-

Other Briefings

- Subscribe

GST Registration in 72 Hours: India's New Auto-Approval System to Begin Nov. 1, 2025

From November 1, 2025, India will roll out a simplified GST registration system, offering automatic approval within three working days for most new applicants. The central government expects the initiative to cover around 96 percent of new registrants.

UAE Overhauls Trademark System: Lower Fees, Faster IP Protection Services

In October 2025, the UAE has introduced trademark reforms with reduced fees, new services, and expedited procedures to enhance accessibility and strengthen IP protection.

Avoiding Penalties During Labor Inspections in Indonesia

Foreign investors can avoid costly labor penalties in Indonesia through strong HR governance and BPJS compliance systems.

How Cross-Border Data and IP Disputes Impact Vietnam’s Digital Transformation

Technology disputes in Asia, from data-transfer conflicts and AI-governance gaps to IP and e-commerce liability, are influencing the mechanics of Vietnam’s digital economy.

Vietnam Tax Compliance in 2025: What Newcomers Should Do?

Stay informed on Vietnam tax compliance in 2025, from corporate income tax and VAT changes to internal control strategies.

Understanding UAE’s New Free Zone Tax Regulations – MD 229 and 230

The UAE Ministry of Finance’s new Free Zone Tax regulations introduce market-based commodity pricing and new eligibility criteria for structured finance. The rules tighten economic-substance tests and bring transfer-pricing requirements in line with Organization for Economic Co-operation and Development-Base Erosion and Profit Shifting (OECD BEPS) standards to preserve 0 percent tax benefits for Qualifying Free Zone Persons (QFZP) under the Corporate Tax Law.

How Can Companies Establish Tax Residency in Singapore to Access Treaty Relief?

Foreign investors can access treaty relief and lower tax rates by establishing genuine management and control in Singapore.

Invest in South India: Unlocking Opportunities for Multinational Firms

Discover South India’s booming economy, infrastructure, and retail potential – key insights for foreign investors seeking expansion in India’s fastest-growing region.

Malaysia’s 2026 Budget: What it Means for Foreign Investors

Malaysia’s 2026 Budget refines tax rules, expands incentives, and strengthens ESG and digital growth opportunities.

Termination Laws and Severance Obligations in Malaysia

Foreign investors should assess termination and severance costs in Malaysia to support workforce and risk management decisions.

Establishing a Representative Office in Saudi Arabia

Establishing a representative office in Saudi Arabia can help foreign firms to conduct market research and liaison activities.

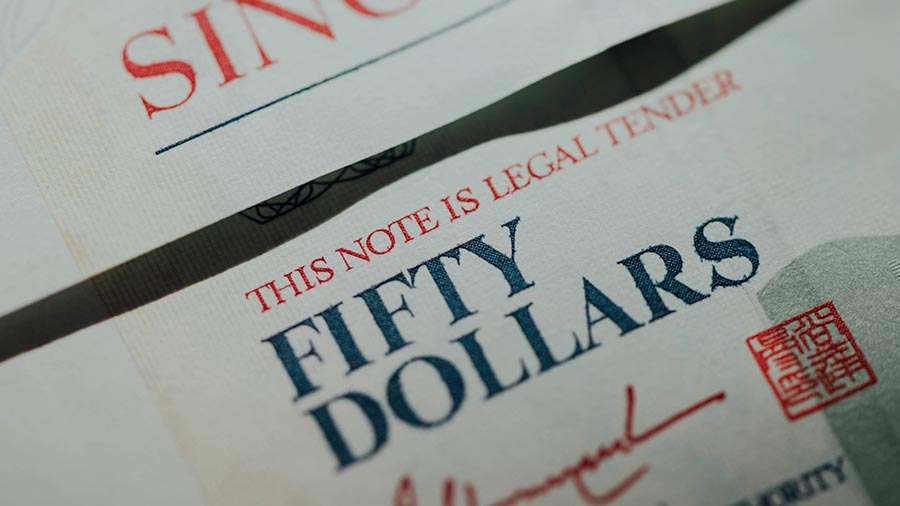

GST in Singapore: When Overseas Vendors Must Register and Collect Tax

Understand Singapore’s GST rules for overseas vendors, registration thresholds, compliance duties, and filing obligations.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

About Us Find an AdvisorWant the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

SUBSCRIBEGet free access to our subscriptions and publications

Subscribe to receive weekly China Briefing news updates, our latest doing business publications, and access to our Asia archives.

Sign Up Now