Paying Foreign Employees in China: Individual Income Tax

(For our latest report on determining tax residency in China, dated October 1, 2018, click here.)

By Dezan Shira & Associates

Editors: Steven Elsinga and Zhou Qian

For foreigners working in China, determining the applicability of individual income tax to one’s situation involves decoding a set of intersecting criteria and rules. Following this, you will need to calculate your precise liability and any applicable deductions. Lastly, consulting with a China taxation specialist can help optimize one’s overall income to achieve the most profitable package for you or your employees.

China’s Individual Income Tax Law recognizes 11 different categories of income, with a host of different deductions, tax rates, and exceptions applying to each of them. As our focus here lies with foreign employees, this article will only address the tax treatment of employment income, including salaries, bonuses, stock options, and allowances.

![]() RELATED: China Individual Income Tax and Social Insurance Calculator

RELATED: China Individual Income Tax and Social Insurance Calculator

Am I subject to Chinese tax?

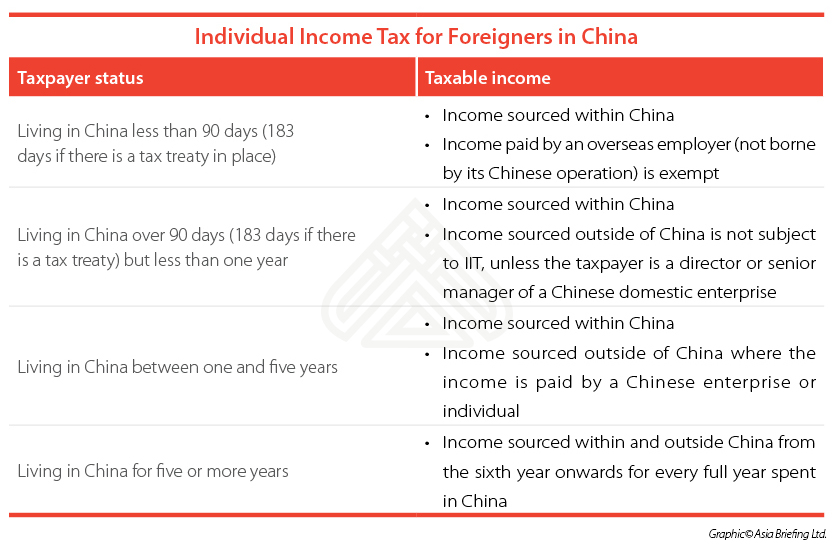

To determine whether a foreign individual working in China is subject to Chinese tax, it is necessary to look at how much time he or she has spent in China, what is the source of his or her income, and where his or her employer is based.

Income sourced within/outside of China is determined by the individual’s actual working period within China, regardless of whether the employer paying the income is based in China or not.

How is “Time in China” calculated?

- Scenario One: Foreign individuals residing in China for less than 90 days in a tax year (the “90-day Rule”)

A non-resident individual who has worked in China continuously or cumulatively for less than 90 days in a tax year only has to pay IIT on income for work done in China and for which the salary is paid by Chinese domestic institutions, entities or individuals. IIT on income derived from working outside of China or paid by a foreign employer outside of China will be exempt. If there is a double taxation agreement (DTA) in place between a foreign country and China, the 90-day limit may be extended to 183 days, depending on the relevant DTA.

- Scenario Two: Foreign Individuals Residing in China for More than 90 Days but Less than One Year (the “One-year Rule”)

An individual who has resided in China for more than 90 days but less than one year during the tax year is subject to IIT on all China-sourced income, including income paid by both Chinese and overseas entities for his/her work in China. Income earned while working overseas (i.e., foreign-sourced income) in the tax year is not Chinese IIT taxable.

![]() RELATED: Individual Income Tax for Expats in China

RELATED: Individual Income Tax for Expats in China

- Scenario Three: Foreign individuals residing in China for more than one year but less than five years

An individual’s period of residency in China is calculated based on the calendar year, excepting temporary absences from the country of up to 30 days continuously or 90 days cumulatively – which are not counted toward the individual’s stay in China.

A foreign individual who is deemed to have resided in China for more than one year but less than five years must pay IIT for income received from both Chinese and foreign employers for work conducted in China (China-sourced income), and also for income paid by Chinese employers during any temporary absences from the country. Income obtained from foreign employers for work done during a temporary absence is not taxable.

- Scenario Four: Foreign individuals residing in China for more than five years consecutively

A foreign individual who has resided in China for more than five years continuously may face new IIT liabilities identical to those of a resident individual of China, depending on the duration of his/her residency in China starting from the sixth year.

If a foreign individual resides in China for one year in the sixth or any following single year, he/she would be considered a resident individual under the IIT Law and therefore liable for IIT on income received globally for that specific tax year; if the individual resides in China for less than one year in the sixth or any following single year, he/she is subject to IIT on only China-sourced income, and the One-year Rule applies.

The five-year threshold will be reset if the individual resides in China for less than 90 days in any single tax year starting from the sixth year, in which case the “90-day Rule” will apply for that tax year. Understanding the “Five-year Rule” is especially important for foreign companies with expats working in China for the long-term as their IIT burden may be significantly reduced if their stay in China is managed properly.

How much do I pay?

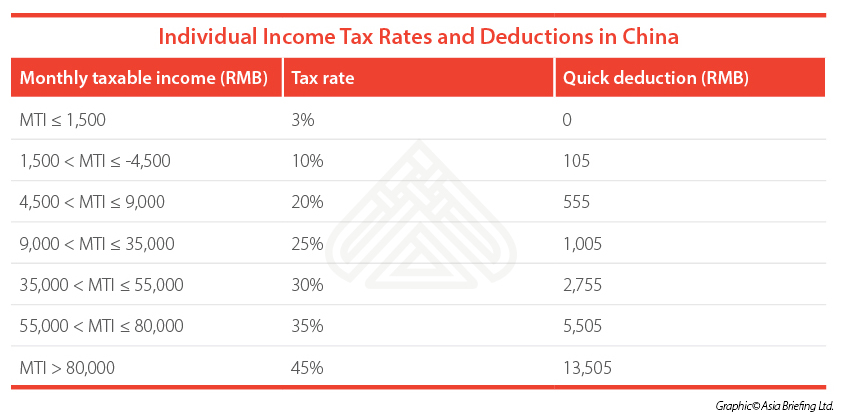

Like in most countries, individual income tax in China is levied at a progressive rate. The tax brackets and corresponding rates are shown below. To avoid the hassle of calculating the different parts of one’s income at different tax rates, the table below includes a Quick Deduction figure. This allows you arrive at the amount of tax payable by entering the full income into the highest applicable tax rate, and then subtracting the Quick Deduction amount.

The formulas for calculating an individual’s tax payable are:

Monthly taxable income = Monthly income – RMB 4,800 (Standard deduction) – Allowances

Tax payable = Monthly taxable income × Applicable tax rate – Quick calculation deduction

![]() RELATED: China Individual Income Tax and Social Insurance Calculator

RELATED: China Individual Income Tax and Social Insurance Calculator

Deductions

Foreign individuals employed in China are eligible to a standard deduction of RMB 4,800. On top of this, there are a number of allowances that may be deducted off an individual’s income, including the mandatory Chinese social security payments for foreigners. Note: at the time of writing, not all Chinese cities have implemented social security for foreigners yet.

Permitted allowances

The Chinese Tax Bureau allows foreign staff to deduct certain “allowances” before calculating the tax burden on their monthly salary. This is something that should be discussed between an employee and employer as part of the discussion of an overall salary package. These include:

- Allowances for housing, meals, relocation, and laundry expenses

- Relocation expenses upon commencement or cessation of employment in China

- Reasonable business travel expenses and two personal trips to the individual’s country of origin

- Reasonable allowances for language training and children’s education

The tax authorities will only permit these allowances to be deducted if they are included in the employee’s contract. The employee needs to produce an official fapiao (receipt) every month for the expenses, in addition to meeting other conditions.

Previously, we gave an overview of expats in China by country of origin, and residence in China. The next article in this series explores the tax benefits of including annual bonuses or stock options in an expat’s salary package. For China-specific income tax and human resources advisory, please contact china@dezshira.com.

This article was originally published on January 28, 2015 and has been updated with the latest regulatory changes.

This article is based on an issue of China Briefing Magazine, titled “Employing Foreign Nationals in China“. In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad. This article is based on an issue of China Briefing Magazine, titled “Employing Foreign Nationals in China“. In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad. |

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Новый “негативный список” ЗСТ Китая снимает ограничения на иностранные инвестиции.

- Next Article What to Expect at China’s 19th Party Congress