We introduce tax avoidance arrangements as defined by Chinese tax authorities, discuss standard procedures for special tax investigations related to arrangements lacking reasonable commercial purposes, and provide practical suggestions for mitigating associated tax risks.

Anti-tax avoidance management encompasses the specific tax adjustments carried out by tax authorities in response to enterprises' tax avoidance schemes designed to secure tax advantages but without valid commercial justifications.

In this article, we introduce the concept of tax avoidance arrangements and how they are defined by Chinese tax authorities. We then explore the standard procedures that come into play when special tax investigations are initiated due to tax avoidance arrangements lacking reasonable commercial purposes. Finally, we offer practical suggestions to assist businesses in mitigating associated tax risks.

What are tax avoidance arrangements?

Tax avoidance arrangements refer to scenarios where taxpayers intentionally select convoluted, intricate, and unconventional legal structures primarily or exclusively to achieve tax advantages, thereby ensuring that the “intended tax treatment” favors their own interests.Article 4 of the General Anti-Tax Avoidance Management Measures (Trial), a circular released by the State Taxation Administration (STA) in 2014 to regulate anti-tax avoidance practices, stipulates that tax avoidance arrangements have the following characteristics:

- The sole purpose or main purpose is to obtain tax benefits; and

- The tax benefits are obtained in a manner that is compliance with the provisions of the tax law but inconsistent with its economic substance.

Different from tax evasion, tax avoidance is the legal usage of the tax regime in a single territory to one’s own advantage to reduce the amount of tax that is payable by means that are within the legal framework. Therefore, it is generally not directly recognized by tax authorities as an illegal act.

However, the tax authorities can initiate anti-tax avoidance related actions on an enterprise based on the principle of substance over form and by taking into consideration the specific economic behaviors or arrangements involved.

What kind of situations are regarded as tax avoidance arrangements by China’s tax authorities?

Article 2 of the General Anti-Tax Avoidance Management Measures (Trial) lists situations where tax avoidance arrangements may exist, such as transfer pricing, advance pricing arrangement, cost sharing agreement, controlled foreign enterprise, thin capitalization, and other general tax avoidance arrangements. Below, we explain the listed situations one by one:- Transfer pricing concerns the prices charged between associated enterprises established in different tax jurisdictions for their intercompany transactions. Specifically, any Chinese taxpayer engaged in related party transactions with other group entities is required to demonstrate that such transactions are conducted in a manner consistent with the “arm’s length standard” – under which taxpayers should be able to demonstrate that they transact with related parties in a similar manner and under comparable conditions, as they would with third parties.

- Advance pricing arrangement refers to situations under which the enterprise proposes the pricing principles and calculation methods for related-party transactions in the future years, negotiates with the tax authorities, and reaches an arrangement in advance to increase tax certainty.

- Cost sharing agreement refers to an agreement between an enterprise and its group affiliates to allocate the costs incurred in a certain business of the group among the participants in accordance with certain principles.

- Controlled foreign enterprise refers to the specific treatment of the portion of income attributable to Chinese resident enterprises involved in profit distribution matters of foreign enterprises that can be substantially controlled by resident enterprises.

- Thin capitalization examines whether the ratio of debt investment and equity investment received by an enterprise from related parties complies with the prescribed ratio or the arm's length principle. Generally, in order to maximize interests or for other purposes, enterprises and investors may reduce the proportion of equity and increase the proportion of loans in the selection of financing and investment methods, resulting in the ratio of corporate debt to owner's equity exceeding a certain limit.

- General tax avoidance arrangements refer to arrangements other than those mentioned above that can reduce taxable income and have no reasonable commercial purpose.

- Abuse of tax preferences;

- Abuse of tax treaties;

- Abuse of corporate organizational forms;

- Using tax havens to avoid taxes; and

- Other arrangements that do not have reasonable commercial purposes.

- The form and substance of the arrangement;

- The time when the arrangement is made and the execution period;

- The way the arrangement is implemented;

- The relationship between the various steps or components of the arrangement;

- The financial situation changes of all parties involved in the arrangement; and

- The tax results of the arrangement, and other aspects of the arrangement to make a comprehensive judgment on whether a tax avoidance arrangement has been implemented.

How will China’s tax authorities deal with situations recognized as tax avoidance arrangements?

For any specific situations that are recognized as tax avoidance arrangements by the tax authorities, the tax authorities will re-characterize the economic substance of the tax avoidance arrangements and cancel the tax benefits obtained by the enterprise from the tax avoidance arrangements.

Enterprises lacking economic substance—particularly those situated in tax havens that facilitate tax avoidance for their related or non-related parties in China—may have their existence challenged by the tax bureau in order to prevent misuse of tax benefits.

Implementation of the special tax investigation

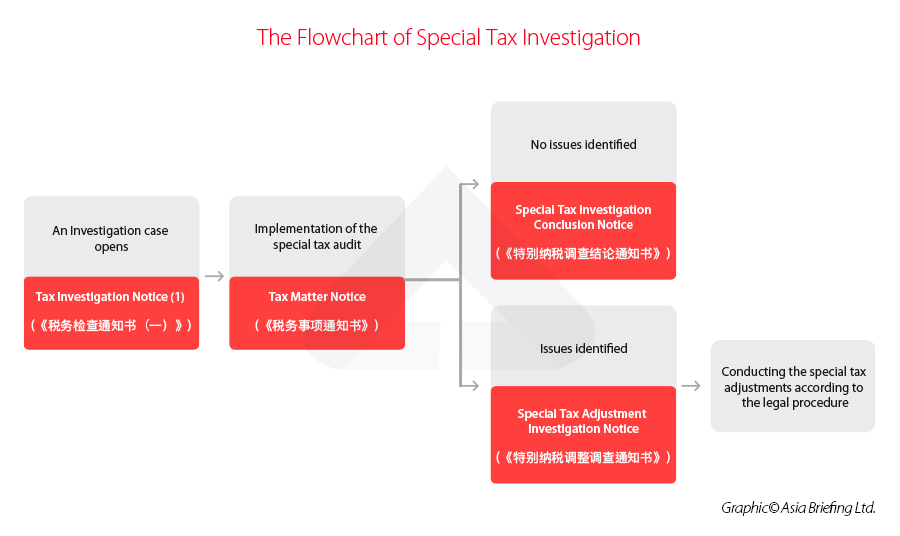

Also, for specific scenarios that are identified as one of the above-mentioned tax avoidance arrangements during the preliminary review, the tax authorities may decide to open special tax investigations as the next step.The special tax investigation generally follows the below procedures:

- A Tax Inspection Notice (1) (《税务检查通知书(一)》) will be sent to the enterprise that the tax authority has decided to make the special tax investigation.

- When conducting a special tax investigation, a Tax Matters Notice (《税务事项通知书》) will be sent to the investigated enterprise and require the enterprise to provide relevant information.

- Later, if the tax authorities do not find any issue that should be subjected to special tax adjustments, they shall make and send the Special Tax Investigation Conclusion Notice (《特别纳税调查结论通知书》) to the enterprise.

- If the tax authorities find that the enterprise has issue that should be subjected to special tax adjustments, they will serve the enterprise with a Special Tax Adjustment Investigation Notice (《特别纳税调整调查通知书》) based on the final plan, and the adjustments will be implemented in accordance with legal procedures.

Why self-investigation and adjustment are recommended strategies for mitigating risks

In practice, the tax authorities mainly implement special tax adjustment monitoring and management on enterprises through daily related-party declaration review, contemporaneous documentation management, and profit level monitoring.If the tax authority finds an enterprise to have special tax adjustment risks during the review, it can serve a Tax Matters Notice (《税务事项通知书》) to the enterprise to remind it of the existence of potential tax risks. If an enterprise receives a special tax adjustment risk reminder or discovers by itself that it has a special tax adjustment risk in daily operation or during regular audit, it can adjust and pay taxes on its own. In this case, it must fill in and submit the Special Tax Adjustment Self-Payment Form (《特别纳税调整自行缴纳税款表》).

While tax authorities retain the ability to conduct special tax investigations and make adjustments even after an enterprise voluntarily adjusts its tax payments, opting for self-adjustments in tax payment allows enterprises to proactively reduce a portion of potential tax risks. Moreover, this approach typically results in considerable time and cost savings compared to the resources required to handle a tax investigation initiated by tax authorities. Additionally, unlike tax investigations, which often impose strict deadlines for material submissions, self-examinations and adjustments afford enterprises greater flexibility, making them easier to manage.

Dezan Shira & Associates’ tax professionals have a deep understanding of Asia’s complex tax environments, as well as in-depth industry knowledge and experience. Our experienced team of tax accountants, lawyers, and ex-tax officials can help on a wide spectrum of tax service areas across all major industries. For more information about tax planning, transfer pricing, and special tax investigation and adjustments, please contact China@dezshira.com.