How to Apply for VAT General Taxpayer Status in China

Acquiring value-added tax (VAT) general taxpayer status is essential for companies in China to credit input VAT from output VAT, and to get export VAT refunds.

However, businesses must fulfill certain requirements to be eligible for VAT general taxpayer status and undergo the application process to acquire the designation.

Requirements for VAT general taxpayer status

VAT taxpayers are categorized into general taxpayers and small-scale taxpayers based on their annual taxable sales amount.

Taxpayers with annual taxable sales exceeding the annual sales ceiling set for small-scale taxpayers must apply for general taxpayer status (except for individual-owned businesses and entities whose taxable acts are infrequent).

Previously, the sales ceiling differed depending on the category of taxpayer:

- RMB 500,000 (US$75,270) for industrial taxpayers. For example, enterprises engaged primarily in the manufacture of goods or provision of taxable services;

- RMB 800,000 (US$120,430) for commercial taxpayers. For example, enterprises engaged in the wholesale or retail sale of goods; and

- RMB 5 million (US$752,700) for VAT reform taxpayers.

Starting May 1, 2018, the sales ceilings of small-scale taxpayers were unified to RMB 5 million (US$752,700) for all types of taxpayers.

Besides, taxpayers registered as general taxpayers shall be allowed to change back to small-scale taxpayer status before December 31, 2019.

Small-scale taxpayers are subject to a lower uniform VAT rate of three percent, as compared to rates ranging from six to 13 percent for general taxpayers, but they cannot credit input VAT from output VAT nor are they entitled to VAT export refunds.

VAT payers whose annual taxable sales are below the ceiling as well as those who have newly established their business can voluntarily apply for general taxpayer recognition provided they are capable of setting up legitimate, valid, and accurate bookkeeping.

Additional “soft” or unwritten requirements also commonly influence the local tax authorities’ judgment on the type and number of VAT fapiao available to the taxpayers, such as registered capital, office size, and number of employees.

VAT general taxpayer registration process

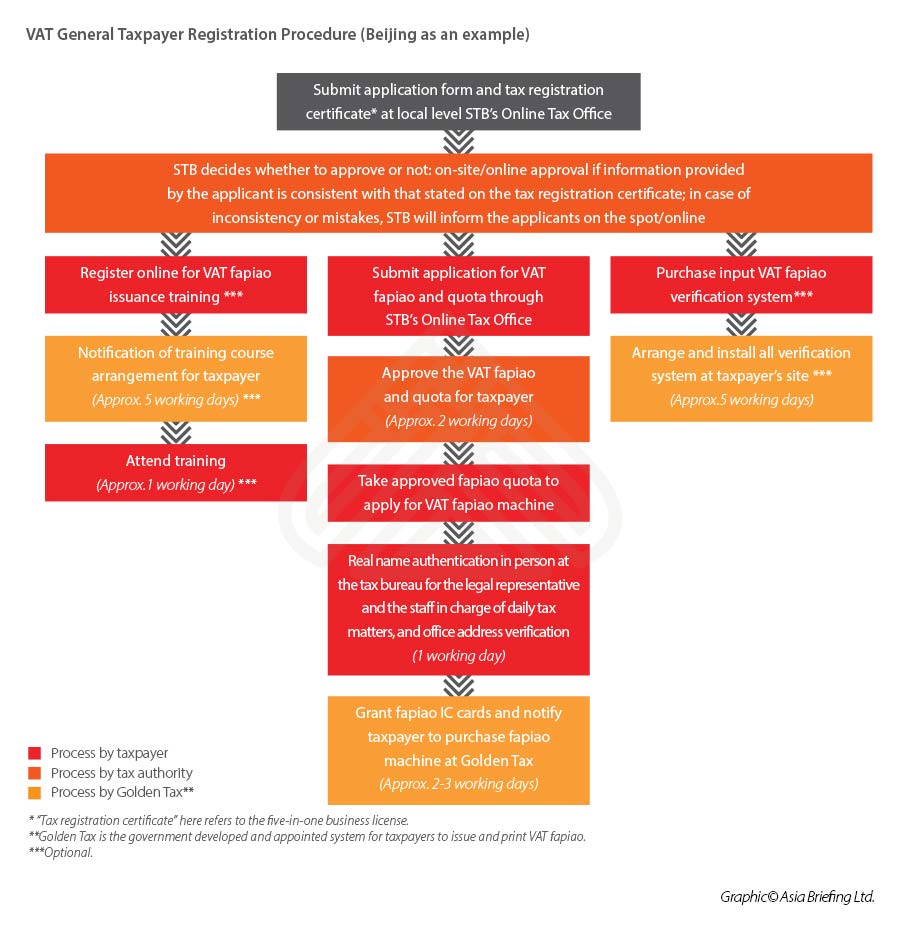

To obtain general taxpayer status, taxpayers are required to go through a registration process. VAT general taxpayer registration occurs at the very end of the corporate establishment process. The general VAT taxpayer status will be effective from the same day the registration is completed.

However, there still is an approximately one month waiting period until a company’s VAT system is fully established, which includes purchasing special printers and blank invoices for fapiao and sending a representative employee to participate in training at the tax bureau on how to issue invoices.

In practice, the waiting period might vary largely by region and even by district in one city. For example, in Shanghai, it takes only three to 14 days to establish the whole VAT system starting from obtaining the tax registration certificate.

Additionally, small wholesale companies (that is, with registered capital of RMB 800,000 [US$120,430] or no more than 10 employees) and companies with previous histories of tax fraud (that is, VAT evasion amount constituted 10 percent or more of the VAT payable and reached RMB 100,000 [US$12,050] and above; obtained export VAT refund fraudulently; or issued VAT deduction proof fraudulently) must pass a three-month and six-month probation period under a tax officer’s supervision, respectively, in order to become fully certified general taxpayers.

The complete VAT general taxpayer application procedure is shown below.

(This article was originally published on October 4, 2017. It was last updated on December 17, 2019.)

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s 2019 Market Access Negative List: What Investors Need to Know

- Next Article Year in Review 2019: Turning Point for Investors in China?