When expanding into the Chinese market, businesses face an important decision on how to establish their presence.

The choice between Incorporation, Employer of Record (EOR), Professional Employer Organization (PEO), and Representative Office (RO) each has distinct advantages and challenges. This decision depends on several factors, including the company’s business goals, budget, timeline, and need for operational control.

Below, we will explore each of these options in detail and provide guidance on choosing the most suitable entry strategy.

Incorporation in China: Establishing a WFOE

Establishing a Wholly Foreign-Owned Enterprise (WFOE) is one of the most common and well-understood methods for foreign companies to enter the Chinese market. A WFOE allows a company to operate fully independently of any local partners, giving it complete control over its operations.

Pros of WFOE:

- A WFOE provides 100 percent ownership and management control of the business, allowing complete autonomy in decision-making and operational management.

- Companies can engage in a wide variety of activities such as manufacturing, servicing, and trading, depending on the type of WFOE and industry.

- A WFOE is ideal for businesses committed to a long-term presence in China. It offers long-term stability and operational freedom.

Cons of WFOE:

- Establishing a WFOE requires significant initial investment, including office space, legal fees, staffing, and compliance with local regulations.

- The process to establish a WFOE can take several months, requiring various approvals and registration steps. This can delay market entry.

- Maintaining a WFOE involves complex compliance with Chinese labor laws, taxes, social insurance, and other local regulations, which can be administratively burdensome.

Best for:

- Large businesses planning to establish a substantial, long-term presence in China.

- Companies that need full control over operations and are prepared for the long-term investment required.

EOR: A leaner, flexible alternative

An Employer of Record (EOR) is an increasingly popular alternative to setting up a WFOE. With an EOR, the EOR provider becomes the legal employer for a company’s employees, assuming responsibility for key administrative functions such as payroll, tax filings, social security contributions, and compliance with labor laws. The company can focus on managing the operational aspects of the business, while the EOR handles the employment-related responsibilities.

Pros of EOR:

- EOR services allow companies to enter the Chinese market quickly, often within weeks, without the lengthy setup process associated with a WFOE.

- By using an EOR, businesses can avoid the significant upfront costs of establishing a WFOE, such as office space, legal fees, and recruitment costs.

- The EOR ensures compliance with all local labor laws, tax regulations, and social insurance requirements, reducing the risk of legal issues or fines.

- EOR allows businesses to scale operations up or down as needed, providing flexibility to respond to market conditions or business changes without the complexity of entity formation or closure.

Best for:

- Companies testing the market before committing to a long-term investment.

- Businesses with short-term projects or pilot operations in China.

- Companies operating in multiple cities or regions in China without establishing separate legal entities in each location.

Case study: Using EOR for efficient project management in China’s shipbuilding industry

A Netherlands-based shipbuilding services company, specializing in providing high-quality shipbuilding technicians and project managers, was contracted to oversee a short-term shipbuilding project in China. Given China’s robust shipbuilding industry, the company needed to deploy expatriate workers to manage the project while ensuring compliance with local labor laws and regulations. Instead of setting up a full legal entity in China, the company decided to partner with an Employer of Record (EOR) provider, leveraging the EOR model to efficiently handle the staffing and compliance requirements for the project.

By using the EOR model, the company was able to quickly deploy expatriate workers for the project, while also maintaining a local workforce in China to assist with operations. This solution allowed the company to manage its team effectively without the lengthy setup process typically required for establishing a Wholly Foreign-Owned Enterprise (WFOE) or Joint Venture (JV).

This approach enabled:

- The company to onboard expatriate supervisors and local employees on board quickly, enabling the project to begin within weeks—significantly faster than the months it would have taken to set up a WFOE or JV.

- By using the EOR, the company avoided the substantial upfront costs of establishing a local entity, such as office space, legal fees, and recruitment expenses. The EOR provider handled all payroll, tax filings, and social security contributions, reducing administrative overhead.

- The EOR ensured both expatriate and local workers adhered to China’s labor laws, including tax regulations, social security contributions, and employment contracts, mitigating the risk of non-compliance.

- The company was able to manage expatriate staff rotations and integrate local employees seamlessly without needing to establish multiple regional entities. This flexibility enabled the company to adjust staffing levels quickly based on project demands.

As the project progressed and proved to be sustainable, the company transitioned some of its teams to local entities, demonstrating the agility and scalability of the EOR model for managing short-term projects in China.

PEO: Co-Employment for Ongoing HR and Compliance

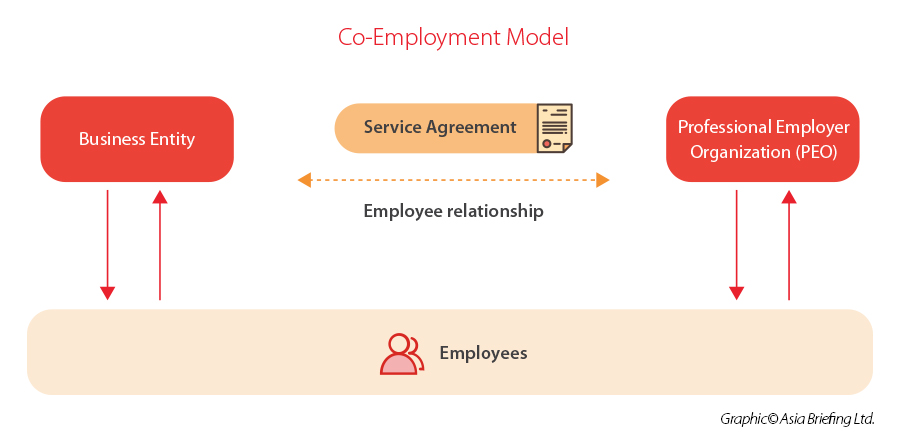

A Professional Employer Organization (PEO) in China operates under a co-employment model, allowing businesses to outsource complex HR functions—such as payroll, benefits administration, tax filings, and labor law compliance—while maintaining full control over the day-to-day management and strategic direction of their employees. This arrangement offers a streamlined solution for businesses seeking to reduce administrative burdens without compromising operational oversight.

Key Benefits of Using a PEO in China:

- Ensures that social insurance, tax obligations, and employment contracts are properly managed according to local laws.

- Supports business expansion into new provinces or cities without the need for local legal setups.

- Frees up internal teams by handling administrative functions such as payroll, tax filings, and benefits administration.

- Reduces the risk of non-compliance and associated penalties by staying current with changing labor laws.

- Provides a centralized approach to HR management, ensuring uniformity and legal alignment across regions.

Ideal for:

- Companies operating across multiple Chinese regions with varying legal requirements.

- Businesses expanding rapidly and needing a flexible HR compliance solution.

- Organizations seeking a long-term, cost-effective approach to managing HR and regulatory compliance without creating multiple local entities.

RO: Representative Office

A Representative Office (RO) is a simple, cost-effective option for foreign businesses that want to establish a presence in China without engaging in commercial operations. An RO allows businesses to conduct market research, build relationships, and establish a network, but it cannot engage in direct profit-generating activities like sales or trading. This makes it ideal for companies looking to test the market or establish connections before committing to a more substantial presence.

Pros of RO:

- Low-Cost Setup: Setting up an RO is relatively quick and inexpensive compared to a WFOE. It provides an entry point into the market with minimal financial and legal commitments.

- Market Research: An RO is ideal for conducting market research, gathering insights, and establishing a network of local contacts.

- Non-Commercial Activities: Foreign companies can use an RO to build their brand in China and liaise with potential partners, without committing to direct sales or revenue-generating activities.

Cons of RO:

- Limited Scope of Activities: An RO cannot engage in commercial activities like selling products or services. It is restricted to non-profit-making activities, such as marketing, research, and liaison.

- No Ability to Hire Employees Directly: An RO is not allowed to hire employees directly and must work through local agencies to staff the office.

- No Revenue Generation: Since an RO cannot conduct sales or other revenue-generating activities, it is not suitable for businesses that want to engage in commercial transactions.

Best for:

- Market Research and Networking: Ideal for companies looking to enter the market for research, liaison, or preliminary business development purposes.

- Short-Term Presence: Companies that do not plan to engage in commercial operations but want to establish a presence in China for non-revenue activities.

Comparison of entry strategies

|

Factor |

Incorporation (WFOE) |

EOR |

PEO |

RO |

|

Control and Ownership |

Full control and ownership over operations |

EOR assumes legal responsibility, but client manages operations |

PEO manages HR and compliance, client manages daily operations |

No operational control, limited to market research and liaison |

|

Market Entry Speed |

Slow (can take months) |

Fast (operations can begin in weeks) |

Fast (operations can begin in weeks) |

Fast (setup within weeks) |

|

Upfront Costs |

High (legal fees, office setup, staffing) |

Moderate (fees for EOR services) |

Moderate (fees for PEO services) |

Low (minimal registration costs) |

|

Ongoing Compliance |

Complex and ongoing (tax, social security, etc.) |

Handled by the EOR, reducing administrative burden |

Handled by the PEO, reducing administrative burden |

Minimal (compliance with registration laws only) |

|

Flexibility |

Low (requires long-term commitment) |

High (easily scalable and adaptable) |

High (scalable and adaptable to business needs) |

Limited (focused on market research and liaison) |

|

Best For |

Long-term presence, large-scale operations |

Market exploration, short-term projects, or regional operations |

Long-term HR support, multi-region operations |

Market research, non-profit activities, establishing a presence |

Conclusion

Choosing the right entry strategy for China depends on the specific needs of your business, including the level of control you require, your timeline, and your investment capacity.

- WFOE offers full control and autonomy for large-scale, long-term operations but comes with high setup costs and a lengthy process.

- EOR offers a faster, cost-efficient, and flexible entry option for businesses testing the market or operating across multiple regions.

- PEO provides ongoing HR and compliance support for businesses with a distributed workforce.

- Lastly, RO is best for businesses that want to establish a presence for market research and liaison without engaging in direct sales or revenue-generating activities.

By carefully evaluating your company’s goals, market conditions, and operational needs, you can determine the most appropriate strategy for entering the Chinese market, ensuring a smoother and more efficient expansion.

FAQ

How does a PEO differ from a traditional HR department?

While a PEO focuses on administrative and compliance-related HR services, an in-house HR department typically deals with strategic planning, company culture, and direct employee relations. A PEO assumes significant responsibility for employment and tax compliance, whereas an in-house HR team may not handle these extensive compliance and liability responsibilities.

Will a PEO replace the existing HR department?

No, a PEO is designed to complement and support your existing HR department, not replace it. It handles routine and compliance-related tasks, allowing your HR team to focus on strategic aspects like employee engagement and organizational development.

What are the costs associated with hiring a PEO?

PEO fees vary, often based on either a percentage of the company's payroll or a per-employee-per-month model. The total cost depends on the size of your workforce and the range of services required.

Should I choose a PEO or an Employer of Record (EOR) for my business?

Choosing between a PEO and an EOR depends on your business's needs. If your operations are domestic, a PEO is suitable as it enhances your existing HR functions while ensuring compliance with domestic laws. However, if you're looking to hire internationally, an EOR is more appropriate as it takes full legal responsibility for your international employees and handles global payroll and compliance issues.