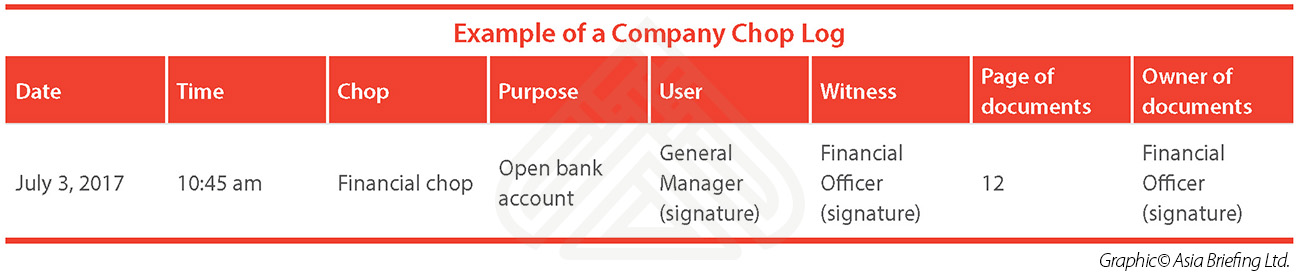

Another typical control is to implement additional security procedures to ensure chops are being used appropriately. This includes establishing a hierarchy of who senior management permits to use a given chop in the event that the regular holder is absent, and creating a log documenting the time, date, and reason each time a chop is used or accessed from the company’s safe.

![]() RELATED: Audit and Financial Review Services from Dezan Shira & Associates

RELATED: Audit and Financial Review Services from Dezan Shira & Associates

Inventory

Businesses in China, particularly manufacturing ones, should set in place systems to monitor and standardize inventory. Although most manufacturers have software to facilitate this process, inventory managers should still make physical checks to account for human error, fraud, and other mistakes.

Staff in charge of inventory might be unfamiliar with the technical details of different parts and materials, resulting in incorrect inventory data or misallocation of inventory. Employees may input inventory information incorrectly into the inventory management software, particularly if the software has been newly introduced to the company or its interface is simply unintuitive. In cases of fraud, inventory might be intentionally mislabeled, such as a perfectly functioning item being labeled scrap, allowing the employee to seize the item or forcing the company to order more from their vendor.

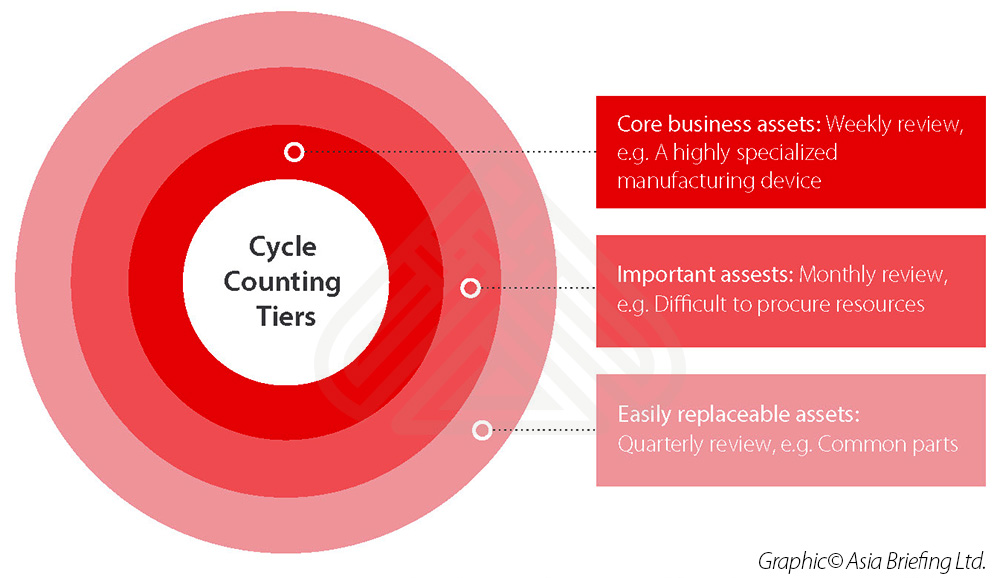

Cycle counting is a method commonly used to take stock of inventory by dividing inventory into tiers based on importance, and then verifying each tier at regular intervals based on their importance.

Sales, billing, and collection

The sales, billing, and collection process is where businesses are most vulnerable to financial fraud and corruption, as it involves the transfer of money and physical goods. Consequently, internal control governing such processes should be thorough and robust.

Price ranges for different products should be firmly set. For some businesses, each product might have a set price, while for others there is room for negotiation with each individual client. In the latter case, businesses should establish firm ranges for which employees can sell a given product, whether it is a certain range for all sales or different ranges based on the quantity sold.

Having price ranges set in stone mitigates the risk of corruption in the sales process, such as when an employee offers the client a lower price for a product in return for a personal side payment or other favor. For example, a company may set a rule that senior management must first approve any sale outside of the standard price range. Additionally, businesses should put in place different credit limit thresholds for clients based on considerations such as their size, the length of the relationship, etc. to avoid selling to an entity that will not be able to pay for the product.

Once completed, the employee completing that sale should share sales order data with inventory, shipping, and invoicing processes. Businesses should record any item shipped out with the relevant invoice. Further, businesses should ensure that their financial accounts are consistent, and log who is in charge of reviewing accounts.

Purchasing

As with selling, companies should put in place standard price ranges for purchasing processes. Companies should routinely compare the expected cost of the item with the actual cost, though the exact cost may differ when making the actual purchase.

For example, a company may find that they have been paying an average of RMB 600 for an item expected to cost RMB 500. This variance should then be investigated to determine whether the expected price was miscalculated, or if employees in charge of purchasing are invoicing falsely and pocketing the surplus money.

To prevent fraud, steps in the purchasing process should be divided among different staff. Ideally, staff responsible for payments should be different from those physically receiving and handling the goods. Additionally, regular staff rotation is an effective way to avoid fraud risks.

HR

For SMEs operating in China, particularly those with overseas headquarters and those with a small staff, internal HR controls are especially important. As business development in China is strongly relationship-oriented, having trusted employees on the ground is essential. Further, terminating an underperforming employee in China can be a significant challenge.

When recruiting employees, companies should establish a thorough screening process to identify and hire strong candidates. That includes a multi-stage interview process with different personnel within a company, and additional screening measures such as a writing test or case study.

As CV fraud is more common in China than in the West, including faked or exaggerated university degrees or work experience, hiring managers should conduct background checks on potential hires to ensure the legitimacy of their CV. Businesses unfamiliar with hiring in China may consider enlisting the services of a professional recruitment firm to identify qualified candidates.

Labor contract management is another key HR control point. HR managers should not only pay close attention to the effectiveness of the contract clauses, but also make sure the written labor contract is signed and renewed in time. For example, the employee would be entitled to double salary if the labor contract is absent for one month; two fixed term labor contract would lead to a non-fixed term labor contract in most cities; and companies may lose clients and institutional knowledge if they don’t have proper confidentiality and non-competition clauses for their senior position employees.

![]() RELATED: Internal Control Review: Audit and Evaluation in China

RELATED: Internal Control Review: Audit and Evaluation in China

Identify core needs and risks

Businesses operating in China encounter a variety of risks to achieving their desired outcomes. Some of these are universal to all businesses, while others are specific to China or particular industries and business structures.

Nevertheless, when setting up a presence in China, investors should thoroughly plan how they will implement internal control. This means identifying core business objectives, pinpointing the greatest risks to fulfilling them, and considering other factors that could detrimentally affect one’s business. An internal control system should then be built and implemented that includes structural checks and balances that mitigate risks from actualizing, as well as reviews that can actively detect weaknesses in the business.

Investors used to doing business in their home countries need to take extra precautions to guard against the risk of fraud and corruption, as well as compliance risks in an unfamiliar regulatory environment.

This article is an excerpt from the July 2017 issue of China Briefing magazine, titled “Internal Control in China.” In this issue of China Briefing magazine, we explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes. This article is an excerpt from the July 2017 issue of China Briefing magazine, titled “Internal Control in China.” In this issue of China Briefing magazine, we explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes. |

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Eco-Friendly Investment Opportunities in China: The Rise of Green Bonds

- Next Article China-Canada Relations: A New Economic Partnership?