In a notable development that demonstrates China’s opening up of the vocational training industry to foreign direct investment (FDI), a wholly foreign-funded vocational training institution was established in Beijing in May this year. We discuss the implications for vocational training enterprises in China and how government policies and regulations are opening doors for FDI.

In May 2023, Deloitte Business Skills Training (Beijing) Co., Ltd. set up in Beijing, becoming the city’s first wholly foreign-funded enterprise to engage in providing vocational training.

Back in August 2022, the Beijing Municipal Human Resources and Social Security Bureau had released the Administrative Measures for Operating For-profit Foreign-Invested Vocational Skills Training Institutions in Beijing to establish the standards, approval processes, and regulatory measures applicable for private vocational skills training institutions in the city.

This policy is expected to instill confidence in foreign investors regarding the business opportunities and potential returns in China's vocational training industry.

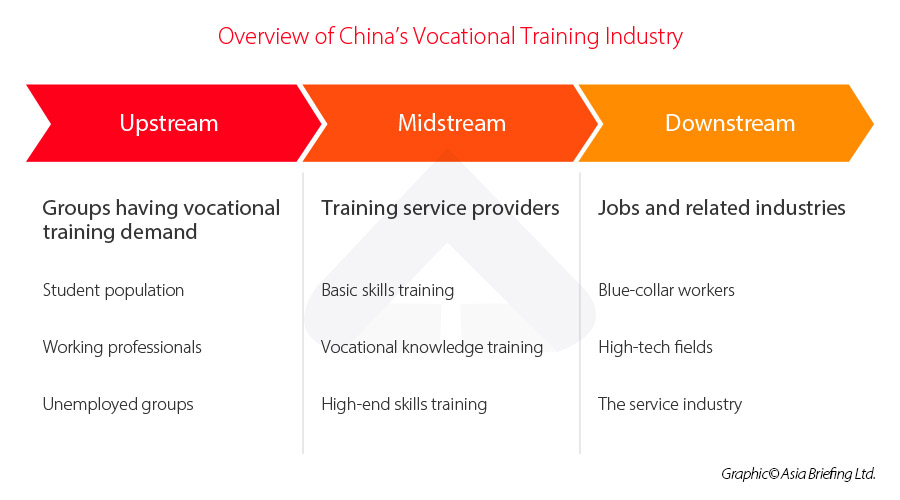

Current landscape of China's vocational training industry

What does vocational training refer to in China?

Vocational education and training refer to a range of learning experiences related to the workplace. It includes various levels and types of vocational school education, apprenticeship training conducted through school-enterprise cooperation, as well as vocational skill and qualification training, and knowledge expansion within enterprises.The division of vocational education into academic and non-academic streams reflects the comprehensive approach taken to cater to different skill requirements and career paths.

Non-academic vocational training plays a significant role in equipping individuals with practical skills and knowledge for specific occupations. This category encompasses vocational qualification exam training, which helps individuals attain industry-recognized certifications, vocational skills training to enhance job-specific competencies, and enterprise internal training aimed at improving employees' professional capabilities within their respective organizations.

Market size

The market size of China's vocational training industry has experienced substantial expansion, reflecting the growing demand for quality vocational education. From RMB 562.6 billion (US$77.92 billion) in 2017, the market size reached RMB 843.9 billion (US$116.88 billion) in 2022, exhibiting a compound annual growth rate (CAGR) of 8.45 percent. Looking ahead, the vocational training industry in China is poised for continued rapid growth. It is projected to reach RMB 909.7 billion (US$125.99 billion) by 2026. The growth of this industry presents significant opportunities for training providers, educational institutions, and investors to contribute to the development of a skilled and adaptable workforce that can meet the evolving demands of China's dynamic economy.Main drivers fueling industry development

The growth rate of the vocational training industry is mainly driven by several key factors:- Policy factors: The government's gradual attention and recognition of the vocational training industry through legislation have played a significant role in boosting industry growth. Policies aimed at promoting vocational education and training have created a favorable environment for industry development.

- Social factors: With improvements in the standard of living, there has been an increasing acceptance of re-education and lifelong learning among the population. This, coupled with a relative increase in available funds for training, has positively contributed to the expansion of educational training opportunities. The societal shift towards valuing continuous learning has fueled the demand for vocational training.

- Labor market factors: China has been diligently working towards its goal of transitioning the economy towards advanced manufacturing and technological innovation in recent years. Consequently, there is a high demand for high-end skilled labor, including mid-level workers, senior workers, technicians, and senior technicians. Additionally, the long-term decline in China's working-age population necessitates a focus on enhancing the competitiveness of the labor force through increased efficiency and skill levels.

- Employment factors: China's employment landscape has become increasingly challenging in recent years. The annual rise in the number of university graduates, combined with factors such as the impact of the pandemic, has led to a higher unemployment rate and increased pressure on employment. As a result, there is a sustained demand for vocational training as individuals seek to acquire specialized skills and improve their employability.

Emerging trends in vocational training

The vocational training industry is witnessing several emerging trends that are shaping its development and response to current challenges.- "Internet+ training" model: The adoption of the "Internet+ training" model is gaining momentum as vocational training leverages technology to provide flexible and efficient learning experiences. The disruption caused by the pandemic has accelerated the growth of online vocational training programs, enabling broader access to training opportunities. Online platforms have proven instrumental in adapting vocational education to meet the needs of learners in a rapidly changing environment.

- Brand differentiation: To stand out in a competitive market, training institutions are increasingly focusing on developing branded programs. By investing in brand culture, strategy, and identity, these institutions aim to differentiate themselves from competitors. Building a strong brand presence enhances institutional visibility, fosters recognition, and establishes consumer trust and preference.

- School-enterprise cooperation: Collaboration between schools and enterprises has emerged as a mainstream trend in vocational training. This partnership involves schools providing a diverse pool of talented individuals and valuable teaching resources, while businesses contribute industry-specific knowledge and skills directly applicable to specific job positions. The objective is to enhance students' employability skills comprehensively, leading to higher employment rates for schools and providing businesses with outstanding employees.

China’s regulations and policies relevant to the vocational training industry

In the context of China's "14th Five-Year Plan", the government has highlighted the pivotal role of vocational training in tackling employment challenges.

To address structural employment contradictions, there has been a notable emphasis on elevating the position of technical skills and talent development in vocational training.

In recent years, China policy efforts have also been directed towards strengthening the employment-oriented approach to talent cultivation and scaling up vocational skill training across various levels.

The overarching objective is to enhance the quality of the labor force and address the evolving demands of the job market.

| Issued date | Policy document | Objective |

| April 2022 | The Vocational Education Law of China (updated version) | The law aims to establish and improve a sound vocational education system, deepen the integration of industry and education, promote school-enterprise cooperation, and enhance the vocational education guarantee system and measures. |

| June 2021 | National Action Plan for Scientific Literacy (2021-2035) | It seeks to establish an integrated system that combines vocational education, employment training, and skill enhancement, with the goal of lifelong skill development for industrial workers. |

| February 2019 | National Vocational Education Reform Implementation Plan | It aims to foster active participation of vocational training enterprises and distinctive types of education with professional characteristics. |

Market entry requirements for foreign investors

The latest Special Administrative Measures (Negative List) for Foreign Investment Market Access (2021 Version, hereinafter, the National Negative List) and the Special Administrative Measures (Negative List) for Foreign Investment Market Access to Pilot Free Trade Zones (2021 Version, hereinafter, the FTZ Negative List), effective from January 1, 2022, stipulated different market entry requirements for FDI in the vocational training industry.Under the National Negative List, education and training institutions are restricted to Sino-foreign cooperation and must have a predominant Chinese leadership. This entails that the president or main administrative officer must be a Chinese national, and at least half of the members of the board of directors, board of trustees, or joint management committee should be Chinese individuals.

In contrast, the FTZ Negative List entailed more relaxed rules for foreign-invested vocational training institutions, both academic and non-academic. Foreign-invested vocational training institutions operating within the FTZs are not mandated to engage in Sino-foreign cooperation and are not subjected to the necessity of having a predominant Chinese leadership.

In addition, China has pilot programs in certain cities to facilitate the market entry of foreign-invested vocational training businesses. In Beijing and Shanghai, for example, regulations were recently introduced providing scope for-profit foreign-invested vocational training institutions.

- In February 2021, Shanghai issued the "Administrative Measures for the Approval and Management of For-profit Foreign-Invested Vocational Skills Training Institutions". This regulation permitted foreign investors to independently invest in for-profit vocational skills training service companies within the administrative jurisdiction of Shanghai.

- As mentioned earlier, the "Administrative Measures for Operating For-Profit Foreign-Invested Vocational Skills Training Institutions in Beijing" were released in August 2022. This policy eliminated the requirement for a specific proportion of Chinese and foreign board members.

Prospects for FDI

According to China’s latest Catalogue of Encouraged Industries for Foreign Investment (2022 Version), foreign investors are encouraged to invest in multiple sectors related to the vocational training industry, such as:- Non-academic vocational training institutions;

- Vocational schools;

- Elderly care service skills training;

- Family caregiving skills training; and

- Virtual Reality (VR) or Augmented Reality (AR)-based vocational and skills training services.

By aligning their strategies with the China's vocational education goals and adapting to the specific requirements of the market, foreign investors can position themselves for success in the country’s expanding vocational training industry.