China Expat Tax Filing and Declarations for 2011 Income

Update: For information regarding expatriate income tax filing for the 2013 tax year, please click here.

Jan. 16 – Individuals residing in China are subject to individual income tax (IIT) and expatriates who are employed by a foreign-invested enterprise in China are liable for IIT from the first day they arrive in China.

IIT is normally withheld from wages or salaries by employers and paid to the tax authorities on a monthly basis (within 15 days of the end of each month). At the end of the year, an annual IIT declaration should be submitted to tax authorities within three months of the end of the previous calendar year (i.e., between January 1, 2012 and March 31, 2012 for the 2011 calendar year). Penalties for late filing can be up to five times the amount that was due.

Annual IIT declarations should be filed for taxpayers who are subject to IIT in China and meet at least one of the following five conditions:

- Have an annual income of more than RMB120,000

- Derive income from two or more places inside the People’s Republic of China

- Derive income from sources outside the People’s Republic of China

- Received taxable income for which there is no withholding agent

- Other conditions regulated by the State Council

What is considered annual income?

- Wages and salaries

- Income from individually-owned industrial and commercial households

- Income from subcontracting or subleasing

- Remuneration for labor services

- Author’s remuneration

- Incomes from royalties

- Incomes from interests, stocks dividends and bonuses

- Incomes from lease, transfer of property

- Incidental incomes

How does IIT apply to expatriate income?

If an individual is paid by a China-based entity, any income derived from working in China will be taxable.

For non-China sourced income or income paid by overseas employers, tax liabilities for foreigners generally depend on the period of time an individual spends in China.

Individuals who spend less than 90 days (or 183 days for residents of countries that have signed a double taxation treaty with China) in one calendar year in China are exempt from IIT if the employment income is paid by an overseas entity.

Individuals who stay in China for more than 90 (183) days, but less than a year, are subject to personal income tax on their employment income derived from work performed in China – regardless of which entity is paying.

Residing in China for one calendar year means that, in a calendar year, temporary absences from China are less than 30 days continuously or 90 days altogether.

IIT applicability timeline

Individuals who reside in China for more than one year, but less than five years, are subject to personal income tax on both China-sourced and foreign-sourced income borne by a China-based entity. Foreign individuals who reside in China for more than five years are taxed on their worldwide income.

After an individual resides in China for five years, in the sixth year, if the individual resides in China for less than a year, the five year period is reset and the “90 (183) day rule” applies again.

Senior management

The 90 (183) day foreign employment exemption rule does not apply if the employee in question holds a senior management position in China.

These individuals are liable to individual income tax regardless of the number of days they reside in China during a calendar year.

In general, senior management positions include:

- Director

- Chief executive officer

- General manager

- Vice president

- Chief representative

- Individuals that hold positions in specific professional fields, such as chief engineer or chief financial officer

- Certain individuals who do not hold a title such as manager but carry similar responsibilities or have a great influence on business operations or decisions

For people holding senior management positions, their director’s fee or salaries paid by domestic employers regardless of whether it is China or non-China sourced is subject to IIT in China.

Tax rates

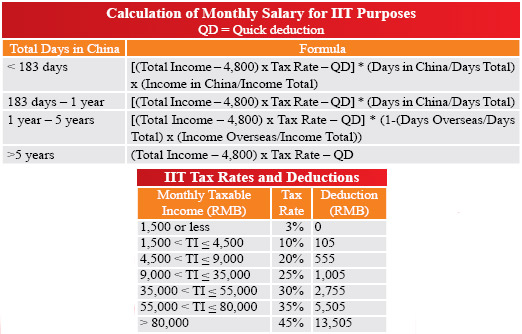

Income from wages and salaries is taxed according to progressive rates, ranging from 3 percent to 45 percent of monthly taxable income.

Monthly taxable income is calculated after a standard monthly deduction of RMB3,500 for local employees. For foreign individuals working in China (including residents of Hong Kong, Taiwan and Macau), the standard monthly deduction is RMB4,800.

Money paid into Chinese social insurance can also be added to your pretax deduction.

- Monthly Taxable Income = Monthly Income – RMB4,800

- Tax Payable = Taxable Income x Applicable Tax Rate – Quick Calculation Deduction

IIT calculation for monthly salary

When calculating their IIT amount, foreign expatriates need to apportion their total taxable income based on the income source and time spent in and outside of China. The specific formulae are listed in the accompanying table.

Employment benefits

For IIT purposes, “taxable income” refers to “wages, salaries, bonuses, year-end bonus, profit shares, allowances or subsidies or other income related to job or employment.”

Certain employment benefits for foreign individuals could be specifically treated as not being taxable under the IIT law if certain criteria can be met. These include (with supporting invoices where applicable):

- Employee housing costs

- Reasonable home leave fares of two trips per year for the employee

- Reasonable employee relocation and moving costs

- Reasonable reimbursement of certain meals, laundry, language training costs and children’s education expenses in China

- Any cash allowance paid to cover expected work-related expenditures (such as an entertaining or travel allowance) will be fully taxable to an employee

IIT may be reduced by reimbursing specific work-related expenses incurred by an employee (which may include entertainment, health or social club fees, local travel, newspapers and journals, telephone costs, etc.) instead of paying an allowance.

Non-employment income

Non-employment income is taxed at rates generally ranging from 5 percent to 35 percent, depending on the income source.

Proprietors; contracting and leasing

Operating profit of individual industrialists and merchants’ production and business operations or from the contracting or leasing of operations of enterprises and institutions is subject to tax at progressive rates ranging from 5 percent to 35 percent. The 35 percent marginal rate applies to annual taxable income (gross revenue less allowable costs, expenses and losses) over RMB100,000.

Income of authors

Flat rate of 20 percent, applied to 70 percent of gross.

Compensation for personal services

Taxable at 20 percent if the taxable income (after allowable deductions) from a single payment does not exceed RMB20,000; 30 percent for the portion over RMB20,000 but not exceeding RMB50,000; and 40 percent for the portion exceeding RMB50,000.

Royalties, interest, dividends, leases on or assignment of property, other income

Flat rate of 20 percent.

Deductions

No deduction is allowed against income from interest, dividends, bonuses or other income. Deductions are allowed from other sources of income, including:

Contracting and leasing of operations of enterprises and institutions

Necessary expenses are deductible.

Compensation for personal services, royalties, or leases on property

A deduction of RMB800 is allowed if the income received in a single payment is less than RMB4,000. If the income received in a single payment is more than RMB4,000, a 20 percent deduction is allowed.

Property transfers

Original cost plus reasonable expenses are deductible.

Content for this article was taken from the January/February issue of China Briefing Magazine, titled “Annual Compliance for FIEs.” Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law (and completing them improperly could lead to fines), but are a good opportunity to conduct an internal financial health check. We discuss all of this, in addition to clarifying expatriate IIT procedures, in the new issue of China Briefing Magazine which is immediately available as a complimentary PDF download on the Asia Briefing Bookstore.

Content for this article was taken from the January/February issue of China Briefing Magazine, titled “Annual Compliance for FIEs.” Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law (and completing them improperly could lead to fines), but are a good opportunity to conduct an internal financial health check. We discuss all of this, in addition to clarifying expatriate IIT procedures, in the new issue of China Briefing Magazine which is immediately available as a complimentary PDF download on the Asia Briefing Bookstore.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, India, Singapore and Vietnam. For further information on individual tax rates or filings in China, please email china@dezshira.com.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in the country is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Calculating Individual Income Tax on Annual Bonus in China

Getting Cash Money RMB Out of China

- Previous Article Twenty Years Ago, Deng Changed China Forever

- Next Article Zhejiang to Invest RMB2 Billion into Oceanic Economy