Shanghai is mainland China’s commercial capital and most populous city. Alongside Beijing, Chongqing, and Tianjin, it is one of four municipalities directly controlled by the central government.

With a storied history of foreign economic and cultural exchange, Shanghai is known as mainland China’s most international city. Today, it boasts significant finance, trade, and shipping industries, including the world’s largest port by cargo throughput.

Located at the mouth of the Yangtze River on China’s east-central coast, Shanghai is surrounded by Jiangsu and Zhejiang provinces to the north, west, and south, and the East China Sea to the east. It is regarded as the center of Yangtze River Delta (YRD) economic circle, the richest mega city cluster per capita in China.

With the highest GDP of any mainland Chinese city and half of its economic activity contributed by non-public enterprises, Shanghai is an economically vibrant and popular destination for private and foreign investment. It is also a core port for domestic and international trade, with the value of its imports and exports accounting for 20 percent of the country’s total.

In addition, Shanghai owns one of the two stock exchanges in mainland China - the Shanghai Stock Exchange - and is home to some of the country’s top universities, including Fudan University and Shanghai Jiaotong University.

Shanghai is currently in the process of recovery after a strict two-month city-wide lockdown which lifted on June 1, 2022. While the lockdown has caused significant disruption to the city’s economy, the municipal government has released a range of relief measures to support companies impacted by the restrictions and restart the economy. These include tax relief measures, fee cuts, and rent waivers, with added support going to small businesses and companies in impacted sectors.

2021 economic overview

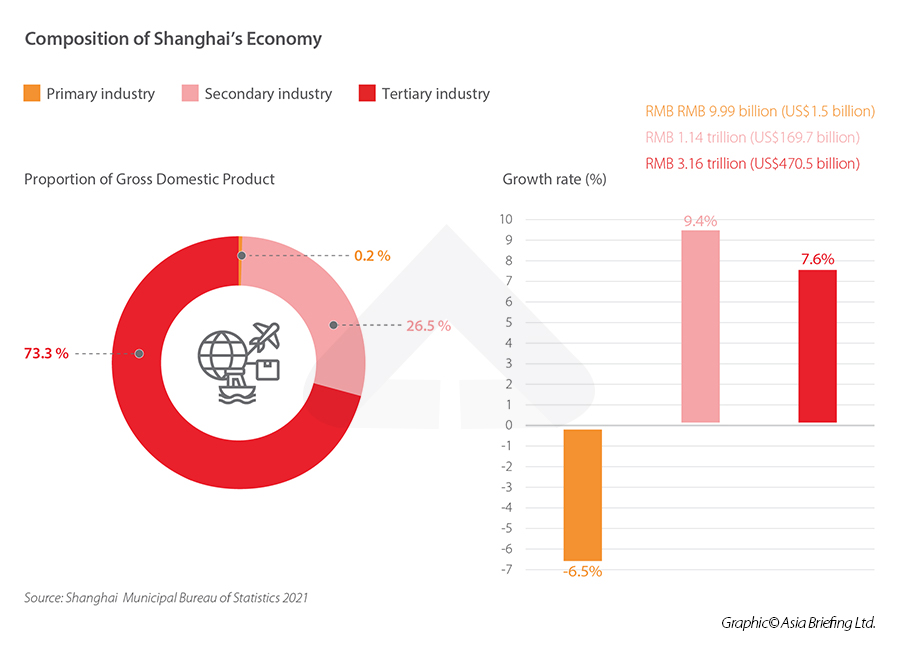

Shanghai’s GDP broke the four trillion mark in 2021, reaching a total of RMB 4.32 trillion (US$643.85 billion) in 2021, a year-on-year growth rate of 8.1 percent. This shows a remarkable recovery from the 1.7 percent growth in 2020 when the COVID-19 pandemic hit.Industry development

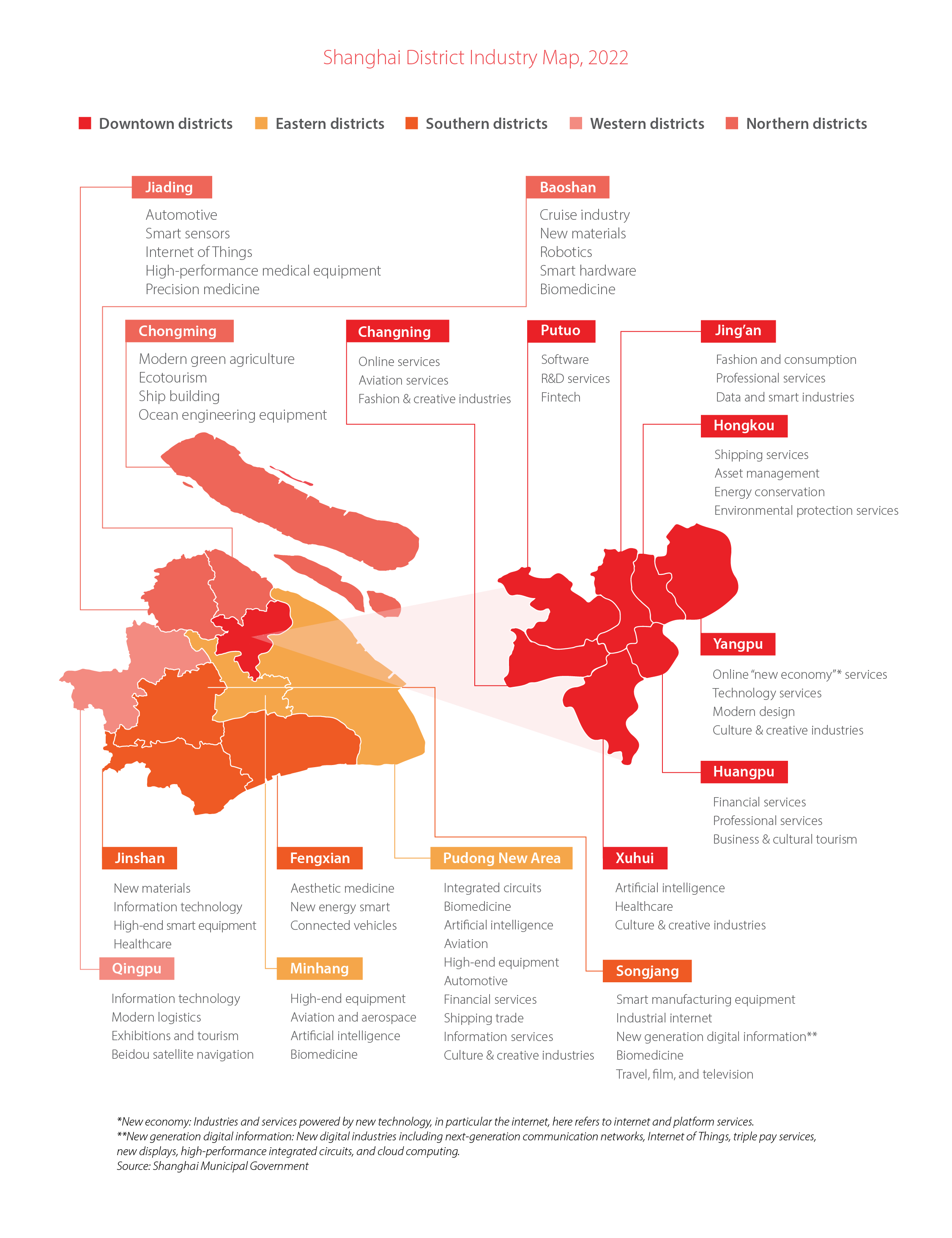

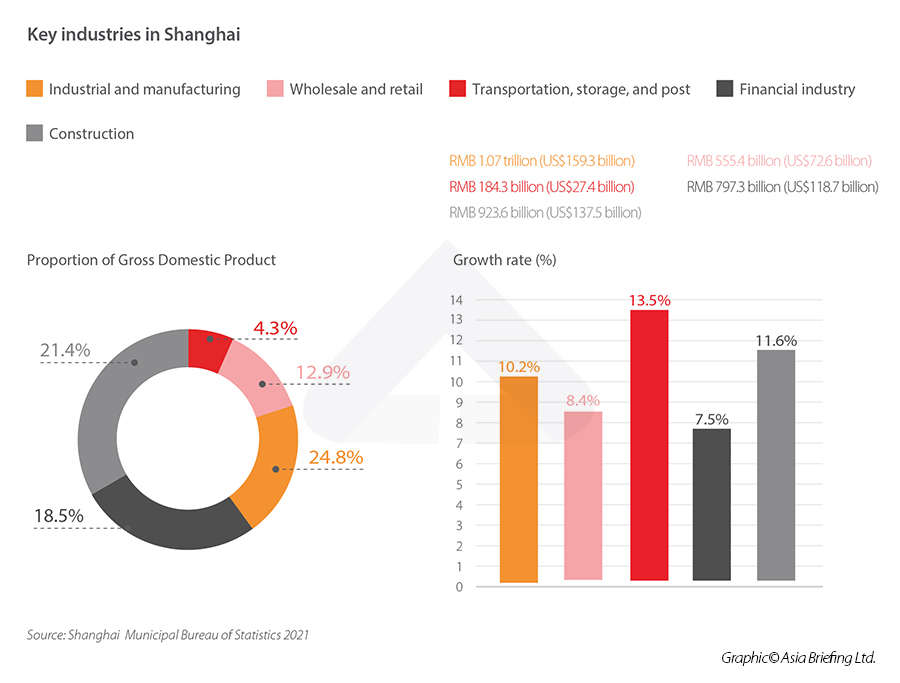

Shanghai is transforming into a post-industrial economy. Its tertiary industry, or service sector, accounts for over 70 percent of the city’s GDP and is still rapidly growing.The largest single service sector is the financial industry, which accounted for 18.5 percent of GDP in 2021, according to the Shanghai Municipal Bureau of Statistics.

The industrial and manufacturing sector, while smaller than the service sector, is still an important mainstay industry of the city, and is modernizing quickly. In 2021, “strategic emerging” industrial sectors, such as new energy and new energy vehicles (NEVs), new materials, high-end machinery, new generation information technology, and biologics, among others, accounted for over 40 percent of the total industrial output.

Shanghai is also home to a thriving automobile manufacturing industry, with the city accounting for about 10 percent of the country’s entire automobile manufacturing output in 2021. Notable foreign car manufacturers with factories in Shanghai include Ford, Tesla, and Volkswagen’s joint venture with SAIC Motor.

Other important industries in Shanghai include wholesale and retail, real estate, transportation, and construction.

Foreign trade and investment

Shanghai’s trade volume also set a new record in 2021, with RMB 4.06 trillion (US$605.5 billion) in total imports and exports. Exports reached RMB 1.57 trillion (US$233.7 billion), up 14.6 percent year-on-year, and imports reached RMB 2.49 trillion (US$370.7 billion), up 17.7 percent.Shanghai’s largest trading partner in 2021 was the EU, which accounted for 15.8 percent of imports and exports, followed by the US (12.5 percent) and Japan (10.1 percent).

The foreign investment saw similarly high growth in 2021. Actual use of foreign capital grew 11.5 percent year on year to reach US$22.6 billion. The vast majority - 95.5 percent - was invested in tertiary industries, with leasing and business services, scientific research, and technical services receiving the most funding.

A total of 6,708 new foreign-invested enterprises (FIEs) were registered in Shanghai in 2021, of which 3,934 are wholly owned.

The largest source region for foreign investment was Hong Kong, which accounted for over 70 percent of the actual amount of foreign capital received, followed by Singapore (70.3 percent), Europe (5.9 percent), Japan (3.3 percent), and the US (2.7 percent).

Shanghai pilot FTZ

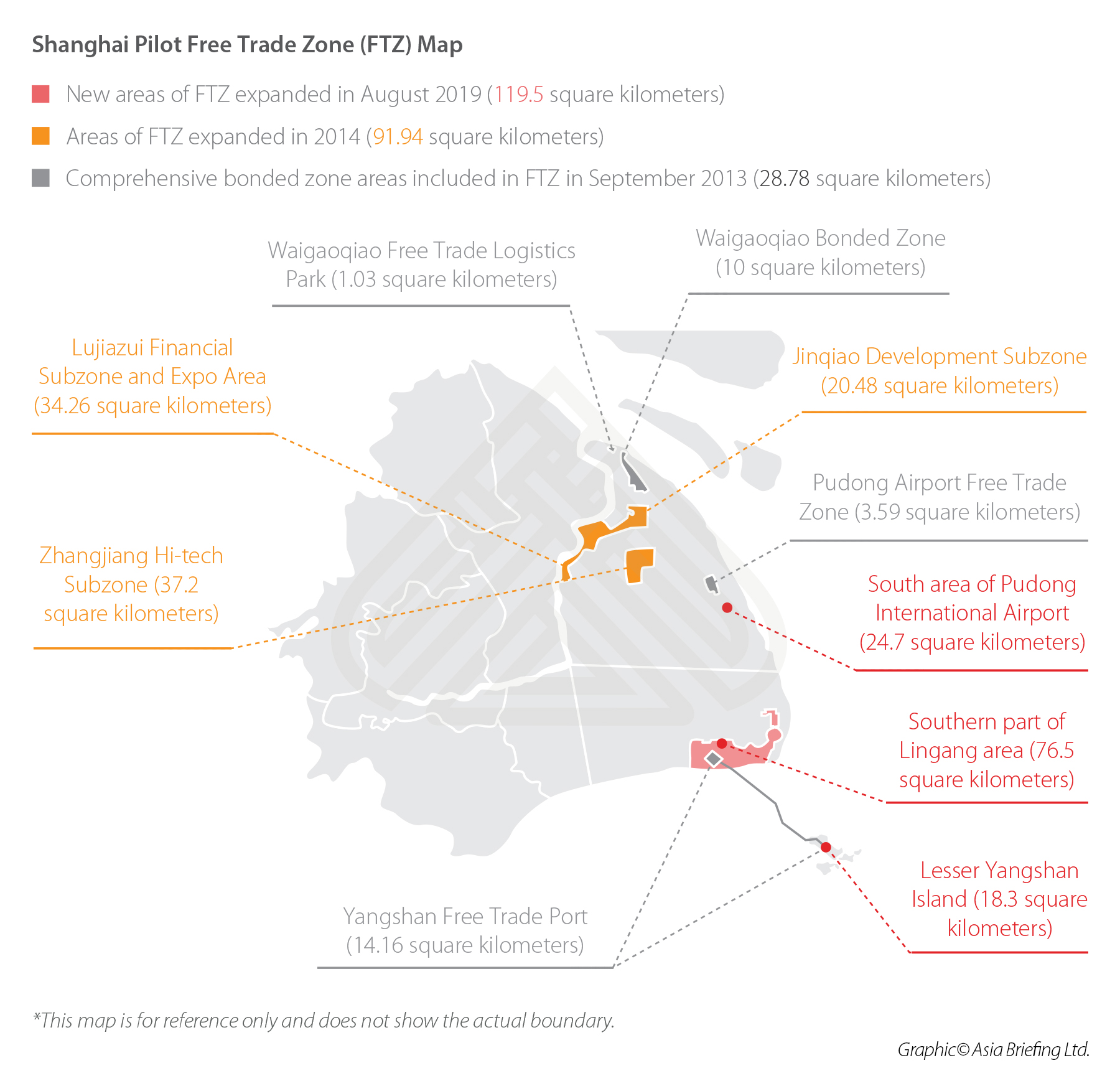

Shanghai is often at the forefront of pilot reforms and economic liberalization. In September 2013, the first Pilot Free Trade Zone (FTZ) in mainland China was established in Shanghai.The FTZ is equipped with world-class infrastructure and is home to a well-established service sector, which creates a quarter of the city’s GDP and about 40 percent of China’s total foreign trade.

Certain types of foreign businesses and organizations operating in China are only permitted to set up within the Shanghai FTZ area.

The FTZ itself has been gradually expanding – covering an area of 28.78 square kilometers in 2013 to 240.22 square kilometers in 2019.

The Lingang New Area – which was established in 2019 – is a special economic function zone of the Shanghai FTZ. Spanning 119.5 square kilometers along the southeastern tip of Shanghai, it aims to facilitate free activities in trade, investment, finance, talents, and information – with a special focus on stimulating new high-tech innovation and cross-border exchange of financial and legal services.

The goal is to establish a relatively mature system of investment and trade and more open functional platforms by 2025 and become a special economic function zone with strong global market influence and competitiveness by 2035 – expanding to new areas, such as Shanghai Dazhi river, Jinhui Port, Xiaoyangshan Island, and the southern part of Pudong International Airport.

Policies and trends

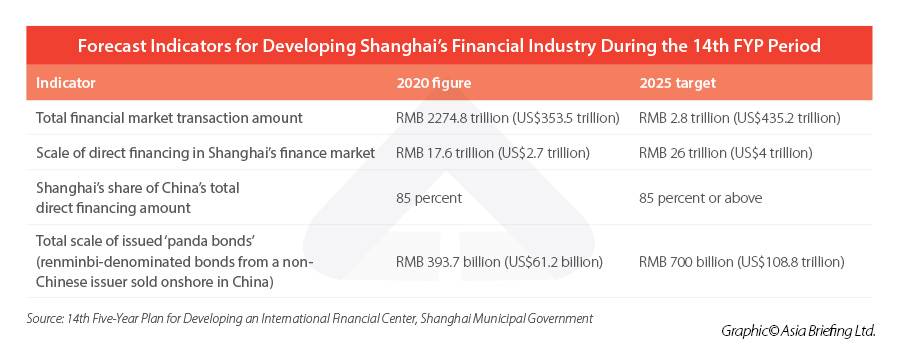

The future trajectory of Shanghai’s economy will lean heavily toward developing the services sector, in particular finance and technology, as well as advanced and high-end manufacturing.Building on its position as a leading financial and tech hub, Shanghai has rolled out several development roadmaps and policy incentives to boost the growth of these strategic sectors. Notable examples include the 14th Five Year Plan for Building a Science and Technology Innovation Center with Global Influence (Science and Technology 14th FYP), and the 14th Five-Year Plan for Developing an International Financial Center (Finance 14th FYP).

The Science and Technology 14th FYP sets several goals for developing the city's technology sectors. This includes considerably increasing its R&D capabilities, as evidenced by the target of increasing its R&D expenditure to about 4.5 percent of local GDP by 2025, of which basic research expenditure will account for about 12 percent.

| Key Targets of the Science and Technology 14th FYP | |

| Indicator | 2025 target |

| Porportion of R&D expenditure of local GDP | Approx 4.5% |

| Porportion of basic R&D expenditure of total R&D expenditure | Approx. 12% |

| Number of new and high-tech enterprises | 26,000 |

| Number of international patents filed annually through the Patent Cooperation Treaty (PCT) of the World Intellectual Property Organization (WIPO) | Approx. 5,000 |

| Value added of strategic emerging industries as a percentage of GDP | Approx. 20% |

| Foreign-invested R&D centers | Approx. 560 total |

In addition to the above, the Shanghai government has also expressed its desire to improve trade and investment facilitation, develop a market-oriented and law-based international business environment, and build a resource-conserving, environmentally-friendly city.

From the perspective of the coordinated development of the YRD mega region, Shanghai plans to leverage its role as the region’s central city, strengthen the division of labor and cooperation with neighboring cities, and build a world-class city cluster with global influence.

Policy incentives for strategic industries

Reduced corporate income tax for high-tech sectors

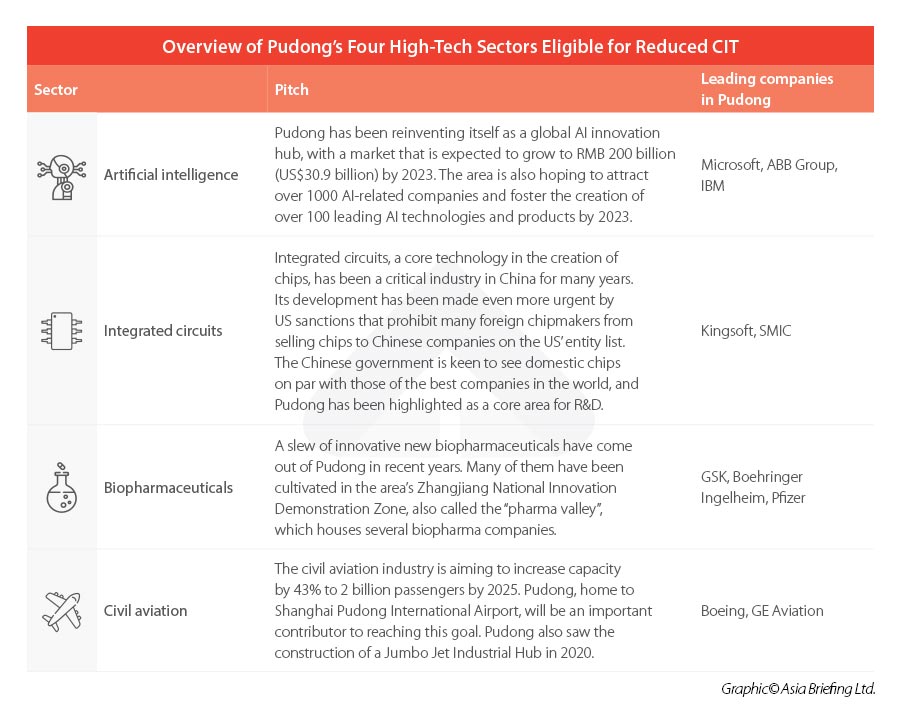

Pudong has become a core engine for sharpening China’s competitive edge in high-tech sectors, and Shanghai has singled out four key sectors for boosting innovation: artificial intelligence (AI), integrated circuits (IC), biopharmaceuticals, and civil aviation.To this end, a set of guidelines released on July 15, 2021 proposed a 15 percent corporate income tax (CIT), reduced from the national standard of 25 percent, for companies engaged in these four sectors in “specific areas” of Pudong. This policy is an expansion of a similar policy effective in the Lingang New Area of the Shanghai FTZ.

The reduced CIT would be in effect for five years from the date of the company’s registration in Pudong. The guidelines do not mention which areas of Pudong will enjoy the reduced CIT or specify exactly what criteria companies must meet to be eligible.

Incentive policies for financial institutes in the Lingang New Area

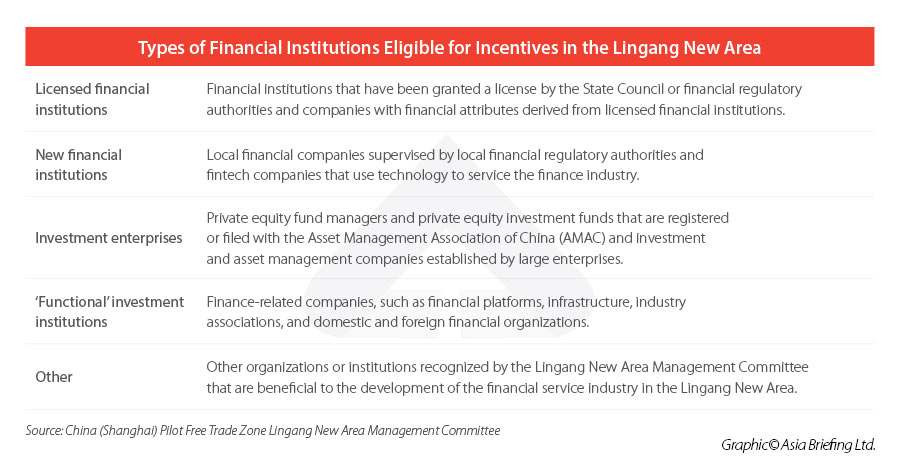

To cultivate the financial industry in the Lingang New Area, on August 23, 2021, the Lingang administrative committee released the Measures to Support the Innovative Development of the Financial Industry in the Lingang New Area (the ‘Lingang measures’). The document is a revision of a previous document released in 2019 and outlines specific policy incentives and rewards to attract and develop financial institutes in the area.The Lingang measures provide a broad range of policy incentives for financial institutions, including rewards of up to RMB 60 million for certain financial institutions to set up in the Lingang New Area, rewards for economic contributions, talent incentives, and rewards for achievements in innovation, among others.

The Lingang measures specify the types of financial institutions that are eligible for the incentive policies.

The rewards are given only to companies that have been established in, relocated to, or obtained business licenses in the Lingang New Area from January 1, 2021 onward. Companies are also required to make commitments to remain in the area for a certain amount of time. See our full article on the incentive policies for financial institutions in the Lingang New Area here.

Incentives for foreign-funded R&D centers

On November 24, 2020, the Shanghai Municipal Government released regulations to lure foreign investors to set up research and development (R&D) centers in Shanghai. The regulations are effective until November 30, 2025.Among other incentives, Shanghai Customs launched measures to facilitate customs clearance for R&D supplies, implementing ‘white list’ management for the import of special items, and providing a “green channel” for R&D talent.

Under the regulations, banks are also encouraged to provide foreign-funded R&D centers with convertible cross-border financial services, including cross-border fundraising, trade in technology, franchising, as well as centralized fund management on the basis of free trade accounts.

Qualified foreign-funded R&D centers that import scientific research and technological development supplies can also be exempted from import duties, VAT, and consumption tax (CT) on imports, and the VAT will be refunded in full if they purchase domestically made equipment.

In addition, eligible global R&D centers can receive start-up and rental subsidies in accordance with the relevant provisions of the regional headquarters development special fund.

Foreign-funded R&D centers are also encouraged to participate in government projects in key areas, such as ICs, biomedicine, and AI.

COVID-19 relief policies

Since the outbreak of the COVID-19 pandemic in early 2020, Shanghai has rolled out a series of relief policies to help businesses and sectors impacted by the pandemic.The recent outbreak of the Omicron variant of COVID-19 in Shanghai - the most severe the city has seen - led to a two-month lockdown starting on April 1, 2022. The COVID-19 restrictions have had a considerable impact on the city leading to a near economic standstill, casing businesses and people across the city hard.

The central government, along with key departments such as the Ministry of Finance (MOF) and State Tax Administration (STA), has released several nationwide relief and stimulus measures to boost economic growth. Notable measures include VAT credit rebates for small businesses and industries that have been adversely impacted by the COVID-19 containment measures, CIT reductions for low-profit enterprises, fee cuts, tax deferments for small manufacturing businesses, and reduction of operating costs, among many others.

On May 29, 2022, a few days before Shanghai lifted its city-wide lockdown, the government released a set of 50 support measures to help restart the economy. Many of the relief measures are targeted at businesses and hard-hit sectors, such as catering, retail, travel and tourism, and manufacturing. The support policies include expansions of previous tax relief measures, rent waivers, fee cuts, and reduction of operating costs.

The measures also propose means of supporting foreign investment and trade. These include establishing a service mechanism for the resumption of work and production in key FIEs and allocating specialized personnel to follow up with relevant FIEs to solve issues that they encounter regarding resumption of work and production, logistics, and COVID-19 control and prevention.

Moreover, they state that the government will advance the application of special funds for encouraging the development of regional headquarters of multinational corporations in 2022, and that it will strive to complete the allocation of the funds by the end of September.

Shanghai remains one of China’s main destinations for foreign investment. With a combination of business-friendly policies, a growing economy, a highly educated population, and cosmopolitan culture, the city is an ideal entry point to the Chinese market, and an exciting and welcoming place to live.

The city also continues to show its commitment to foreign companies, which play an essential role in the economy. In the wake of the COVID-19 lockdown, the local government is making efforts to maintain communication with foreign companies through a series of meetings and discussions.

Moreover, with the proposals for boosting foreign investment laid out in the economic support measures, we anticipate that the city will continue to roll out more favorable policy measures to attract and maintain foreign companies and talent in the city.

(Editor’s Note: This article was originally published in April 2019 and was last updated on June 22, 2022 to include new developments.)