China's cosmetics and personal care market is on track to reach a remarkable US$78 billion by 2025. China is now the world's second-largest market and leads regional growth in Asia. In this article, we delve into the key drivers building up China’s beauty and personal care sector and the business scope for foreign brands.

China’s cosmetics market is experiencing an unprecedented boom, positioning itself as a formidable global player. The country’s beauty and personal care sector is projected to reach a staggering US$78 billion in revenue by 2025.

These figures solidify China's position as the second-largest beauty market in the world, trailing only the United States. Remarkably, within the Asia-Pacific region, China is poised to drive nearly 70 percent of the growth in the regional beauty and personal care market until 2025.

We discuss the factors fueling the rapid expansion of China's beauty market, examine key consumer trends, and provide valuable insights for businesses seeking growth in this area.

[portal-ads country="china"]

Market overview

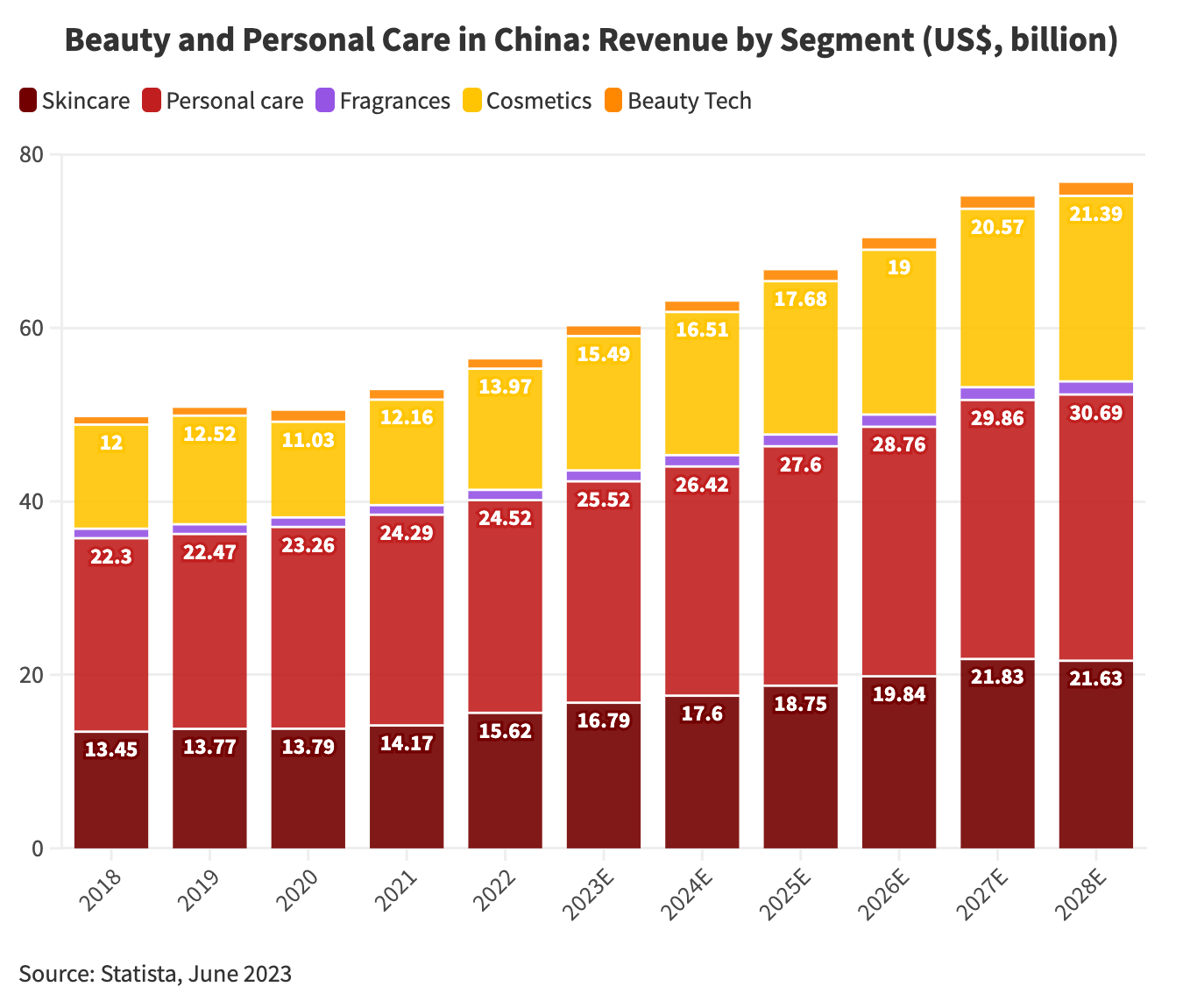

The beauty and personal care industry caters to consumer goods for cosmetics and body care. These include cosmetics for the face, lips, skin care products, fragrances, and personal care products, such as hair care, deodorants, shaving products, and beauty tech.Based on Statista's Market Insight, the beauty and personal care market in China is forecast to reach a substantial revenue of US$73.66 billion in 2025, with a projected compound annual growth rate (CAGR) of 3.71 percent between 2025 and 2030. Specifically, the personal care segment is expected to play a significant role, with its revenue expected to exceed US$30.65 billion in 2025.

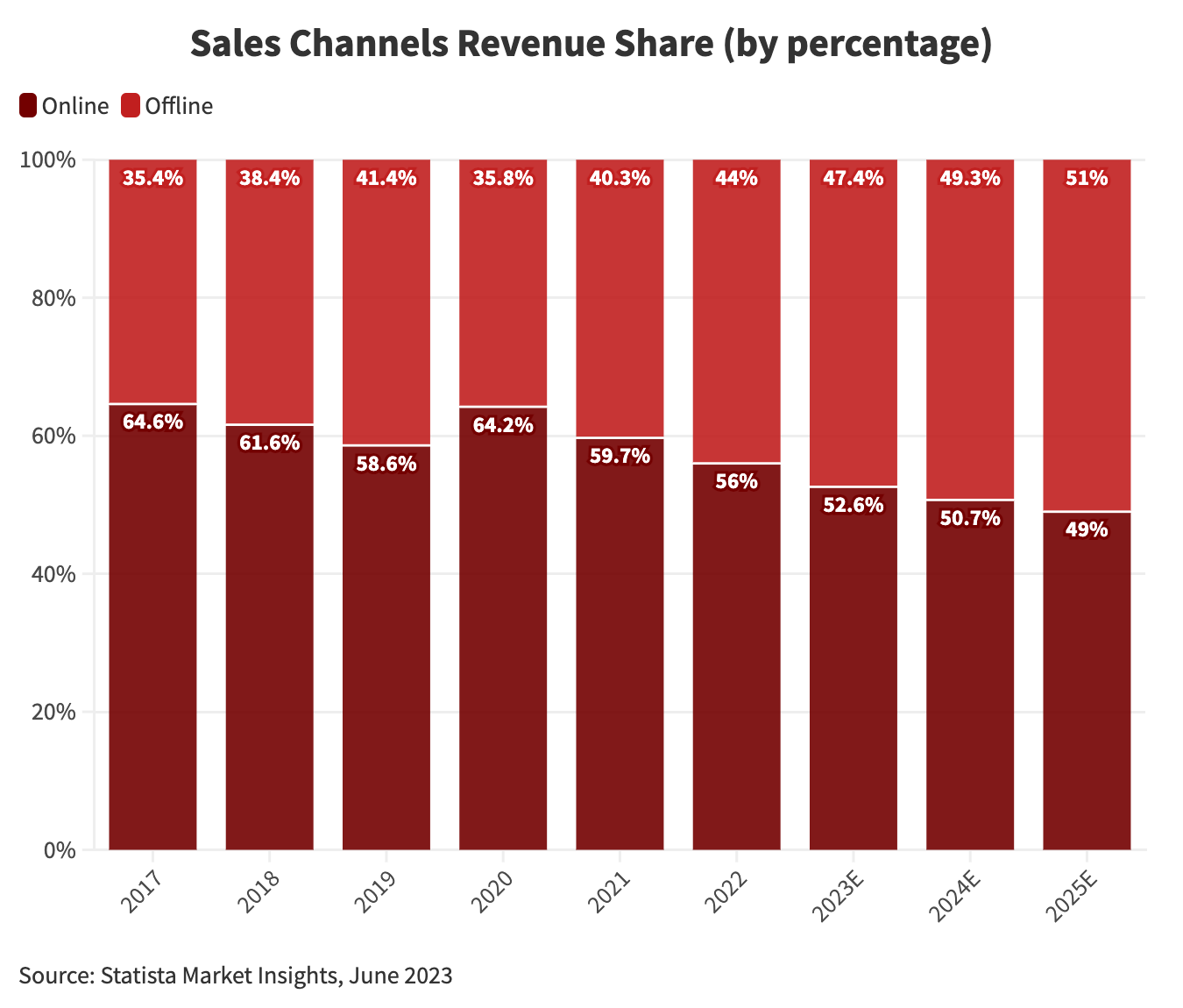

By 2025, online sales are expected to account for around 25.3 percent of total revenue in China’s beauty and personal care market, underscoring the dominance of e-commerce and social commerce in shaping consumer behavior.

At the same time, China’s growing middle class continues to fuel demand for premium and luxury beauty products, reflecting a broader aspiration toward quality, wellness, and self-expression. However, while the appetite for premium products remains strong, consumption has become more value-conscious amid slower economic growth and heightened price sensitivity. As a result, brands are adapting by balancing exclusivity with accessibility, offering entry-level luxury lines, tailoring products to local preferences, and enhancing customer engagement through loyalty programs and targeted online experiences.

Key players and major competitors

The Chinese beauty and personal care market is vast, yet highly competitive, with significant participation from both domestic and international players.Domestic brands have emerged prominently in the Chinese market by focusing on local preferences and implementing competitive pricing strategies. Notable Chinese companies, such as Pechoin, Chando, and Herborist, have successfully gained market share by understanding and addressing the specific demands of Chinese consumers.

For instance, Pechoin, a popular domestic brand, consistently surpassed RMB 100 million (US$14.04 million) in monthly Douyin GMV and entered the platform’s Beauty TOP10 by February 2025, reflecting its strong foothold in the Chinese cosmetics industry. Pechoin's rise to becoming a top player in China’s cosmetic market can be attributed in part to its effective use of traditional Chinese medicinal ingredients. By catering to local preferences, the brand has captured the attention of younger shoppers who value natural and herbal ingredients for their skincare regimen.

Pechoin recognized the growing interest among Chinese consumers, particularly younger ones, in incorporating traditional remedies into their beauty routines. They conducted extensive research to identify key medicinal ingredients known for their skincare benefits and then integrated them into their cosmetic formulations.

On the other hand, international cosmetics giants have also made significant investments in the Chinese market, adapting their products to meet the unique demands of their domestic consumers. Renowned brands like L'Oréal, Estée Lauder, Procter & Gamble, and Shiseido have all established a strong presence in China, leveraging their global reputation and expertise.

L'Oréal, for one, witnessed robust revenue growth in China, surpassing US$40.9 billion in 2022, and maintained its position as the leading foreign beauty group in the market through 2024 despite a mild year-on-year decline in sales. The company’s success in China’s beauty and personal care industry can be attributed to its localized and innovation-driven approach under the “5-Power Model.” This strategy combines a multi-brand portfolio covering all market tiers, “China-for-China” research and development tailored to local consumer needs, agile digital marketing and social-commerce engagement, expansion across online and offline retail ecosystems, and strong alignment with evolving Chinese consumer values such as sustainability and authenticity.

In particular, L'Oréal has embraced new marketing techniques to engage with Chinese consumers. They have leveraged digital platforms and social media channels to create immersive brand experiences and connect with their target audience. By understanding the importance of a strong social media presence in China's digitally savvy market, L'Oréal has effectively utilized online platforms to build brand awareness, drive engagement, and foster a sense of community among consumers.

Regulatory environment and government policies

Authorities in charge

China's beauty and personal care industry operates within a regulatory framework overseen by multiple authorities:- National Medical Products Administration (NMPA)

- Product registration and filing

- Production licensing

- Quality supervision

- Standards formulation

- Adverse reaction monitoring

- Safety assessment

- Review of registration and filing documents

- Approval of production licenses

- Routine inspections and sampling

- Investigation and enforcement actions

- State Administration for Market Regulation (SAMR)

- Market order regulation: Oversight of cosmetics distribution and sales, both online (e-commerce platforms) and offline (retail stores, pharmacies, etc.); crackdown on false advertising, illegal promotions, fraudulent sales, and counterfeit products.

- Advertising and consumer protection: Legal supervision of cosmetics advertising to prevent misleading claims; handling consumer complaints and safeguarding consumer rights.

- Joint enforcement with NMPA: Collaboration on product quality sampling, disposal of non-compliant products, and combating illegal additives

- General Administration of Customs (GAC)

|

Top 15 Domestic Beauty Brands in China (2025) |

||||

| Rank | Brand (English/Chinese) | Company/Group | Core positioning | Market highlights (2025) |

| 1 | PROYA 珀莱雅 | PROYA Cosmetics Co., Ltd. | Natural, science-based skincare | Among the top three domestic brands, strong multi-platform sales. |

| 2 | WINONA 薇诺娜 | Betta Pharmaceuticals / Yunnan Botanee Bio | Sensitive-skin repair | Functional skincare leader with over 20% market share in its segment. |

| 3 | Pechoin 百雀羚 | Shanghai Pechoin Daily Chemical Co., Ltd. | Herbal skincare | Classic brand revitalized via digital campaigns; still among the top 10 sellers. |

| 4 | CHANDO 自然堂 | JALA Group | Smart digital skincare | Expanding omni-channel presence; strong Gen-Z recognition. |

| 5 | BIOHYALUX 润百颜 | Bloomage Biotech | Hyaluronic acid skincare | Leading biotech-driven skincare brand; rapid growth in derma beauty. |

| 6 | Dr.Yu 玉泽 | Shanghai Jahwa United Co., Ltd. | Dermatological skincare | Strong momentum in clinical skincare; 20% annual sales growth. |

| 7 | MAOGEPING 毛戈平 | Mao Geping Cosmetics Co., Ltd. | Professional high-end makeup | Strong brand premiumization; artistry image drives offline sales. |

| 8 | CARSLAN 卡姿兰 | Guangzhou Carslan Cosmetics Co., Ltd. | Affordable makeup | Top three in online makeup sales; solid mid-tier positioning. |

| 9 | INOHERB 相宜本草 | Shanghai Inoherb Cosmetics Co., Ltd. | Herbal skincare | Recognized for affordable efficacy, expanding into new retail channels. |

| 10 | OSM 欧诗漫 | Zhejiang OSM Group | Pearl-based skincare | Owns multiple patents on pearl ingredients; growing offline presence. |

| 11 | HERBORIST 佰草集 | Shanghai Jahwa United Co., Ltd. | Herbal dermocosmetics | National “pharma beauty” pioneer; repositioned for young consumers. |

| 12 | QUADHA 夸迪 | Bloomage Biotech | Active-ingredient skincare | High-end sub-brand of Bloomage; popular in Tmall’s “tech beauty” category. |

| 13 | Florasis 花西子 | Zhejiang Yige Group | Oriental aesthetic makeup | Online bestseller; dominates Guochao (national trend) beauty. |

| 14 | SIMPCare 溪木源 | Nørds Biotechnology | Natural ingredient skincare | Fast growth among young consumers; focuses on clean beauty. |

| 15 | Perfect Diary 完美日记 | Yatsen E-commerce | Affordable, trendy makeup | Remains the top online-native brand despite market competition. |

| Source: WWW.ASKCI.COM | ||||

|

Top 15 Global Beauty Brands in China (2025) |

||||

| Rank | Brand (English/Chinese) | Country | Core positioning | Market highlights (2025) |

| 1 | Lancôme 兰蔻 | France / L’Oréal Group | Anti-aging, luxury skincare | Leading brand in China’s high-end skincare market. |

| 2 | Estée Lauder 雅诗兰黛 | United States | Premium anti-aging skincare | High-end market leader; “Advanced Night Repair” iconic in China. |

| 3 | L’Oréal Paris 巴黎欧莱雅 | France / L’Oréal Group | Mass-market skincare | Tops sales among affordable international brands. |

| 4 | CHANEL 香奈儿 | France | Luxury skincare & makeup | Prestigious reputation in China’s luxury beauty space. |

| 5 | Dior 迪奥 | France / LVMH Group | Premium makeup & fragrance | Strong growth in color cosmetics. |

| 6 | SK-II | Japan / Procter & Gamble | Fermented skincare | “Pitera Essence” remains cult favorite. |

| 7 | Shiseido 资生堂 | Japan | Asian-focused high-end skincare | Strong retail presence in China’s tier-one cities. |

| 8 | Kiehl’s 科颜氏 | United States / L’Oréal Group | Natural skincare | Favored by younger consumers for eco-conscious image. |

| 9 | YSL Beauty 圣罗兰美妆 | France / L’Oréal Group | Trendsetting makeup | Lipstick and foundation sales are growing 20% annually. |

| 10 | La Mer 海蓝之谜 | United States / Estée Lauder Group | Ultra-luxury skincare | Benchmark in the high-end repair segment. |

| 11 | Helena Rubinstein 赫莲娜 | France / L’Oréal Group | Cellular anti-aging | Grows steadily in China’s top-tier luxury segment. |

| 12 | Clé de Peau Beauté 肌肤之钥 (CPB) | Japan / Shiseido Group | Premium skincare & makeup | Stable premium user base; symbolic of “refined luxury.” |

| 13 | La Prairie 莱珀妮 | Switzerland | Ultra-premium anti-aging | Dominates the top 1% luxury skincare tier. |

| 14 | M·A·C 魅可 | United States / Estée Lauder Group | Professional makeup | Strong offline performance; expanding into livestreaming. |

| 15 | Shu Uemura 植村秀 | Japan / L’Oréal Group | Makeup & cleansing oil | Leading brand in the cleansing oil segment. |

| Source: WWW.ASKCI.COM | ||||

Regulatory updates

Within this industry, adherence to multiple laws and regulations is crucial. Among these, the most significant is the Regulations on Supervision and Administration of Cosmetics, of which the latest version was issued by the State Council in 2020 (implemented in 2021) as an update to the previous 2015 draft. This set of updated regulations replaces the original 1989 Regulations on the Hygiene Supervision of Cosmetics (last amended in 22019), introducing improvements to facilitate market access for international cosmetics businesses.Since 2021, China’s beauty and personal care industry has placed increased emphasis on quality control and safety supervision. It is imperative for companies operating within this domain to acquaint themselves with the updated regulatory provisions.

Despite the stricter quality control measures, the new regulations are a positive development for foreign businesses. They provide enhanced clarity and certainty in the Chinese market, offering a more favorable environment for international companies than ever before. In particular, the regulations introduce a simplified filing system to replace the previous cumbersome approval process for an increasing number of products.

|

A Comparison of the Old and New Cosmetics Regulations |

||

| Category | Old cosmetics regulation | New cosmetics regulation |

| Number of articles | 35 | 80 |

| Scope of special-use cosmetics | 9 categories | 6 categories |

| Scope of general cosmetics | Refers to products used on any part of the human body surface (skin, hair, nails, lips, etc.) by scrubbing, spraying, or other similar methods. | Same product scope, but toothpaste now added. Hair growth and removal products, beauty milk products, bodybuilding and fitness products, as well as deodorizing products, have been shifted from the “special-use cosmetics” category (old regulations) to the “general cosmetics” category (new regulations). |

| Use of raw material | Prior approval must be obtained from the NMPA to use any new ingredients, either natural or synthetic, that have not already been used in the manufacture of cosmetics in China. | No prior approval required; admission now based on filing with the NMPA — with the exception of some high-risk ingredients, which will still require approval. |

| Required licenses for manufacturing | • Cosmetic Manufacturing License • Cosmetic Manufacturer Sanitary License | • Cosmetic Manufacturing License |

| Import of cosmetics | Complex process for special-purpose and non-special-purpose cosmetics. | Non-special-use cosmetics are only subject to record-filing with NMPA. Special-use cosmetics are subject to registration requirements with NMPA. |

| Quality control and safety assessments | General quality control requirements listed, such as the hygiene quality examination of products before market launch. | Requires the appointment of a responsible person (with the requisite special knowledge) in charge of safety and quality of the cosmetics for cosmetic manufacturers, cosmetic filing persons, and cosmetic registrants. The NMPA can conduct supplementary testing if current tests are considered insufficient. |

| Penalties | Penalties were at the discretion of the relevant cosmetic supervision and administrative departments. | Harsher and clearer penalties laid out for each of the different violations. |

|

China's Cosmetics and Personal Care 2024-2025 Regulatory Changes |

||

| Update | Description | Why it matters |

| Full safety assessment dossiers required from May 1, 2025 | Starting May 1, 2025, all cosmetic registrants and notifiers must submit a complete version of the safety-assessment report (in line with Technical Guidelines for Cosmetic Safety Assessment (2021) and related rules). | Foreign and domestic firms must ensure their safety-assessment documentation is comprehensive, not relying on simplified formats beyond that date. Compliance cost and dossier quality become more important. |

| Measures for Cosmetic Safety Risk Monitoring and Assessment | On April 9, 2025, NMPA issued the Administrative Measures for Cosmetic Safety Risk Monitoring and Assessment (Announcement No. 37 of 2025) to systematise lifecycle risk monitoring of cosmetics (ingredients, finished products, distribution, post-market) in line with CSAR. | Brands must adopt post-market monitoring systems, adverse reaction reporting and risk-management frameworks. This reflects a shift from only pre-market checks to full lifecycle supervision. |

| Two-Tier Management of the Inventory of Existing Cosmetic Ingredients (IECIC) | On June 24, 2025, NMPA released Announcement No. 61 of 2025: A new two-tier system (List I / List II) for existing cosmetic ingredients, standardisation of naming (Chinese/INCI), dynamic adjustment mechanism, and addition of new ingredients to the inventory. | For brands using new or innovative ingredients, this system means faster inclusion (after 3-year monitoring) and greater clarity on allowable use. Also means more frequent updates, so ingredient-roadmap planning is critical. |

| Provisions Supporting Innovation in Cosmetic Raw Materials | On June 11, 2025, NMPA issued the Several Provisions for Supporting the Innovation on Cosmetic Raw Materials (No. 12 of 2025). These provisions give a regulatory boost to ingredient-innovation: easier registration/notification for certain types of new ingredients (e.g., biotech, traditional-Chinese-medicine-derived, novel plant resources) and simultaneous submission of new-ingredient + product applications. | This is a sign of regulatory encouragement of innovation in the sector. Foreign firms with novel ingredients or biotech collaborations may find a more favourable pathway, but must still satisfy rigorous safety/monitoring evidence. |

| New and Revised Testing Methods / Technical Standards | Several new testing methods and standards were issued, such as, supplementary method for methylprednisolone in creams/lotions (April 30, 2025), new testing methods for azelaic acid & salts, and others effective from July 2025. | Companies must ensure their test-method protocols (for registration/filing and market-monitor) align with the newest national methods. Using outdated testing risks non-compliance or delays. |

| Enhanced Ingredient Use Tracking & Public Consultation Framework | NIFDC (part of the NMPA system) released draft “Technical Guidelines for Updating Filing Information of New Cosmetic Ingredients” (March 27, 2025).

Also, public consultation on cosmetic standard projects for 2025 (34 projects) was announced on July 30, 2025. |

Shows the regulator is actively evolving ingredient standards and inviting industry input. Brands need to track upcoming standard revisions and public consultation windows, to anticipate changes and participate if strategic. |

| Import / Filing / Registration Optimisation | While the CSAR already cut red tape for many general cosmetics (for example, moved from mandatory pre-market animal testing for many imported general cosmetics), the 2024-25 updates continue to refine processes (for instance, simultaneous submission of ingredient + product) and improve transparency of requirements. | For foreign brands, the regulatory pathway is clearer but increasingly stringent. Early preparation of filings, the responsible-person domestic entity, local safety-assessment partner, and monitoring systems are critical. |

However, stricter post-market monitoring and frequent sampling inspections will heighten compliance costs. Foreign firms should remain vigilant to ongoing public consultations and the rapid evolution of ingredient standards, as staying ahead of these changes will be critical to maintaining market access and competitiveness.

Consumer behavior and preferences

Consumer behavior and preferences in the Chinese beauty and personal care market are continuously shaped by various factors, including changing demographics, rising disposable income, evolving consumer values, and the influence of technology.Changing consumer demographics and rising disposable income

China's population has witnessed significant demographic shifts in recent years, with a burgeoning middle class and rising disposable income.China’s median disposable income per capita reached RMB 34,707 (US$4,860) in 2024, marking a 5.5 percent year-on-year increase in the first quarter of 2025, according to data from the National Bureau of Statistics of China (NBS) and CEIC Data. This figure has more than doubled from the RMB 15,632 (US$2,163) recorded in 2013, reflecting steady income growth driven by urbanization, labor market expansion, and rising household consumption.

Naturally, the rising disposable income has led to higher spending on personal care and beauty products.

China’s beauty and personal care market experienced a mild contraction in 2024, with sales revenue reaching RMB 8.55 billion (US$1.2 billion), down 9.8 percent year-on-year, and sales volume totaling 128 million units, a 10.5 percent decline. The market displayed pronounced seasonal variations, with sales peaking during the winter months, while signs of recovery emerged in the second half of the year. Despite the decline in overall sales, the sector’s structural evolution has been notable. Product filings and domestic registrations continued to increase, and the number of SKUs and retail outlets expanded, signaling greater market activity and innovation.

At the same time, consumer preferences are shifting toward premium and high-value products, reflecting a broader trend of “consumption upgrading” in China’s post-pandemic market. Demand is increasingly concentrated in high-end skincare, fragrance, and specialized treatment products, while price-sensitive mass-market segments face saturation.

In body and hand care (still the largest categories), brands are differentiating through advanced formulations, ingredient innovation, and functional diversification, offering products that emphasize whitening, anti-aging, and localized care benefits. Niche categories, such as men’s grooming and targeted personal care, are also gaining momentum, driven by younger consumers willing to pay more for quality, efficacy, and brand prestige.

One direct result of this shifting trend is the rise of premiumization. Higher-end brands are gaining significant traction as female consumers, in particular, prioritize self-investment and align beauty with the flourishing wellness and self-care lifestyle trends in the country. Recent data reveals that the premium beauty sector has the potential to capture 53 percent of the market share in China by the end of 2025.

Major global players have adapted quickly to this shift. L’Oréal Paris has deepened its engagement with Chinese consumers through art-driven brand activations, such as its collaboration with The Louvre Museum for an exhibition exploring beauty through art and history, part of the group’s push into the ultra-premium beauty segment, which is growing twice as fast as the broader market.

Similarly, Hermès expanded its beauty portfolio with the launch of the “Le Regard” eye makeup line in 2023, following strong demand in China, reinforcing how luxury houses view the country as a core driver of growth in high-end cosmetics.

Domestic brands, too, are elevating their game. In June 2025, Florasis unveiled a 6,480-square-meter AI-enabled smart factory near Hangzhou to improve product precision, reduce defects, and accelerate the rollout of premium product lines, an example of homegrown innovation fueling China’s beauty sector upgrade. Meanwhile, other Chinese players such as Proya and S’Young have shifted from volume expansion to strategic acquisitions of niche foreign brands, mirroring the global consolidation models of L’Oréal and Estée Lauder to enhance portfolio quality and access higher-margin segments.

According to Mordor Intelligence, the premium cosmetics segment in China is forecast to grow at a compound annual rate of 10.6 percent through 2030, even as total market volumes remain subdued. This underscores how the industry’s growth model is transitioning from scale to value, anchored in brand equity, technological sophistication, and experiential storytelling.

The convergence of global luxury investment and domestic brand innovation signals that China’s beauty and personal care industry is entering a new era: one defined less by mass consumption and more by curation, quality, and cultural resonance.

Increasing demand for natural and organic cosmetics

Labels like “natural” and “organic” have emerged as new drivers of purchasing preferences in China’s cosmetic industry. Increasingly, consumers are opting for these products due to their perceived health benefits and environmental friendliness.Tmall Global, one of China’s largest cross-border e-commerce platforms, saw a meaningful uptick in demand for natural and organic cosmetics around the Double 11 Shopping Festival and has since declared plans to escalate investment in this category by the end of 2025 as consumer preferences shift toward “clean beauty” and eco-friendly brands.

However, it is worth mentioning that, while the organic and natural cosmetics segment presents potential opportunities for foreign brands, China's regulatory framework does not currently acknowledge this subcategory, and authorities maintain a cautious stance towards these emerging concepts. Therefore, it becomes imperative for companies, especially small and medium-sized enterprises (SMEs) venturing into this specific segment, to have a comprehensive understanding of the specific regulations governing organic and natural cosmetics in the country.

Influence of social media and e-commerce on consumer choices

China's cosmetic industry has been highly influenced by social media and e-commerce platforms in recent years. In the first half of 2025, China’s cosmetics retail sector recorded sales of RMB 229.1 billion (US$31.3 billion), a 2.9 percent increase year-on-year. Notably, on social commerce, the beauty category on Douyin generated nearly RMB 20 billion (US$2.80 billion) in gross merchandise volume in July 2025, up 31.7 percent year-on-year.Meanwhile, the platform Xiaohongshu (Little Red Book) achieved estimated revenues of US$4.8 billion in 2024, growing approximately 30 percent year-on-year, underlining increasing investment in influencer-led beauty and lifestyle commerce.

Notably, these platforms have become the new shopping arenas for Chinese consumers, as they seek beauty recommendations, trends, and purchasing opportunities.

Product trends: Focus on anti-aging and clinical brands

Beauty brands in China are intensifying their research and development (R&D) efforts in response to four key consumer demands: sun protection, whitening, skin rejuvenation, and anti-aging. Chinese consumers are increasingly scrutinizing ingredient lists and placing greater emphasis on product efficacy. According to a 2024 report by NielsenIQ, the skincare category in China saw moisturizers reach a 62.9 percent share of the segment in 2024, growing 9.5 percent, while overall skincare grew 4.2 percent.Leading this shift, brands are intensifying R&D efforts to address four principal consumer demands: sun protection and whitening, skin rejuvenation and anti-aging, moisturizing and soothing, and cleansing and oil control.

For example, Florasis has publicly committed to global expansion and enhanced manufacturing capabilities in 2024, launching a flagship in Europe and prioritising botanical and plant-based formulations rooted in traditional Chinese aesthetics.

Consumers in China are also increasingly drawn to clinical brands founded by doctors and chemists, driven by a desire for proven efficacy. Premium Chinese skincare brands hold an advantage as they cater to the specific skincare concerns faced by Chinese consumers. An example is the Chinese brand Winona, which focuses entirely on sensitive skin. This shift towards clinical and problem-solving brands reflects the evolving preferences and demands of Chinese consumers.

The impact of artificial intelligence

Artificial intelligence (AI) is rapidly redefining China’s beauty and personal care industry, transforming how products are created, marketed, and consumed. Within it, the beauty-tech segment is surging, worth US$5.64 billion in 2024 and projected to reach US$18.39 billion by 2030, at a compound annual growth rate of 22.4 percent.As consumers become more ingredient-literate and value-conscious, brands are increasingly turning to AI to meet rising expectations for transparency, science-backed efficacy, and personalized solutions. The typical Chinese beauty consumer today is a 25–35-year-old woman, while Gen Z buyers already make up about 20 percent of the market, demographics that are digitally native and highly responsive to data-driven innovation.

AI integration is reshaping the entire beauty value chain, from product development to consumer engagement. In R&D, AI-powered formulation simulation enables companies to shorten development cycles by up to 40 percent, helping them respond quickly to fast-changing preferences. In marketing and retail, AI tools power hyper-personalized recommendations, virtual try-ons, and even AI livestream hosts, allowing brands to operate 24/7 with consistent quality.

In physical stores, technologies such as Sephora’s AI skin analysis and AR makeup systems in Shanghai combine diagnostics with real-time product matching, creating immersive, data-enhanced experiences. These innovations reflect the broader transition from mass production to mass personalization, where data and algorithms guide every step of product creation and delivery.

This technological transformation is further supported by China’s policy environment, which actively encourages “AI + Beauty” integration. Under the 14th Five-Year Plan, AI and the digital economy are identified as strategic growth pillars. The National Medical Products Administration’s Guidelines for AI Technology Services in Cosmetics and local subsidies in major cities like Beijing and Shanghai are accelerating adoption, lowering costs, and ensuring compliance. As a result, AI is no longer just a marketing tool: it has become a structural advantage. The winners in China’s beauty and personal care industry will be those who leverage AI not only to improve efficiency but also to build trust, personalize value, and strengthen emotional connections with increasingly discerning consumers.

Distribution channels

Rise of e-commerce platforms and online sales

Chinese consumers allocate a significant amount of their online time to researching and evaluating beauty products, relying heavily on recommendations from friends and family when making purchasing decisions. The influence of China's e-commerce platforms in shaping consumer behavior has grown exponentially, as they provide a platform for the beauty community to share shopping experiences and product recommendations. For instance, Xiaohongshu has amassed over 200 million predominantly female users under the age of 26. This demographic aligns closely with the target market for imported cosmetic products.Livestreaming has emerged as a pivotal sales platform for cosmetics, catering to tech-savvy consumers who prefer shopping via their smartphones. In 2024, China’s livestream-shopping market reached approximately RMB 5.86 trillion (about US$800 billion) overall.

While beauty-specific figures are less frequently published, livestreaming continues to dominate social-commerce strategies: over 85 percent of major consumer-facing companies reported dedicating a livestreaming budget in 2024. ashleydudarenok.com Including livestreaming as part of a multi-channel sales strategy is now essential for brands targeting China’s digitally engaged beauty shoppers.

According to industry data from early August 2025, Douyin’s beauty and personal care gross merchandise value (GMV) reached between RMB 15 billion (US$2.1 billion) and 20 billion (US$2.8 billion) in July, marking a 31.7 percent year-on-year increase despite a 17.5 percent month-on-month decline. The platform’s sales structure shows a clear dual-track pattern, where lower-priced products (under RMB 200 or US$28.13) now account for 68.1 percent of total GMV, while high-end items (above RMB 600 or US$84.83) continue to maintain strong sales. The top 20 beauty brands grew 56.1 percent year-on-year, with KANS (韩束) holding the top-selling position for seven consecutive months.

These data points demonstrate that livestreaming is more than a promotional tactic: it is a strategic channel influencing both consumer behaviour and brand equity. Beauty brands that succeed are increasingly integrating livestreams with KOL/KOC partnerships, short-video storytelling, in-stream commerce and rapid-fire conversion. For instance, brands use interactive product demonstrations and real-time Q&A during live sessions to deepen consumer engagement and accelerate purchase intent. Combined with short-video teasers and community building, this approach fosters loyalty beyond a single transaction.

In other words, for a brand entering the Chinese beauty market, the strategic formula is shifting from “traditional e-shop + display ads” to “omnichannel digital ecosystem”, where livestreaming plays a central role in connecting with younger, mobile-first consumers, amplifying brand recognition and converting intent into purchase.

Importance of physical stores and shopping malls

Despite the narrative surrounding the closure of physical stores, the significance of brick-and-mortar retail remains intact, particularly as China has now moved past the zero-COVID phase.Offline stores continue to hold a critical role in China’s beauty market in 2024-25, albeit in an evolving format. While traditional department-store beauty counters have been declining (with thousands shut over recent years) high-impact flagship stores, multi-brand boutiques, and hybrid O2O formats are growing rapidly.

These channels offer consumers the ability to fulfill their desire for professional consultation, product safety assurances, prestige positioning, immersive comfort, and a sense of luxury: all attributes that are hard to replicate purely online. For example, brands are leveraging offline spaces to deliver AR/AI skin diagnostics, exclusive service,s and personalized product matches.

At the same time, expansion into lower-tier cities and new urban formats is making offline retail more accessible and relevant

Recent developments highlight the continued importance of physical retail. Chinese beauty giant Florasis opened its inaugural brick-and-mortar store, while Armani Beauty introduced a high-end global flagship store in China.

Industry experts believe that the next few years will witness a significant wave of new growth as international brands capitalize on opportunities to enter the Chinese market. This indicates that offline stores will continue to play a crucial role in the beauty industry's expansion and the integration of international brands in China.

Key lessons for foreign brands entering China’s cosmetics and personal care market

Entering the Chinese cosmetics and personal care market can be a rewarding endeavor for foreign brands, but it requires a keen understanding of local preferences. Here are three key lessons to consider when venturing into this competitive landscape:- Competition and deep brand evaluation: Foreign brands should be prepared to face intense competition when entering the market and develop strategies to differentiate themselves. Chinese consumers are no longer solely focused on comparing prices; they want to understand brands on a deeper level and forge stronger connections. Foreign brands should invest in showcasing their brand values, sharing compelling brand stories, and highlighting their current initiatives. This can help establish an emotional connection with consumers and differentiate themselves in the market.

- Focused targeting: It is crucial for foreign brands to define their target audience beyond broad demographics like "Gen-Z." There needs to be a clear understanding of who the target consumers are, their preferences, and their current mindset. This targeted approach enables brands to tailor their marketing strategies and product offerings to meet the specific needs and expectations of their intended audience.

- Diversified distribution channels: The evolving landscape of distribution channels in China offers several valuable opportunities, if properly harnessed. While Tmall and JD.com are well-established e-commerce platforms, emerging channels like Douyin and Xiaohongshu are gaining traction in the market. These new channels provide opportunities for brands to reach a wider audience and tap into the growing demand for cosmetic products.

- Leveraging KOLs and KOCs: Establishing strong partnerships with Chinese influencers – key opinion leaders (KOLs) and key opinion consumers (KOCs) – can greatly enhance brand visibility and credibility.