In recent years, China has been quickly digitalizing its tax system, with multiple electronic value-added tax (VAT) fapiao programs piloted in the country.

Being easier to obtain, issue, deliver, and store, the new invoicing process will lead to more cost-effective and environmentally friendly business practices. The high automatable nature of e-fapiao enables enterprises to further streamline their businesses, which will help them to achieve higher productivity, more accuracy and enhanced internal control in risk management.

However, the e-fapiao implementation imposes challenges on businesses in the short-term, in terms of understanding the laws and regulations, developing relevant internal protocols, revising standard business processes, and upgrading relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements. Besides, companies might be exposed to higher tax scrutiny with tax authorities gaining more control in tax administration enabled by the real-time monitoring and the traceability of e-fapiao and the advanced technology.

CFOs and finance managers with responsibility for China operations are suggested to prepare for e-fapiao’s impacts on their existing systems and procedures as well as the benefits rooted in the digitalization management of VAT invoices.

In this article, we will walk you through China’s developing e-fapiao system by introducing what it is, explaining why it matters, and exploring the potential challenges associated with the implementation.

What is e-fapiao?

Fapiao

To explain what is e-fapiao, one must first understand the basic concept of fapiao.

In China, fapiao refers to VAT fapiao. It is a business voucher issued and received by all parties involved in purchasing and selling goods or services.

Different from the commercial invoices or receipts used in many other countries mainly to record transactions, fapiao in China serve as both the legal receipt and the tax invoice:

- The fapiao is the original accounting document for a taxpayer to support the legitimacy of their activities; and

- The fapiao stipulates the VAT due and is used by the authorities to track transactions for tax purposes and avoid tax evasion.

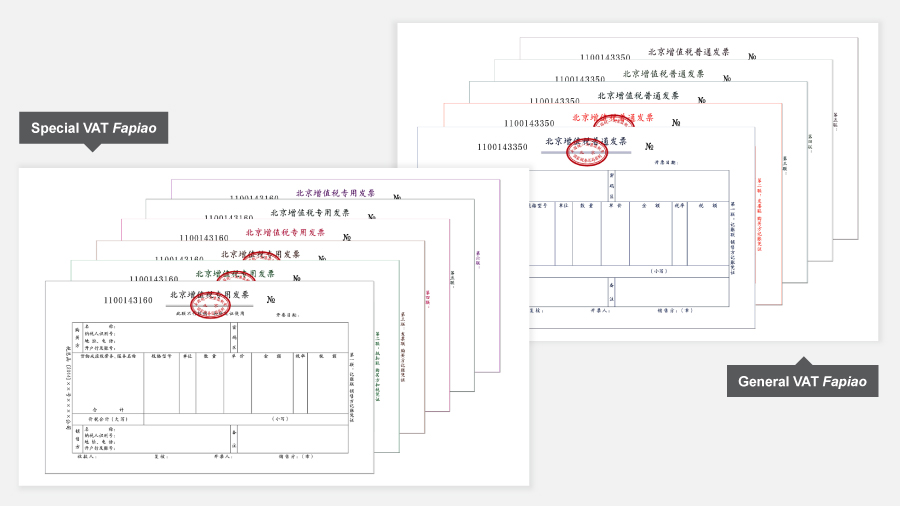

Fapiao can mainly be sorted into general VAT fapiao and special VAT fapiao.

- Special VAT fapiao can only be utilized by VAT general taxpayers whose annual taxable turnover is over RMB 5 million (USD 700000) or who have applied for such general taxpayer status voluntarily to ease their VAT obligations.

- General VAT fapiao can be utilized by any company registered in China but cannot be used by the recipient for VAT deduction purposes. Individuals regularly use general VAT fapiao when reimbursing their business expenses.

These two types of fapiao have been in paper form for a long time. The State Taxation Administration (STA) and its local branches print, distribute, and administer them. Examples of the conventional general VAT fapiao and special VAT fapiao can be found below:

When a company wants to issue fapiao in China, it must first obtain blank sheets of specially templated fapiao paper from the local tax bureau within its quota every month, print the transaction information on the fapiao sheets with a special printer that is linked to and controlled by the tax system, and then seal the fapiao with a dedicated fapiao seal showing the issuer’s name and tax identification code, and other necessary information.

The paper fapiao system has remained in place for many years. However, the methodology has come under increased strain in recent years from high-frequency transaction industries, such as retail, food and beverage, and travel. Especially with e-commerce booming in China, sellers find it difficult to issue and deliver fapiao using the traditional method due to the explosive number of online requests. This is why China started to explore the application of e-fapiao.

E-fapiao

As the name suggests, E-fapiao is a type of fapiao in electronic form. It has the same purpose and legal effect as the conventional paper fapiao.

Despite the similar appearance of an e-fapiao and the scanned copy of a paper fapiao, the two are different in nature:

- E-fapiao is a data file generated in a structured format in the official tax system. It is easier for financial systems to comprehend, book, and archive automatically. And it adopts technical anti-counterfeiting measures, such as electronic signature, to ensure its authenticity.

- The scanned copy of a paper fapiao mirrors the corresponding paper fapiao It doesn’t contain the original anti-counterfeiting measures possessed by the paper fapiao, which are mainly physical measures, such as special printing ink, the printing font, the company fapiao chop, etc. The tax bureau can’t regard it as an “original” fapiao in the way the e-fapiao can be.

E-fapiao application in China

Designed for simplicity, these invoices can be generated automatically or semi-automatically upon payment, streamlining the process by eliminating the need for manual data entry.

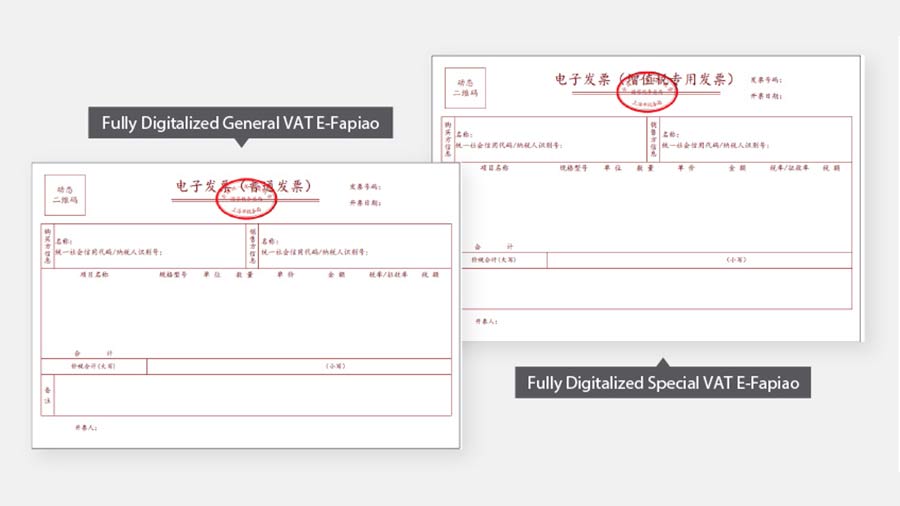

Presently, China recognizes four types of E-Fapiaos amidst ongoing reforms:

- Special VAT E-Fapiao;

- General VAT E-Fapiao;

- Fully Digitalized Special VAT E-Fapiao; and,

- Fully Digitalized General VAT E-Fapiao.

This diversity caters to different transactional and regulatory requirements, marking a significant milestone in China's tax administration evolution. The samples of the fully digitalized electronic fapiao can be found below:

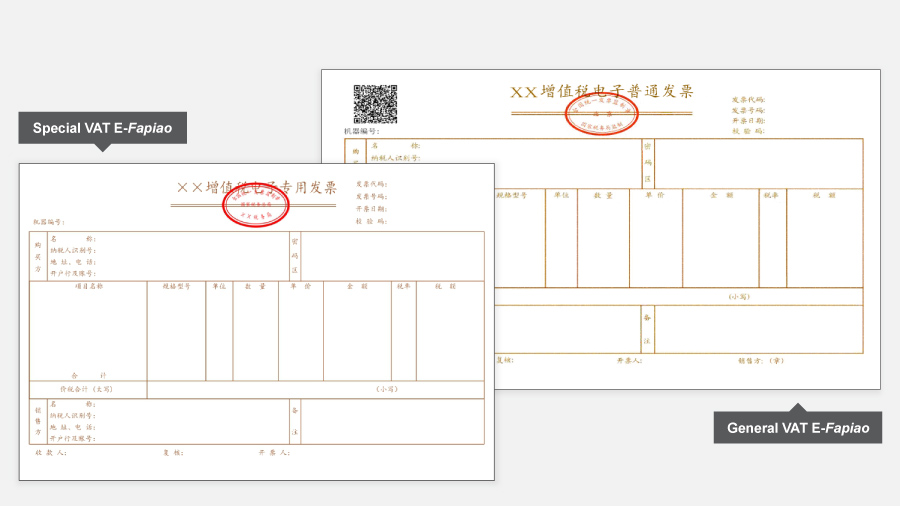

In comparison, the normal VAT electronic fapiao and conventional fapiao look more complicated as below:

New features of the fully digitalized e-fapiao

As a new type of electronic invoice, the fully digitalized e-fapiao will have unique features as explained below.

Simplified procedures to obtain and issue fully digitalized e-fapiao:

- “No medium”: Taxpayers under the pilot program will not need to get the special tax control equipment (the medium) in advance to issue fapiao; Instead, they can issue the fully digitalized e-fapiao through the national e-invoicing service platform.

- “Fapiao number automatic assignment system”: Taxpayers under the pilot program will not need to obtain the fapiao through application to the tax bureaus; Instead, they can obtain the fully digitalized e-fapiao through the e-invoicing service platform, which will automatically assign a unique fapiao number when the fapiao information is generated.

- “Managing the total amount of fapiao based on taxpayers’ credibility”: The tax authorities will determine the initial maximum amount of invoices issued by the taxpayer in a calendar month and make dynamic adjustments thereto – based on the risk level, taxpaying credit rating, actual operating conditions, and other factors of a taxpayer. The maximum invoice amount refers to the upper limit of the total invoice amount the pilot taxpayer’s invoice issued within a natural month, excluding VAT. Different from traditional paper fapiao, the fully digitalized e-fapiao is not limited by the number of fapiao pieces or the maximum among of a single fapiao.

- Diversified channels to issue fapiao: Pilot taxpayers can issue the fully digitalized e-fapiao through the unified e-invoicing service platform. In future, they may be able to issue such e-fapiao through a terminal or the mobile app. This way they will no longer require special tax control equipment.

- One-stop e-invoicing service platform: After logging onto the platform, pilot taxpayers can issue, deliver, and verify fapiao on a single platform, instead of completing related operations on multiple platforms as before.

- More widely applicable fapiao data: Pilot taxpayers’ tax digital accounts on the e-invoicing service platform will automatically collect invoice data for inquiry, downloading, and printing by pilot taxpayers. Once the fully digitalized e-fapiao is issued, the fapiao information will automatically be sent to the tax digital accounts of both the issuer and the receiver for them to check and download. The issuers can track the invoice usage of the receiver in real-time through the tax digital account ((such as whether the VAT has been deducted or not). These digitalized fapiao data will also lay a foundation for taxpayers to pre-fill the ‘one integrated form’ for tax declaration.

- No specific digital formats required: Unlike normal VAT e-fapiao, which has to be in PDF or OFD formats, fully digitalized e-fapiao is not required to be saved in a specific digital format. Pilot taxpayers can deliver fully digitalized e-fapiao through their tax digital accounts on the e-invoicing service platform, or deliver fully digitalized e-fapiao by email, QR code, or other means. This will reduce fapiao delivery costs and make it easier for taxpayers to process fapiao.

- Unblocked channel to access tax services: The e-invoicing service platform will incorporate more interactive features, such as smart consulting and objection submission functions.

In addition to the above, in the future, the e-invoicing service platform is expected to support the direct connection with ERP and other financial software of the majority of enterprises to realize the integrated operation of invoice reimbursement, entry, and filing.

The scope of fully digitalized e-fapiao

| The Latest Scope of Issuers and Recipients of Fully Digitalized E-fapiao | |

| Scope of issuers* | Selected taxpayers in all regions nationwide |

| Scope of recipients* | Taxpayers nationwide |

| *Taxpayers who do not use or have the Internet are temporarily excluded from the pilot fully digitalized e-fapiao program. | |

Compliance requirements on e-fapiao management

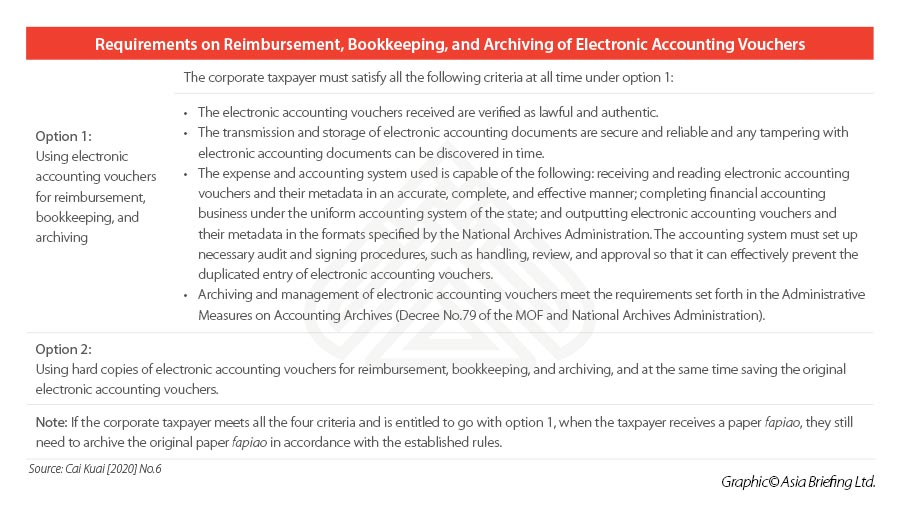

In a bid to better regulate the conduct of enterprises in managing electronic accounting vouchers, in March 2020, the State Tax Administration (STA) released the Notice on Regulating the Reimbursement, Bookkeeping, and Archiving of Electronic Accounting Vouchers (Cai Kuai [2020] No.6).

Fake and falsified e-fapiao

According to Cai Kuai [2020] No.6, all electronic accounting vouchers received by enterprises must be verified as lawful and authentic before being applied for reimbursement and then for bookkeeping and archiving.

However, an electronic version of a fapiao is more likely to be maliciously forged or falsified using Photoshop or other editing technologies. False e-fapiao may not be based on a real business transaction; and a falsified e-fapiao may lack genuine accounting data like sales amount, date of issue, and buyer’s and seller’s tax code. These e-fapiao are not allowed to be used by law.

This process could require a lot of manpower, especially if the e-fapiao needs to be opened one by one manually. For businesses that receive large amounts of electronic accounting vouchers, it would be more efficient to install a smart expense management application that can automatically verify an array of e-fapiao or immediately verify the e-fapiao when it is first scanned and uploaded to the system.

Duplicated entry of the same e-fapiao

In addition, Cai Kuai [2020] No.6 also requires enterprises to set up necessary review and signature procedures to prevent electronic accounting vouchers from being repeatedly entered into accounts.

The reason is that unlike paper fapiao, which requires a fresh company stamp, an electronic version of a fapiao with electronic signatures can be easily reprinted, and all printed copies look the same. When using printed e-fapiao for reimbursement and bookkeeping, accounting personnel may repetitively enter the same fapiao that has been used. This will lead to duplicated reimbursement of the same expense and fraudulent bookkeeping.

To avoid this situation, enterprises should better optimize their internal control system. For those without an intelligent fapiao management system, accounting personnel will need to manually check the fapiao code and fapiao number when processing claims to eliminate duplicated input. However, this can be time-consuming and error-prone when there are piles of fapiao to confirm.

Alternatively, an enterprise may want to consider installing a smart, efficient fapiao management system to identify and reject a previously submitted fapiao when uploaded to the system.

Archiving e-fapiao properly

It must also be noted that, according to Cai Kuai [2020] No.6, companies shall not merely use the printed hard copy of e-fapiao for reimbursement, bookkeeping, and archiving.

Instead, corporate taxpayers have two options:

- Only using e-fapiao for reimbursement, bookkeeping, and archiving if they establish a digital system that satisfies all the criteria set out in the Cai Kuai [2020] No.6; and

- Using the hard copy of e-fapiao for reimbursement, bookkeeping, and archiving, and simultaneously saving the original file of the e-fapiao.

As shown in the table below, under the first option (only using the electronic version of Fapiao for bookkeeping and archiving), corporate taxpayers must always satisfy four specific criteria.

Companies are required to have a financial system in place that guarantees the secure transmission and storage of e-fapiao, with capabilities for detecting any tampering. Additionally, their accounting systems must efficiently process and audit e-fapiao, preventing duplicate entries. For those unable to meet these standards, the transition to using printed copies for reimbursement and archiving purposes, as mandated by regulation, can result in increased administrative costs. Despite the coexistence of paper and electronic fapiao in China, adherence to these regulations is crucial for companies to avoid compliance risks and potential penalties for past malpractices, especially since the Cai Kuai [2020] No.6 directive has been in effect for over a year.

This situation underscores the importance of modernizing invoice and expense management systems to meet current standards

Retaining e-fapiao for a sufficient period

Companies should also be aware that the minimum retention periods for some accounting records – either in paper or electronic version – have been changed to 10 or 30 years instead of the original 3, 5, 10, 15, or 25 years, according to the Administrative Measures on Accounting Archives (Decree No.79 of the MOF and National Archives Administration).

E-fapiao, as one kind of original accounting voucher, is required to be retained for 30 years. This can be challenging for businesses. Paper fapiao needs storage space and is easily damaged or lost. At the same time, e-fapiao and other electronic accounting documents require a powerful and secure cloud or localized storage system and an intelligent archive management solution to manage them.

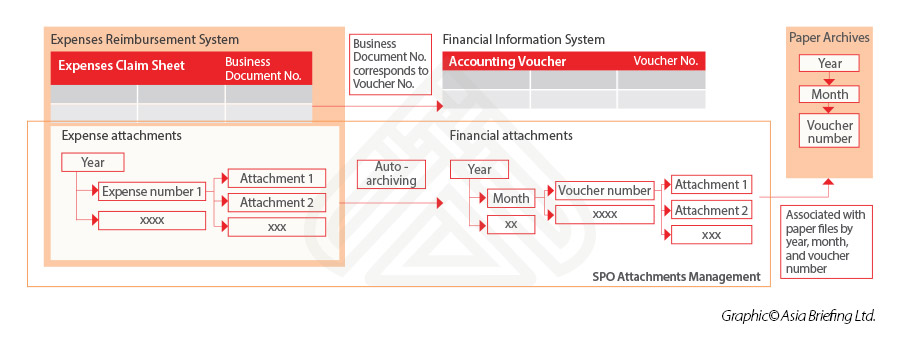

For taxpayers who need to keep both paper and electronic accounting vouchers, it is highly recommended to establish a retrieval system between the physical and digital documents.

An ideal intelligent archive management system should be able to store e-fapiao, accounting vouchers, and other business documents in a digital format, build the business logic and reference relationship between the files, and provide multi-dimensional retrieval conditions for quick access to the original accounting documents. In this way, the system will save time and workforce when looking to retrieve information and improve the efficiency of internal and external audits.

Advantages of e-fapiao

Because of the digital nature of e-fapiao, it comes with added benefits for taxpayers and tax administration.

The new invoicing process will lead to:

- More cost-effective and environmentally friendly business practices,

- Easier to obtain, issue, deliver, and store.

- Considering e-fapiao is easier to search for later, to retrieve when needed, and more suitable for automation, the whole financial and accounting process can be expected to be more streamlined, efficient, and accurate with improved data quality.

- The business environment and general market vitality can be improved.

E-fapiao and automation

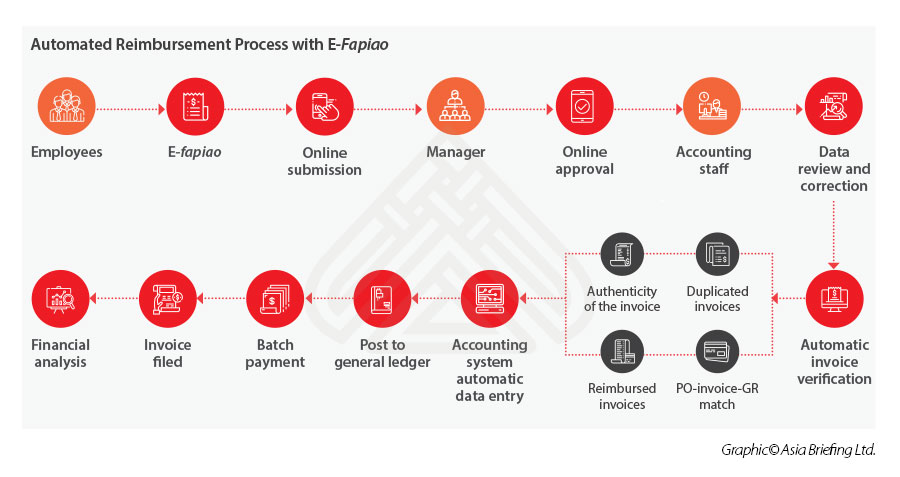

The added value of e-fapiao, including higher productivity, improved transparency and accuracy, human resource cost-saving, and better risk control, are deeply associated with the automation level of the relevant processes. To ensure compliance and get the most out of the e-fapiao implementation, companies are suggested to consider adopting technologies to facilitate their e-fapiao management, reimbursement management, accounting, tax, and supply chain management processes, step by step.

Tech-powered e-fapiao management

The digital nature of e-fapiao enables it to be powered by automation technologies, which is essential in ensuring the accuracy, reliability, security, efficiency, and completeness of the e-fapiao management.

Regardless of being self-built or procured from an external source, an ideal tech-powered e-fapiao management should achieve the following functions:

- Automatically verify the validity of electronic accounting vouchers;

- Automatically read electronic accounting vouchers accurately, completely, and effectively;

- Reject duplicated entry of the electronic accounting voucher that has been submitted;

- Set up necessary audit and signing procedures, such as handling, review, and approval;

- Prevent electronic accounting records from being tampered with;

- Link electronic invoices with other vouchers and store the documents in a systematic way;

- Enable a backup system, which can effectively protect data against accidents, vandalism, and natural disasters; and

- Ensure that the local system or cloud storage solution can satisfy the long-term retention requirements of electronic accounting

Companies can use these as the starting points to plan their own solutions or to negotiate with third-party service providers for out-of-the-box solutions.

Digitalized expenses management

Expense management digitalization has been explored for a while under the trend of “shift to digital” and the implementation of e-fapiao makes the process even easier as the e-fapiao data is natively machine-readable.

With the shift to digital, companies have three main approaches to managing expenses digitally:

- Developing In-House Solutions: Suitable for large companies, this approach integrates tools like MS PowerApps with existing accounting software, offering complete control but at higher costs and longer development time.

- Utilizing Global Platforms: Platforms like Concur cater to a global digital expense management strategy but may not be fully optimized for specific environments like China.

- Exploring Local Market Solutions: These are cost-effective and often bilingual, but identifying and configuring the most appropriate solutions can be challenging for foreign investors.

There are pros and cons to each of these approaches. The first approach is probably only viable for quite large companies with a substantial presence in China. The main advantage of this approach would be to maintain all data within one integrated environment and to have 100 percent control over that environment. However, the cost is relatively high, and development can be expected to take several months to complete.

The second approach has been chosen by quite a few companies already, as part of their global digital expense management strategy. However, these platforms are generally not optimized for the Chinese environment to an adequate degree and tend not to link with all the important third-party apps to facilitate the seamless transfer of data during the overall process. They can also be very expensive in terms of a monthly per-employee subscription.

The third approach is the most affordable way. The cost of one license for some of these apps can be as little as RMB 300 /year (approx. USD 42). Some of them are bilingual and they have a lot of flexibility in terms of their configuration. The main problem for foreign investors is how to identify the most appropriate providers and how to configure the apps in the most suitable manner.

Accounting and tax automation

Starting from the implementation of tech-powered e-fapiao management solutions, companies can explore the possibility of accounting and tax automation as both areas are highly rules-based.

Once an e-fapiao management system can be made compatible with the company’s existing ERP system, information about both income and expenses can be extracted from the ERP system and be automatically linked with relevant accounting vouchers (e-fapiao) processed by the e-fapiao management system, before attributing to pre-established accounting subjects. A general ledger record can be generated and archived automatically, which is one major component of accounting automation. Via this process, tax automation can also be achieved by automatically recognizing, calculating, entering, and reporting the input VAT and export VAT data obtained from the procurement and sale processes.

General E-Fapiao Frequently Asked Questions

Why does e-fapiao matter?

The implementation of e-fapiao will not only initiate a revolution within the traditional financial and accounting processes of a business, but also will significantly affect the whole business operation and supply chain management. Below we explain why.

E-fapiao has imposed new compliance requirements on the financial and accounting processes

China has also been developing relevant laws and regulations to facilitate the implementation of e-fapiao management and has put forward specific compliance requirements to businesses. According to the previously mentioned Cai Kuai [2020] No.6, taxpayers can solely use electronic accounting vouchers (including e-fapiao) for bookkeeping and accounting only if they satisfy the criteria set out in the Notice.

- Taxpayers (companies and individuals) unable to fulfill all requirements must preserve both printed and original digital files of electronic accounting vouchers and establish a system linking archived electronic vouchers with their corresponding printed records for swift document retrieval.

- Non-compliance may result in financial penalties, operational restrictions, and adverse effects on tax credits or VAT rebate eligibility, potentially leading to significant business losses. Therefore, it is advised that companies implement appropriate financial and accounting protocols and train their financial staff early to guarantee full compliance and avoid the accumulation of non-compliant records.

E-fapiao requires software instalment and system upgrade

To be able to issue, receive, or automate the e-fapiao management, enterprises might be required to install special software developed by the STA or third-party developers. However, foreign invested enterprises are usually subject to strict restrictions in installing such software. For larger organizations, may take months for the headquarters to assess the security of the software before approving the instalment. If the enterprise doesn’t think about this issue until they start receiving e-fapiao, the corresponding accounting, tax calculation and filing, and archiving process will be unavoidably delayed.

The company may also need to upgrade its existing system to be compatible with the new e-fapiao format.

E-fapiao offer a great opportunity for enterprises to further automate and optimize their operations

- Adopting e-fapiao enhances productivity, accuracy, and risk management through automation, streamlining business operations.

- Beyond financial and accounting workflows, e-fapiao implementation benefits other areas such as supply chain management, client relationship management, and reporting.

- In reimbursement processes, e-fapiao simplifies submission through automated expense management apps, eliminating manual application forms and physical attachment of invoices, leading to greater efficiency and accuracy.

- Although currently, e-fapiao may still need to be printed for internal administrative reasons, this requirement is expected to phase out shortly, further reducing manual tasks.

- The procurement process becomes more efficient with e-fapiao, allowing for immediate digital receipt and booking of invoices, automating order-invoice-receipt matching, and shortening payment cycles, hence enhancing supplier relationships.

How should companies prepare for the application of e-fapiao?

Figuring out the compliance requirements

Before developing any new accounting and financial processes and building sophisticated automation solutions, the first thing the CFO should do to prepare for the VAT e-fapiao implementation is to let the financial team have a good understanding of the relevant compliance requirements. This is the basis of everything.

As introduced in the previous sections, China has been developing relevant laws and regulations to facilitate the implementation of e-fapiao, which put forward specific requirements on the authenticity, non-repeatability, and archiving/retention of electronic invoices.

Failing to comply with such requirements may cause monetary penalties and worsening tax credits. What’s worse, the enterprise may not be able to deduct the corresponding expenses from taxable income when calculating corporate income tax, or not be able to offset the output VAT from the input VAT when calculating the VAT liability.

Companies are advised to keep abreast of the regulatory updates by regularly checking the official website of the STA as well as professional analysis written by tax and financial experts. When necessary, companies are also suggested to arrange training sessions for financial staff to help them grasp the key compliance points.

Solving the software issue in advance

If a company has no established solution before receiving large amounts of e-fapiao, the corresponding accounting, tax calculation and filing, and archiving process will unavoidably be delayed and affected.

Companies are suggested to deal with this issue as early as possible, to give the overseas headquarters enough time to evaluate the software and try to get approval for instalment in time. This is the most straightforward solution.

Alternatively, companies can use third-party professional services firms to help them process the e-fapiao received. Such professional firms usually have complete and up-to-date e-fapiao solutions, which are more convenient to use for companies. However, as it also takes time for both parties to reach a consensus on the terms, such as price and service scope, companies are also suggested to start the process sooner rather than later.

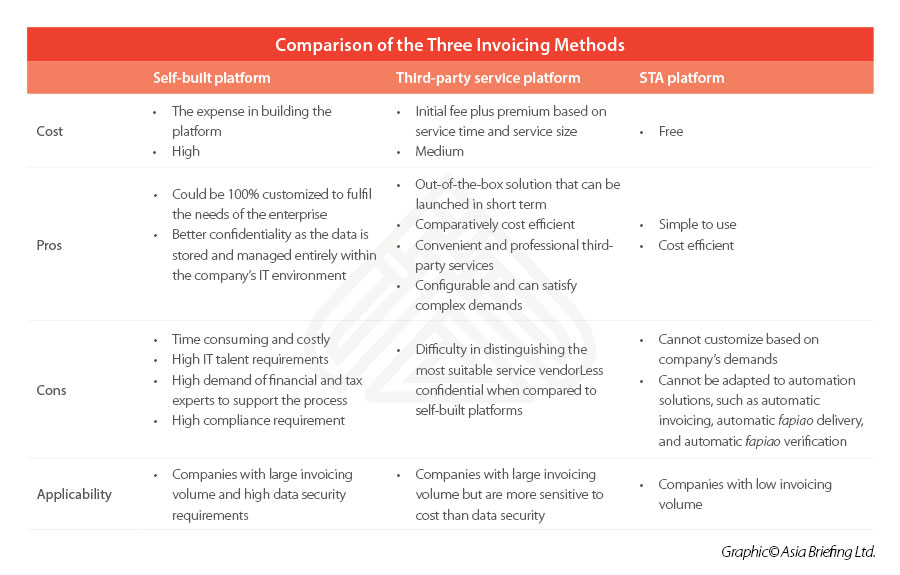

Choose the most suitable invoicing method

Another item on the CFO’s checklist should be choosing the most suitable invoicing method to issue e-fapiao. This will depend on the specific situation and demands of the enterprise.

Generally, there are three main invoicing methods being discussed:

- STA e-fapiao Platform: Free and user-friendly but unsuitable for high-volume processing due to manual effort and lack of customization options for advanced features like automated processing and reporting.

- Third-party e-fapiao Platforms: Offers customization to meet specific needs but raises data security concerns due to cloud storage and transaction data access, necessitating careful selection and possibly involving scrutiny by overseas headquarters.

- Self-built e-fapiao Platforms: Ideal for high data security and large volume invoicing with deep customization capabilities; however, it requires significant IT and financial expertise and adherence to STA specifications, and it can be costly and time-consuming to develop.

A comparison of the three methods is summarized in the following table. Companies are recommended to carefully understand their own demands and study the pros and cons of each method to make the best choice.

Design corresponding financial and operational procedures

As the laws and regulations impose new requirements on the authenticity, non-repeatability, and archiving of the e-fapiao, companies will need to redesign corresponding financial procedures to maintain compliance.

For example, companies can solely use the e-fapiao as the voucher for reimbursement, bookkeeping, and archiving, only if they can satisfy all the below conditions:

- The electronic accounting vouchers received are verified as lawful.

- The transmission and storage of electronic accounting documents are secure and reliable and any tampering with electronic accounting documents can be discovered.

- The expense and accounting system used is capable of the following: receiving and reading electronic accounting vouchers and their metadata in an accurate, complete, and effective manner; completing financial accounting business under the uniform accounting system of the state; and outputting electronic accounting vouchers and their metadata in the formats specified by the National Archives The accounting system must set up necessary audit and signing procedures, such as handling, review, and approval so that it can effectively prevent the duplicated entry of electronic accounting vouchers.

- Archiving and management of electronic accounting vouchers meet the requirements set forth in the Administrative Measures on Accounting Archives (Decree 79 of the MOF and National Archives Administration).

But if a taxpayer cannot meet the above conditions, they can use printed copies of electronic accounting vouchers as the basis for reimbursement, bookkeeping, and archiving, however, the original electronic accounting voucher should be saved simultaneously. Companies have to develop due procedures to distinguish whether the e-fapiao they have received can satisfy the conditions of solely using e-fapiao for reimbursement, bookkeeping, and archiving, and then take the right actions in dealing with the reimbursement, bookkeeping, and archiving.

Companies will also need to make relevant changes to their other operations with the e-fapiao rolling out an automation upgrade. For example, companies will have to upgrade their payment cycle as the “delivery upon issuing” of e-fapiao will make the process much faster. Companies are suggested to carefully comb their financial and operational scenarios to check if any of them need to be redesigned to fit the e-fapiao implementation and integrate internal and external resources to standardize the upgraded processes.

Tax health check

As the real-time monitoring and the traceability of e-fapiao improve the tax bureau’s capability to discover tax-related violations, companies are suggested to take measures in advance to find and resolve any risky areas before being caught by the authority in charge. This can include arranging a regular tax health check and improving the firm’s internal control system.

Internal control is important in ensuring the smooth application of e-fapiao and avoiding unnecessary risks. A regular tax health check, either conducted internally or by a professional third party, will help identify the weak points in the business’s daily operations and reduce the risk of triggering worse tax investigations from the tax bureau. Considering third-party service firms are usually more professional on relevant matters and more confidential when reviewing financial and operational documents, it is highly recommended if the company’s budget allows.