Often dubbed China’s Silicon Valley, Shenzhen is China’s fastest-growing city. It is ranked by the Chinese Academy of Social Sciences as the mainland’s top city for “overall economic competitiveness” and is China’s premier Special Economic Zone (SEZ) for foreign investment as well as a sub-provincial class city.

Shenzhen was declared China’s first SEZ by then-Communist Party (CCP) chairman Deng Xiaoping in 1979. Aided by capital flowing easily from neighboring Hong Kong, the city has since transformed from a small fishing town to a bustling megacity.

Every year, millions flock to its city center as part-time or migrant workers, entrepreneurs from around the globe seek to benefit from its investment-friendly practices, and tourists admire its futuristic landscape.

Located in Guangdong province only 100 km (62 miles) southeast of its capital, Guangzhou, Shenzhen is strategically located on the Pearl River Delta that serves as a border with Hong Kong. The city center is under 20 minutes from Kowloon by fast train. Other nearby cities include Zhongshan, Dongguan, and Foshan.

2021 economic overview

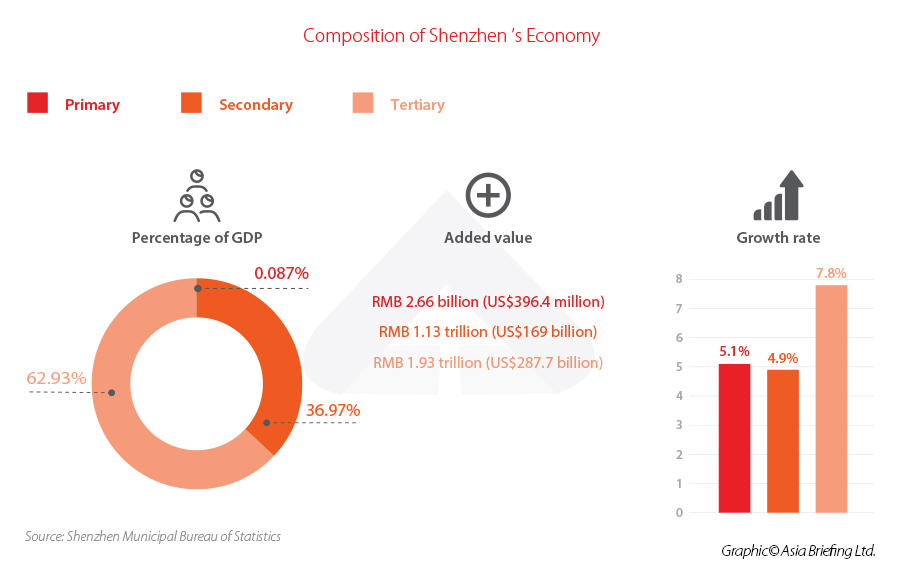

Shenzhen is China’s third-largest city by GDP after Shanghai and Beijing. GDP in 2021 surpassed the RMB 3 trillion mark, up 6.7 percent from the previous year. This is a significant recovery from the 3.1 percent year-on-year growth in 2020. Shenzhen also has the highest per capita of any city in China, reaching RMB 173,663 (US$25,889) in 2021.Shenzhen is a service-driven economy, with the tertiary sector accounting for almost 63 percent of GDP. Manufacturing nonetheless remains an important mainstay industry, accounting for almost all of the remaining value-add to GDP.

According to the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), Shenzhen is one of four core cities to serve as the engines for development in the region. Shenzhen is frequently called upon to be the GBA’s technology and R&D hub. As of 2018, four percent of Shenzhen’s GDP was invested in research and over 11,000 high-tech enterprises called the city home.

Foreign trade and investment

Shenzhen is China’s largest exporting city, ranking first among China’s main cities for 29 years in a row. The Port of Shenzhen is the fourth-largest in the world, with annual throughput reaching 28.77 million TEUs in 2021, up 8.4 percent from the previous year.In 2021, Shenzhen’s trade in goods grew at a rate of 16.2 percent year-on-year to reach RMB 3.54 trillion (US$528.3 billion). Exports grew 13.5 percent year-on-year to reach RMB 1.9 trillion (US$283.9 billion), while imports surged 19.5 percent, reaching RMB 1.6 trillion (US$239 billion).

The growth rate of trade significantly outpaced that of 2020, when trade in goods grew 2.4 percent year-on-year, exports grew 1.5 percent, and imports grew 3.6 percent. The 2021 uptick in foreign trade is reflected in high trade numbers nationwide, as China benefitted from strong demand from overseas consumers who were still under COVID-19 restrictions and a relative lack of COVID-19 restrictions at home enabling high rates of production.

Shenzhen exported the highest volume of goods to Hong Kong, with exports to the special administrative region reaching a total of RMB 707.5 billion (US$105.7 billion), a growth rate of 17.3 percent year-on-year. Meanwhile, Shenzhen imported the largest volume of goods from ASEAN, with imports from the 10-country region reaching RMB 356 billion (US$53.2 billion), up 11.1 percent year-on-year.

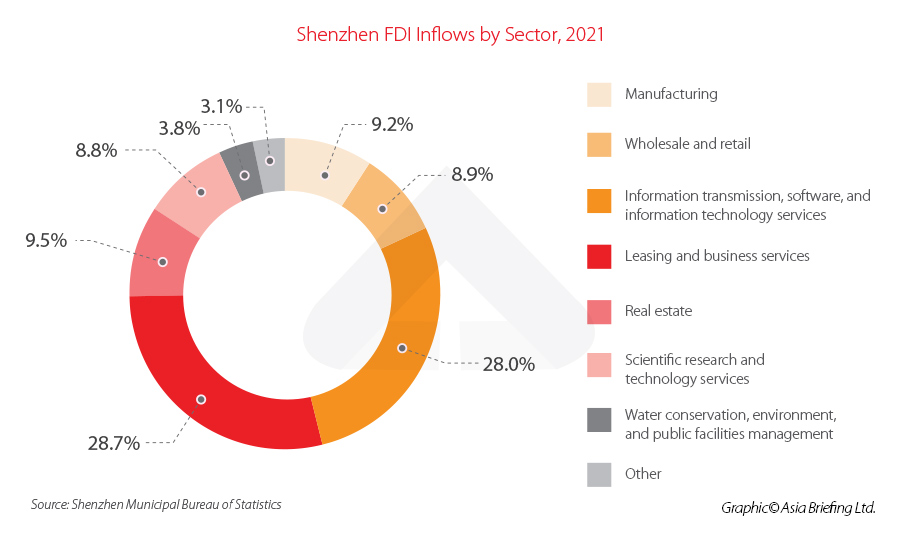

Actual use of foreign capital grew 26.3 percent in 2021, reaching US$11 billion. A total of 5,788 new FDI projects were signed throughout the year.

A total of US$3.1 billion went to leasing and business services, accounting for the largest proportion - 28.7 percent - of actual use of foreign capital. The second-largest sector was information transmission, software, and IT services, which accounted for 28 percent of the total, receiving US$3 billion in actual use of foreign capital.

Industry development

High-tech industries

The technology industry is the beating heart of Shenzhen’s economy and leads the country in the digital economy. Some of the largest names in the technology industry are headquartered in Shenzhen - Huawei, Tencent, ZTE, and DJI, to name a few.Shenzhen’s 14th Five Year Plan (14th FYP), the city’s main economic development plan for the period from 2021 to 2025, targets for the “core digital economy industries” to reach 31 percent by 2025 - considerably higher than the national target of 10 percent. By the end of 2021, Shenzhen had almost already hit this target, with this sector accounting for 30.6 percent of GDP, surpassing RMB 900 billion (US$134.5 billion) in scale.

“Core digital economy industries” refers to digital technologies, products, services, infrastructure, and solutions for the digital development of industries and various economic activities that are completely dependent on digital technologies and data elements.

The tech and digital industries are also major employers, and the city is home to a large number of highly skilled tech workers. At the end of 2021, there were over two million professional technical workers, of which 617,000 held at least a mid-level technical job title.

Shenzhen is also a pioneer in developing regulations for emerging and high-tech industries, acting as a test bed for regulations for high-tech and emerging industries such as artificial intelligence (AI), autonomous driving, and data privacy.

Industry and manufacturing

Manufacturing remains an important mainstay industry in Shenzhen’s economy. The industry recovered significantly in 2021 after a lull in 2020 as the sector was impacted by the pandemic. High-tech manufacturing grew at a rate of 4.7 percent year-on-year in 2021, up from 2.3 percent in 2020. The profits of industrial enterprises also rebounded in 2021, with the profits of industrial enterprises above designated size (companies with the main business income of at least RMB 20 million (US$3 million)).Multiple manufacturing sectors saw explosive growth in 2021, including new energy vehicles (173.9 percent year-on-year), industrial robots (60.5 percent), smartphones (40.9 percent), and 3D printing (21.2 percent).

Manufacturing accounts for the largest industry by employment, with over four million people employed in the sector at the end of 2020, according to the 2021 Shenzhen Statistical Yearbook released by the Shenzhen Municipal Bureau of Statistics.

Major companies with a presence in Shenzhen include electronics manufacturer Foxconn and battery manufacturer CATL.

Finance

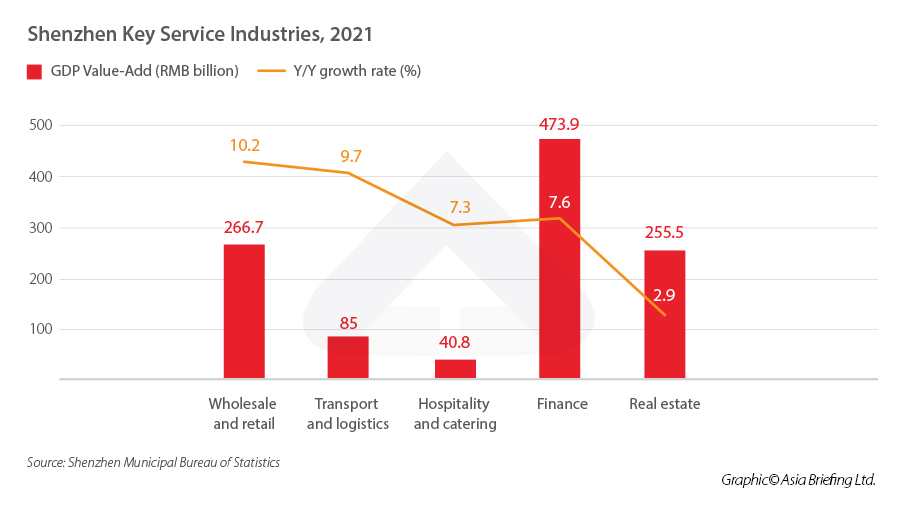

Preliminary statistics show that Shenzhen’s finance industry grew at a rate of 7.6 percent year-on-year in 2021 to reach a total of RMB 473.9 billion (US$70.8 billion), accounting for 15.4 percent of GDP. The two-year average growth rate of the industry also surpassed the national average (5.3 percent), growing at a rate of 8.3 percent.Total assets of the city’s banking sector amounted to RMB 11.3 trillion (US$1.7 trillion) at the end of 2021, a growth rate of 7.83 percent year-on-year. Meanwhile, in the insurance sector, the total assets of the city’s 27 corporate insurance companies reached RMB 5.75 trillion (US$859.3 billion).

Major financial institutions headquartered in Shenzhen include Ping’an Bank and China Merchant’s Bank. HSBC, Standard Chartered, and Citibank also all have a presence in the city.

Shenzhen policy trends

On August 18, 2019, the Party’s leading committee on reform, the Central Comprehensive Deepening Reforms Commission (CCCDR), announced new plans for expanding the city’s role on the national stage.Benchmark dates include:

- By 2025: Shenzhen is to become a world-class city renowned for innovation, with a special focus on public services and environmentally sustainable development. This will entail R&D investment to be raised and “innovative capacity” to reach the standards of global leaders. Along the way, the city’s cultural “soft power” will be vastly improved.

- By 2035: Shenzhen is to become China’s leading international showcase as the “world capital of innovation, creativity, and entrepreneurship,” showing the world what a “modern, powerful, socialist Chinese city” looks like.

- By 2050: Shenzhen is to stand among the world’s top cities, a benchmark of competitiveness, innovation, and influence.

- Higher education institutions will be granted “self-ruling rights”, to accelerate the building of world-class universities.

- The building of high-quality medical institutions by private enterprises, especially Hong Kong or Macau-funded entities will be highly encouraged;

- The building of medical talent training programs in line with international standards;

- Regulations will be relaxed for overseas doctors to practice on the mainland;

- Increased trialing of global cutting-edge medical technology.

While the actual steps Shenzhen will take to secure intellectual property (IP) have not been made clear at this time, the language implies a greater shift by the country to comply with IP concerns from foreign enterprises and encourage their continued investment within the city.

Shenzhen key development areas

Shenzhen Economic Zone

Shenzhen’s Special Economic Zone (SEZ) was expanded in 2010 from four districts to the entire city. Businesses within the Shenzhen SEZ enjoy a wide range of tax exemptions, grants and loans, and reduced rates. These notably include:- Three to five-year tax exemptions for manufacturing and operating sites by high-tech enterprises.

- Value-added tax (VAT) and tariff exemptions for imported materials used for finished products.

- Equal living rates for foreigners and local citizens.

- Immunity from state quotas or permits for production.

- VAT exemption for goods made and sold locally.

Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone

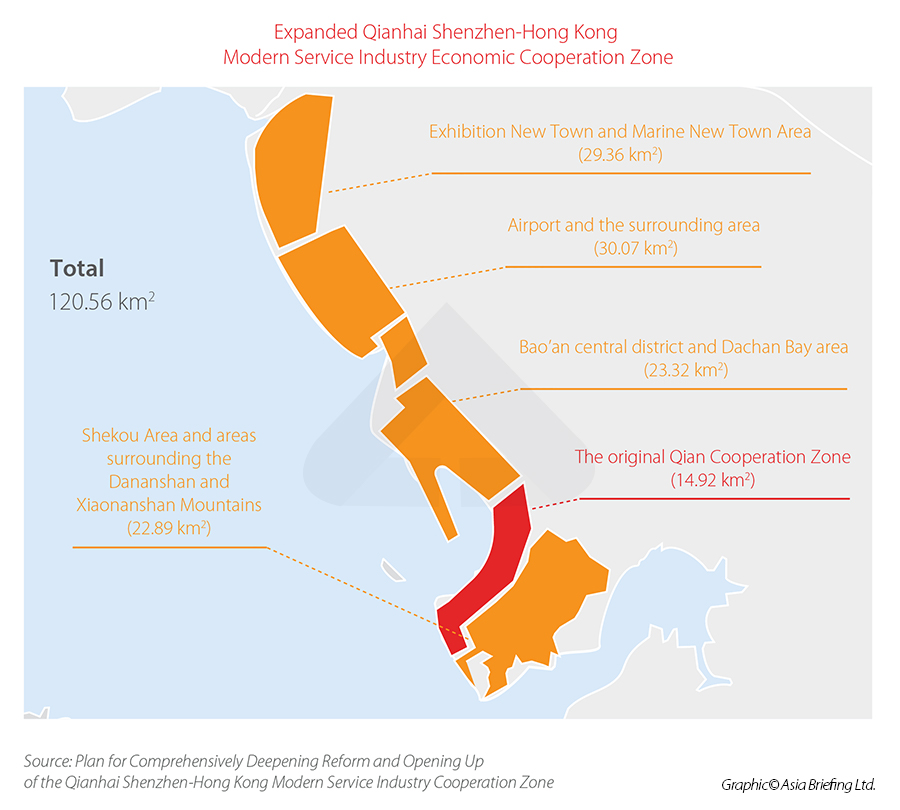

Qianhai Cooperation Zone is an experimental business zone to facilitate financial, logistics, and IT services activity between Mainland China and Hong Kong. It currently covers an area of 15 square kilometers on the east coast of the Pearl River Delta, covering three areas, namely Guiwan, Qianwan, and Mawan.In September 2021, the State Council released the Plan to Comprehensively Deepen Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone (the Qianhai Plan), which lays the development blueprint for the area over the next five years, with additional long-term goals set for the year 2035.

The Qianhai Plan will seek to expand the area of the cooperation zone from the current 14.92 square kilometers to over 120 square kilometers covering four zones.

The Qianhai Plan aims to further integrate Hong Kong and Macao’s economies into the GB and demands the zone liberalize services trade and open the financial sector further, including through supporting links to Hong Kong’s financial market. This would allow for cross-border renminbi use, facilitating management of foreign exchange and further supporting cross-border security investments.

Incentive policies for foreign investment in Shenzhen

Shenzhen is one of mainland China’s most business-friendly cities. Companies that seek to set up and expand into the area can benefit from a range of beneficial policies, including reduced tax rates, rewards for contributions to key industries, talent incentives, and more. Below we list some of the incentive policies currently available in Shenzhen.IIT subsidy for foreign talent in the GBA

Foreign talent working in Shenzhen can benefit from the IIT subsidy policy available in all nine mainland cities of the GBA. Successful applicants can get subsidies equal to the portion of the IIT paid in the GBA city in excess of 15 percent of the taxpayer’s taxable income for the previous year. This policy is available until 2024 when applications for IIT subsidies for the year 2023 can be submitted.See our full Q&A on the application process for the IIT subsidy here.

Reduced CIT rate for qualified companies in Qianhai

From January 1, 2021 to December 31, 2025, qualified enterprises engaged in encouraged industries in the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone (“Qianhai) are able to enjoy a reduced CIT rate of 15 percent, below China’s national CIT rate of 25 percent.“Encouraged industries” refers to sectors included in the 2021 version of the Catalogue for Encouraged Industries Eligible for CIT Preferential Treatment. This Qianhai’s new CIT Preferential Catalogue covers 30 sectors under five broad industry categories – modern logistics, information services, technology services, cultural and creative industries, and commercial services.

To be eligible for the reduced CIT rates, companies must derive at least 60 percent of their revenue from one of the industries in the catalogue. On June 2, 2022, the Shenzhen Municipal Government released a guide to determining eligibility for the reduced CIT rate.

For more on the reduced CIT rate for companies in Qianhai, see our related article here.

Incentives for headquartering in Shenzhen

For the establishment of headquarters of companies (subject to the requirements of The Implementations Measures for Encouraging the Development of Headquarters in Shenzhen), subsidies granted may be up to RMB 20 million (US$3 million).For financial enterprises headquarters, subsidies may be up to RMB 10 million (US$1.5 million) and 50 percent of support for relocation costs. In the case of establishments of logistics companies, these aids may be in the amount of RMB 10 million (US$1.5 million), depending on the amount of registered capital of the company in question.

Shenzhen COVID-19 restrictions and relief measures

Shenzhen has experienced a series of COVID-19 outbreaks in recent months, which has impacted the city’s economic activity. In March 2022, the government imposed a city-wide lockdown lasting one week, which led to the closure of businesses, including major factories.At the time of writing, Shenzhen is once again imposing COVID-19 restrictions in response to a small outbreak, with restrictions including locking down a district bordering Hong Kong, suspending some public transport services, and imposing city-wide testing.

As in the rest of China, Shenzhen imposes the strict “zero-COVID” (also called “dynamic zero-COVID”) policy, which takes wide-ranging measures to maintain the case count to a minimum. This often results in lockdowns of the affected neighborhoods and districts

However, Shenzhen has been considerably more successful in maintaining zero-COVID than other cities in China, managing to swiftly stop the spread of small outbreaks using targeted and localized measures. The full lockdown in March lasted only one week (although some restrictions remained in place for longer), much shorter than the two-month lockdown that Shanghai underwent. This has enabled the city to run at relative normalcy with less disruption to economic activity as compared to other regions.

In addition, Shenzhen has rolled out a series of relief measures to assist companies that have been impacted by COVID-19, in addition to the nationwide relief and support measures. At the end of March, Shenzhen released a set of 30 relief measures to assist struggling businesses. These include:

- Partial reduction of taxes and fees, such as resource tax, urban maintenance, and construction tax, real estate tax, urban land use tax, and stamp duties, among others.

- Postponement or reduction of social insurance premiums and housing provident funds.

- Rent reductions or waivers.

- Reduction of utility fees, such as water, electricity, and gas.

- Increasing loans for small businesses and reducing guarantee rates.

See our articles on VAT rebates for more information on the tax relief measures available for businesses.

This article was originally published on September 17, 2019 and was last updated on July 1, 2022.