China has set two major carbon emissions targets, the first of which is due to be reached in 2030. To achieve these goals, policymakers have created an overarching policy framework to guide China's energy transition. As part of its decarbonization plan, China has announced several major renewable energy projects and is set to become the leader in renewable and clean energy by the end of the decade. At the same time, the country's growing energy demand puts it at odds with these commitments as the country continues to increase the output of coal to a stable power supply. We discuss how far China has come on its road toward decarbonization and the challenges it still faces.

China is steaming ahead with plans to expand renewable energy capacity in the coming decade in an ambitious effort to meet its core climate pledges - reaching peak carbon by 2030 and carbon neutrality in 2060. Reaching these goals will require a huge level of investment and commitment for a country that is still heavily reliant on fossil fuels, and which is still expanding its overall energy output and consumption every year.

Moreover, the country is facing new challenges as tension grows between the dual commitments of meeting its climate targets and ensuring energy stability.

In this article, we provide an overview of China’s climate plans and commitments and look at how far the country has come in decarbonizing its economy. Finally, we discuss why China is still increasing coal production despite the looming carbon peak deadline.

The pledge: China’s decarbonization commitments and climate policy framework

In a video address to the UN General Assembly on September 21, 2020, President Xi Jinping announced that China would strive to reach peak carbon emissions by 2030 and carbon neutrality by 2060, setting in motion a new effort for the transition to a green economy. In the run-up to the COP26 summit in early November 2021, China released two key policy documents, further cementing its decarbonization commitments.The two documents, titled the Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy (“Working Guidance”) and the Action Plan for Reaching Carbon Dioxide Peak Before 2030 (“Action Plan”) also form the basis of China’s climate policy framework for reaching its carbon reduction targets, known as the “1+N” policy framework.

The “1” part of the policy framework refers to the Working Guidance, which acts as the country’s overarching guiding principles for reaching its climate goals, while the “N” stands for an unspecified number of auxiliary policy documents targeting specific industries, fields, and goals. The Action Plan is the first “N” document to be released. The Working Guidance offers an overview of China’s overall plan for reaching both the 2030 and the 2060 goals.

Meanwhile, the Action Plan provides an extensive overview of the areas of China’s economy that will gradually be reduced or shifted to sustainable energy and methods, in order to slow the growth of high-carbon industries and areas of the economy.

The stats: Current progress on decarbonization

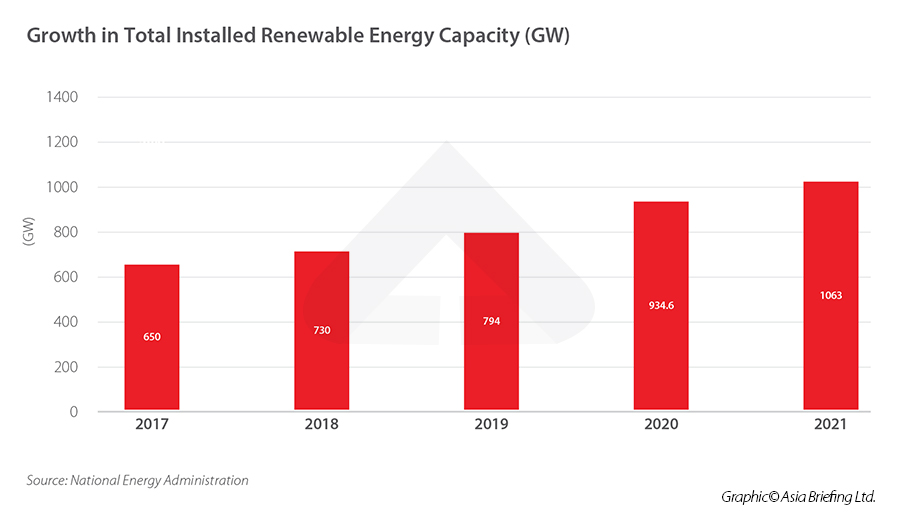

China has been investing heavily in renewable energy over the past decade, with the total installed energy capacity of renewable energy increasing steadily. According to the National Energy Administration (NEA), China’s installed renewable energy capacity reached 1063 gigawatts (GW) in 2021, accounting for 44.8 percent of China’s total power generation capacity.Hydroelectric power accounts for the highest proportion of installed renewable energy capacity, 16.5 percent of the country’s total power generation capacity, followed by wind (13.8 percent), solar (12.9 percent, and biomass (1.6 percent).  However, it is important to note that “capacity” refers to the maximum level of electrical power that can be produced in the country, not the total amount of electrical power that has been generated. This figure can be useful to gauge the energy generation potential of the country but does not show the actual amount of energy that has been generated from renewables.

However, it is important to note that “capacity” refers to the maximum level of electrical power that can be produced in the country, not the total amount of electrical power that has been generated. This figure can be useful to gauge the energy generation potential of the country but does not show the actual amount of energy that has been generated from renewables.

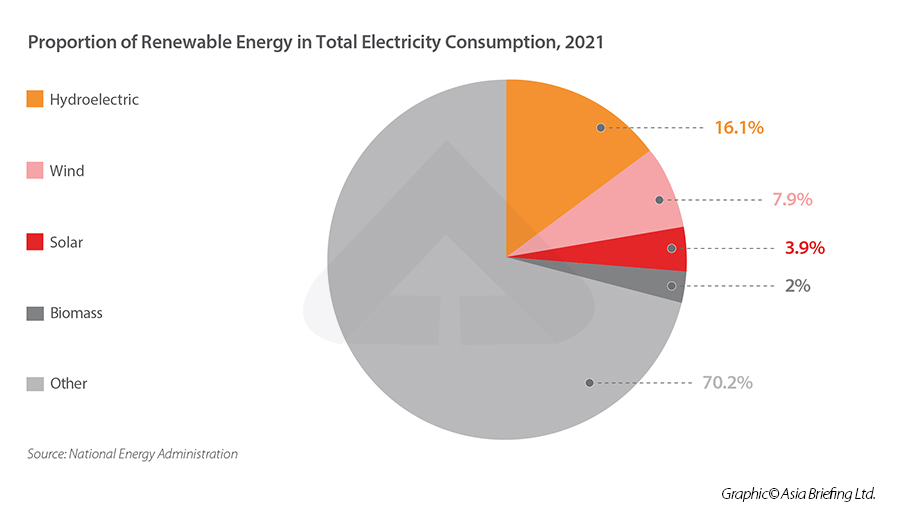

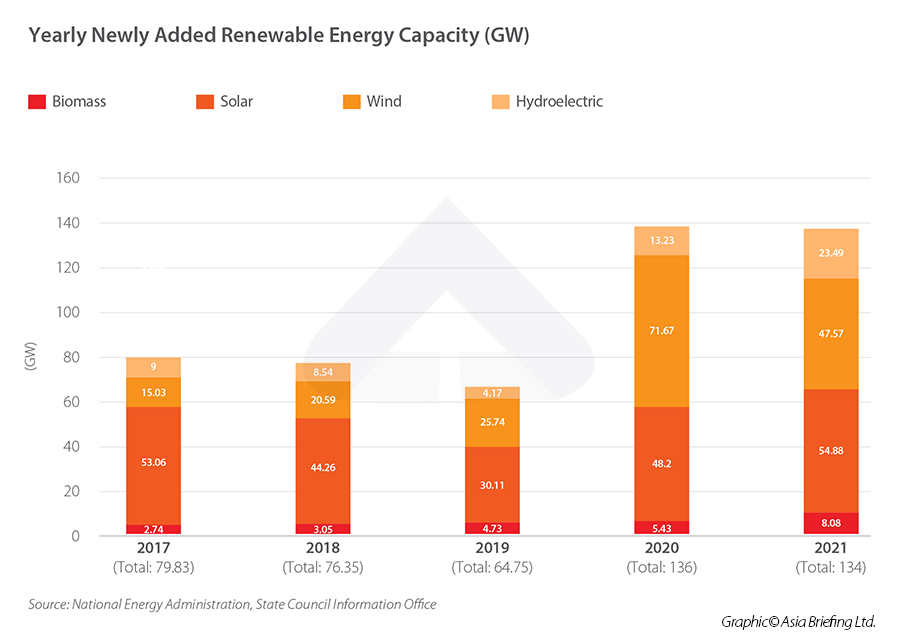

In terms of electricity generation, renewables account for a smaller proportion, reaching 2.48 trillion kWh in 2021, equivalent to 29.9 percent of total electricity use that year. The majority of this came from hydroelectric power sources, which generated 1340.1 billion kWh, or 16.1 percent of total electricity use. Wind power was the second-highest source of renewable energy generation, at 7.9 percent in 2021.  This number is set to increase in the coming years, however, as China continues to invest in renewable energy infrastructure. In 2021, newly installed renewable energy capacity reached 134 GW, which accounted for 76.1 percent of the total newly installed power generation capacity that year. Solar energy saw the highest buildout in 2021, accounting for 31.1 percent of total added capacity, followed by wind (27 percent), hydroelectricity (13.3 percent), and biomass (4.6 percent).

This number is set to increase in the coming years, however, as China continues to invest in renewable energy infrastructure. In 2021, newly installed renewable energy capacity reached 134 GW, which accounted for 76.1 percent of the total newly installed power generation capacity that year. Solar energy saw the highest buildout in 2021, accounting for 31.1 percent of total added capacity, followed by wind (27 percent), hydroelectricity (13.3 percent), and biomass (4.6 percent).

The action plan: China’s energy transition

Targets for green energy transition

The Action Plan released in October 2021 set specific goals for the green energy transition in the coming decade, including renewable energy buildout and low carbon development of several industries, such as construction, transport, and industrial sectors. These targets aim to lay the groundwork for the country to begin reducing overall carbon emissions from 2030 onward. Below we list some of the concrete targets set out in the Action Plan.| Key Renewable Energy and Carbon Reduction Targets in the Action Plan | ||

| Category | By 2025 | By 2030 |

| New energy transition of power grids | Reach more than 30 GW in installed new energy storage capacity. | Reach over 1,200 GW of total installed capacity for wind and solar power |

| Add 40 GW of installed hydropower capacity | Add (another) 40 GW of installed hydropower capacity | |

| - | Reach 120 GW of installed capacity of pumped storage hydropower | |

| - | Reach over 5 percent peak load response capacity for provincial power grids. | |

| Coal consumption | Reach peak coal consumption | - |

| Low-carbon development of industrial sectors | Keep domestic crude oil processing capacity within 1 billion tons | - |

| Increase the capacity utilization rate of major products to over 80 percent | - | |

| Low carbon development of urban and rural construction | Fully implement green standards for new buildings | Reach 8 percent rate of replacement of renewable energy in urban buildings |

| Reach 50 percent coverage of solar panels on the roofs of new public institutions and factory buildings. | ||

| Reach 8 percent rate of replacement of renewable energy in urban buildings | - | |

| Reach 50 percent coverage of solar panels on the roofs of new public institutions and factory buildings. | - | |

| Low carbon development of the transport industry | Maintain a 15 percent annual increase in the combined transportation volume of containerized iron and water. | Drive new energy and clean energy-powered vehicles to account for 40 percent of new car sales that year |

| - | Reduce carbon emissions intensity of operating vehicles by about 9.5 percent from 2020 levels | |

| - | Decrease the comprehensive energy consumption ratio of the national railway by 10 percent from 2020 | |

| - | Ensure green modes of transport reach a minimum of 70 percent coverage in cities with a permanent population of more than 1 million. | |

| - | Strive to fully electrify vehicles and equipment in civil airports. | |

| Consolidating and improving carbon sink capabilities | - | Reach 25 percent coverage of national forests |

| - | Reach 9 billion cubic meters in forest stock volume | |

| Source: Action Plan for Reaching Carbon Dioxide Peak Before 2030, State Council | ||

Solar and wind energy

Among Action Plan’s targets is a goal to reach 1,200 GW of total installed wind and solar capacity by 2030, in line with the country’s pledges under the Paris Agreement. However, China has since set plans for renewable energy infrastructure construction that would put it well above this target by the end of the decade.According to a report by Bloomberg, which quoted officials and researchers at an event hosted by China Electricity Council, a trade association for power companies, China has launched a plan to build 455 GW of solar and wind energy capacity in the country’s vast desert regions. The plan targets to install 200 GW of capacity by 2025 and an additional 255 GW by 2030, of which about 60 percent will be solar, and 40 percent will be wind.

The plan has previously been teased by officials, with Xi Jinping first announcing that China had begun construction of 100 GW of solar and wind capacity in a speech at the COP15 Biodiversity Conference in October 2022. The construction was reported to take place mainly in Inner Mongolia, Qinghai, Gansu, Ningxia, Shaanxi, and Xinjiang. According to a researcher from the National Development and Reform Commission quoted by Bloomberg, including the desert project, China will install 500 GW of wind and solar by 2025 and 700 GW by 2030, which would put its total installed capacity of wind and solar at 1,700 GW.

Nuclear energy

China’s plan to reach net-zero by 2060 will involve replacing a portion of the power produced from fossil fuels with nuclear energy. China’s 14th Five Year Plan, the country’s overarching economic and development plan for the period from 2021 to 2025, targets the installed capacity of nuclear power operation to reach 70 GW by the end of 2025, a 40 percent increase from 2020 levels.According to data from the NEA, China’s total installed capacity of nuclear power reached approximately 54.65 GW, and had 53 operating reactors. For comparison, the U.S., which is currently the top nuclear energy-producing country in the world, had 93 operating reactors and a total of 95.49 GW in installed capacity in 2021, while France - the second largest producer after the U.S. - had 56 operational reactors and 64 GW of total installed capacity.

However, China is expected to outpace the rest of the world’s nuclear power development, reaching 120 GW installed capacity by 2030, according to the China Nuclear Energy Development Report (2021) Blue Book, which would likely put it ahead of the U.S. and France. On April 20, 2022, at the weekly State Council meeting, China announced that another three nuclear projects had been approved in Zhejiang, Shandong, and Guangdong, with each region to get two new nuclear reactors.

The elephant in the room: Why China is still increasing coal consumption

Although China has made concrete pledges to the world to take action against climate change and decarbonize its economy, one issue has continued to irk observers around the world: China’s continued reliance on coal.Despite the active buildout of renewable and green energy capacity, the majority of China’s power supply still comes from fossil fuel sources. According to data from the NBS, consumption of coal also increased 4.6 percent year-over-year and accounted for 56 percent of total energy consumption.

China has made several pledges to reduce coal consumption over the next decade. The Action Plan states that China will begin to reduce total coal consumption of coal from 2025 onward, and calls for “promoting the substitution, transformation, and upgrading of coal consumption”. Moreover, in the 2022 Energy Work Plan, released by the NEA in March 2022, the government pledged to “steadily decrease coal consumption”, but did not provide a specific target. These two policies leave the door open for China to increase coal consumption for at least the next three years, although increasing consumption by a considerable amount would reduce consumption in the latter half of the decade much harder.

Furthermore, in a speech to the UN General Assembly in September 2021, President Xi Jinping pledged that China would cease building new coal-burning power plants outside of China. However, new domestic coal-fired power plants have been given the green light as recently as February this year.

China also confirmed that it will increase its output of coal in 2022 to 300 million tons, up from 220 million tons in 2021, according to a readout of the weekly State Council meeting held on April 20, 2022. The main reason for China’s reluctance to take drastic action on coal is that it is still highly reliant on coal for its power supply, and when it comes to ensuring a stable energy supply and reducing its reliance on fossil fuels, China finds itself stuck between a rock and a hard place.

China suffered one of the worst power shortages in many years in the fall of 2021, leading to rolling blackouts in urban areas and forcing the closure of factories in parts of the country. The power crunch was blamed on a combination of factors, including an increase in demand and a cut to coal production in response to policies to reduce energy intensity. The shortage was a considerable shock to the country. As a result, government officials have repeatedly stressed the importance of ensuring a stable energy supply and have placed energy security as a top priority for 2022.

2022 is also a pivotal year for the government as it prepares for the upcoming 20th National Congress of the CCP in the latter half of the year, which will see the appointment of the country’s top leadership, including the expected reappointment of Xi Jinping himself. In the run-up to this event, economic and social stability are paramount.

China is currently facing growing economic pressure stemming from the recent COVID-19 outbreaks, which have triggered strict lockdowns and economic standstills in some of the country’s largest economic centers. Unemployment is also on the rise, and small and medium-sized enterprises - the lifeline of China’s economy - are expected to suffer considerably.

External factors, such as continued supply chain bottlenecks, high commodity prices, and instability as a result of the Russia-Ukraine war, will also be weighing heavily on the minds of policymakers. Another power crunch of the kind seen in 2021 would therefore be disastrous for the country’s economy. Although China is committed to its decarbonization pledges, economic stability will always come first on the list of priorities, and as stated in the April 22 State Council meeting, “energy is the basis for economic and social development”.

The upshot: Can China meet its climate targets?

Despite China’s seemingly contradictory actions on energy transition and carbon reduction, we currently do not have reason to believe that China is going back on its decarbonization commitments. We expect the current increase in coal production and consumption to be a response to short-term issues of energy supply, and that the country will begin to ease coal consumption once the current situation stabilizes, and other energy sources catch up.China’s current renewable energy buildout may take a few years to bear fruit as the country builds and improves upon the infrastructure necessary to connect power production facilities with the power supply network, and as overall capacity and efficiency increase.

At the same time, we expect policymakers to release more policies and regulations aimed at reducing carbon emissions in specific areas of the economy and roll out more incentives to encourage the participation of private capital in the country’s energy transition.